Jointly published by The Division of General Studies, Chukwuemeka Odumegwu Ojukwu University, Nigeria (formerly Anambra State University) and Klamidas.com Journal of Education, Humanities, Management and Social Sciences (JEHMSS), Vol. 2, No. 5, November 2024. https://klamidas.com/jehmss-v2n5-2024-03/ |

||||||||||||||

|

Corporate Governance and the Performance of Quoted Industrial Goods Companies in Nigeria (2012 to 2021) Ogonna Clara Ngangah

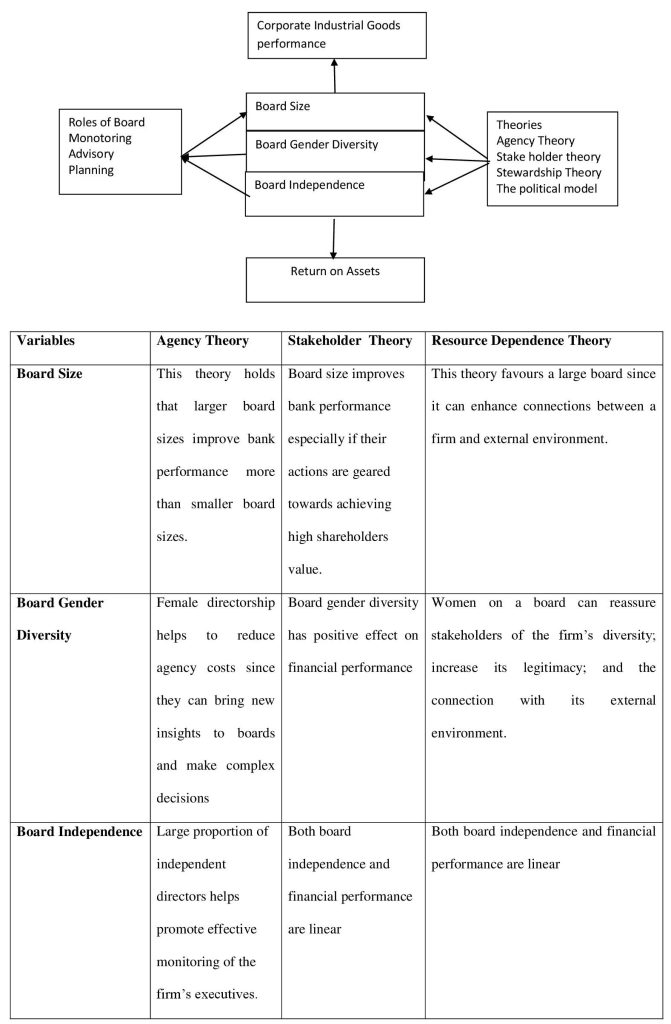

Abstract This study examines the corporate Governance and the Performance of Quoted Industrial Goods Companies in Nigeria from 2012 -2021 using data obtained from the Nigerian Stock Exchange (NSE). The variables for the study are Board Size (BCIZ), Board Gender Diversity (BGD) and Board Independence (BIN) were used as Independent variables and Return on Assets (ROA) were used as the dependent variables. The findings of the study revealed that Board Size (BSIZ) has a positive and significant effect on return on asset (ROA) of industrial goods firms in Nigeria. Board gender Diversity (BGD) has a negative but insignificant effect on return on asset (ROA) of industrial goods firms in Nigeria. Board independence (BIN) has a positive but significant effect on return on asset (ROA) of industrial goods firms in Nigeria. Based on these results the study concludes that what matters most in the industrial goods firms in Nigeria is the size of the board as more board members will bring diverse ideas which if well harnessed will always lead to higher returns on assets. The study concluded that Boards of various firms in the industry should increase in size as this has shown to boost the performance of the firms. Female board members should be well utilized so as to tap from their moderate nature and improve on the performance of industrial goods firms. Measures should be put in place to prevent the dominance of the executive board members so that the independent board members can freely make good proposals that can be implemented for the success of the firms. Keywords: corporate governance, quoted industrial goods companies, corporate board, Nigeria

INTRODUCTION

The success of a modern organization lies to a great extent on internal as well as external factors. While the internal factors are somewhat latent and caused by less competent and inefficient management team, external factors are caused by economic dynamics and/or regulatory bottlenecks. Thus, boards of directors must be free to drive their institutions forward, but exercise that freedom within a framework of transparency and effective accountability. This is the essence of any system of good corporate governance. Corporate governance epitomizes the system of controls, processes, policies, rules and proceedings set up by the Board and Management of a company to ensure the smooth running of the company, maximize shareholders wealth and satisfy the interest of every stakeholder. Corporate Governance is the set of processes, customs, policies, laws and regulations affecting the way a corporation or company is directed, administered or controlled (Owolabi& Dada, 2011). In the opinions of Akingunola, Adekunle & Adedipe (2013), it has become a worldwide dictum that the quality of corporate governance makes an important difference to the soundness and unsoundness of an organization. Thus, effective corporate governance practice incorporates transparency, openness, accurate reporting and compliance with statutory regulations among others. The debates sprung following an increase in agency problem, which emanated from separation of ownership and control created in the case of Salomon v Salomon, (1897). Recently corporate governance becomes a hot topic among a wide spectrum of people, government, industry operations, directors, investors, shareholders, academics and international organizations among others. Today’s world has seen that organization transparency, financial disclosure, independency, board size, board composition, board committees, board diversity and among others are the cornerstone of good governance practices Shungu, Ngirande, & Ndloy (2014). These variables are in the main agenda of most meetings and conferences worldwide including the World Bank, International Monetary Fund (IMF) and Organisation of Economic Co-operation and Development (OECD) (Inyanga, 2009). Recently researchers have managed to come up with many definitions of corporate governance. Strine (2010) pointed out that corporate governance is about putting in place the structure, processes and mechanisms that insure that the firm is directed and managed in a way that enhances long-term shareholder value through accountability of manager, which will then enhance firm performance. At the company level, well-governed companies tend to have better and cheaper access to capital, and tend to outperform their poorly governed peers over the long-term, on the other hand corporate governance reduce financial crisis. Currently many country leaders all over the world have increased concern over corporate governance due to the increase of reported cases of frauds, inside trading, agency conflicts among other corporations saga Enobakhare (2010). Corporate failure has recently been witnessed in both developed and developing countries with the reported cases of the East Asia crises of 1997/98, the collapse of Enron in 2001 and WorldCom in 2002, One of the key constituents of corporate governance is the role of board of directors in overseeing management. Oversight function paramount on the board of directors is to checkmate the excesses of the managers because managers have their own inclination and may not always act in the best interest of the shareholders. Also, they are expected to be between company management and shareholders Oyedokun (2019). To fully understand the role of the board, boards of managements ensures that team of individuals whose competencies and capabilities collectively represent the pool of social capital are appointed as board members. In view of this, these team of individuals are expected to initiate and facilitate organizational change, formulate corporate policies, approve strategic plans, hire, advise, compensate, and, if necessary remove inefficient management, arrange for succession determine the board size subject to approval by shareholders. Doaa and Khaled (2018) added that, it is the responsibility of these team of individuals to safeguard and maximize shareholder’s wealth, oversee firm performance, and assess managerial efficiency. Consequent upon the above, the role of the board is quite compellingly complicated as it seeks to discharge diverse and challenging responsibilities as enshrined in the Nigerian Securities and Exchange Commission Code of Best Practice for Publicly Quoted Companies 2003. However, the relative neglect of board governance in Nigeria public policy is perhaps a reflection of the scarcity of empirical works in this area. Meanwhile, board of directors are criticized for being responsible for the dwindling in shareholders’ wealth, both in developed and developing economies, particularly, in Nigeria where this study is based. More so, non-adherence to good corporate governance ethics have been argued as the fore-runner of the fraud cases in and outside Nigeria since the corporate failure of major corporations, such as Enron Corporation, Tyco International, WorldCom, Global Crossing, Oceanic bank Plc, Afribank, Intercontinental bank, Bank PHB in early 2000. Given the increasing importance of boards attributes in realization of high company performance, this study examined the effects of board attributes on the industrial good’s firms’ performance in Nigeria. 1.2 Statement of the problem There seem to be no global consensus on the effect of corporate governance indices on various performance indicators of firms as there appears to be disagreement in respect of the effects of some corporate governance measures on some performance indicators of firms. For instance, in Adekunle and Aghedo (2014) showed that board composition and board size have positive relationship with financial performance while ownership concentration has a negative relationship with financial performance of selected companies in Nigeria. In a study by Kajola (2008), only board size and chief executive status has positive significant relationship with return on equity. In another study on Malaysian companies, the results reveal that there is no significant relationship between board structure and return on assets as well as between CEO duality and return on equity (Ponnu, 2008). In a more recent study that modified the data make-up of the corporate governance correlates and increases the number of observations of Nigerian data, the regression result reveals a significant relationship and positive correlation between corporate governance and bank performance, Okereke, Abu and Anyanwu (2010). Unlike the Okereke, Abu and Anyanwu (2010) and earlier studies by the authors, this study attempts to examine the effect of corporate governance on the performance of quoted industrial goods in Nigeria Also, the fall of companies in the world like Enron, Parmalet, Xerox, HealthSouth, Toshiba Corp, Lucent, Adelphia, Tyco, WorldCom, Maxwell pension scandals, Satyam, Reebok (Aggarwal, 2013; Surbakti, Shaari & Bamahros, 2017) apart from being attributed to poor accounting practices as a result of unethical conduct and misuse of power by both preparers of financial statements and auditors (Aggarwal, 2013), has also been attributed to poor and weak corporate governance (Gaio & Raposo, 2014). This alarming rate of corporate failures as witnessed globally has necessitated this study as the failures have known no boundary and cut across both the very big organizations and the very small corporate entities. Most studies on corporate governance are focused on banks, a single aspect of governance, such as the role of directors or that of shareholders while omitting other factors and interactions that may be important within the governance framework. This study, however, seeks to explore the effect of corporate governance on the performance of industrial goods firms in Nigeria. 1.3 Objectives of the Study The broad objective of this study is to examine the effect of corporate governance on the performance of industrial goods companies in Nigeria. The broad objective will be achieved using the following specific objectives: i. To examine the effect of board size (BSIZ) on the performance of industrial goods firms in Nigeria. ii. To evaluate the effect of board gender diversity (BGD) on the performance of industrial goods firms in Nigeria. iii. To determine the effect of board independence (BIN) on the performance of industrial goods firms in Nigeria. 1.4 Research Questions The following are the Research Question formulated for this study i. To what extent does the board size affect the performance of industrial goods firms in Nigeria? ii. To what extent does board gender diversity affect the performance of industrial goods firms in Nigeria? iii. To what extent does board independence affect the performance of industrial goods firms in Nigeria? 1.5 Research Hypotheses The following null hypotheses were formulated for the study: H01: Board size has no significant effect on the performance of industrial goods firms in Nigeria H02: Board gender diversity has no significant effect on the performance of industrial goods firms in Nigeria H03: Board independence has no significant effect on the performance of industrial goods firms in Nigeria 1.6 Significance of the Study This study will be indispensable to many. The significance of this study will be useful to various organs such as The Investors: The understanding of the effect of corporate governance on the performance of industrial goods firms in Nigeria will enhance the ability of investors to exploit desiredprofitable ventures and continue to keep their vested interest in the firms. Policy makers: It will enlighten policy makers more on the effect of corporate governance on industrial goods firms in Nigeria. It will shed light on the proceeds of corporate finance as well as formulating a trade policy. Managers: Managers will read the findings with keen interest as a well functioning, effective and efficient board may succeed in checkmating their excesses or inadequacies. Academics: However, the academics and the students of corporate finance will be provided with current trend in the knowledge of the effect of corporate governance on the performance of industrial goods firms in Nigeria. Researchers: The finding might lead to enrichment of finance literature and act as a launch pad for further research. 1.7 Scope of the Study The study comprises of – industrial goods firms in Nigerian for a period of 10 years from 2012 to 2021. The 10 years period is because of the period that corporate governance became pronounced in Nigeria. REVIEW OF RELATED LITERATURE 2.0 Conceptual Framework 2.1.1 Corporate Governance According to Kwakwa and Nzekwu (2003), governance is a ‘vital ingredient in the balance between the need for order and equality in society; promoting the efficient production and delivery of goods and services; ensuring accountability in the house of power and the protection of human right and freedoms’. Governance is, therefore, concerned with the processes, systems, practices and procedures that govern institutions, the manner in which these rules and regulations are applied and followed, the relationships created by these rules and nature of the relationships. Corporate governance, on the other hand, refers to the manner in which the power of a corporate is exercised in accounting for corporation’s total portfolio of assets and resources with the objective of maintaining and increasing shareholder value and the satisfaction of other stakeholders while attaining the corporate mission (Kwakwa and Nzekwu, 2003). In other words, corporate governance refers to the establishment of an appropriate legal, economic and institutional environment that allows companies to thrive as institutions for advancing long-term shareholder’s value and maximum human centered development. The corporation has to achieve this while remaining conscious of its responsibilities to other stakeholders, the environment and the society at large. Thus, corporate governance is also concerned with the creation of a balance between economic and social goals and between individual and communal goals. To achieve this, there is the need to encourage efficient use of resources, accountability in the use of power, and, the alignment of the interest of the various stakeholders, such as individuals, corporations and the society. Corporate governance is now widely accepted as being concerned with improved stakeholder performance. Viewed from this perspective, corporate governance is all about accountability, boards, disclosure, investor involvement and related issues. From the foregoing, it is apparent that no matter the angle from which corporate governance is viewed, there is always a common consensus that corporate governance is concerned with improving stakeholder value, and that governance and management should be mutually reinforcing in working towards the realization of that objective. OECD (1999) opines that corporate governance is the system by which business corporations are directed and controlled. That the corporate governance structure specifies the distribution of rights and responsibilities among different participants in the corporation, such as, the board, managers, shareholders and other stakeholders and spells out the rules and procedures for making decisions on corporate affairs. By doing this, it also provide the structure through which the company objectives are set, and the means of attaining those objectives and monitoring performance. A perfect system of corporate governance would give management all the right incentives to make value maximizing investment and financing decision and would assure that cash is paid out to investors when the company runs out of viable projects i.e. investment with positive NPV Corporate governance attracts a good deal of public interest, because of its importance to the economic health of corporations, groups, countries, and society at large. But because it covers a large number of economic phenomena, it has become a subject with many definitions, with each definition reflecting an understanding of, and in the domain of an economic phenomenon being considered. In general terms, however, corporate governance deals with the way corporate bodies utilize their funds to generate financial wealth for shareholders, and social wealth for the community in which they are located. This latter consideration is what has now become known as the Corporate Social Responsibility (CSR) of organizations. So, essentially, corporate governance deals with issues of accountability and fiduciary duty, in the main advocating the implementation of policies and mechanisms to ensure good behaviour and protect shareholders. There is also the perspective of economic efficiency, through which corporate governance should aim to optimize economic results with strong emphasis on shareholders welfare. Yet a third consideration accommodates the interest of all stakeholders, which call for more attention and accountability to players other than the shareholders; like the employees and the environment/community, for examples. So, in short, corporate governance is about how an entity is managed or run. 2.1.2 PRINCIPLES AND PILLARS OF CORPORATE GOVERNANCE Pandey (2005) opines that good corporate governance requires companies to adopt practices and policies which comprise performance, accountability, effective management control by the board of directors, constitution of board committee as part of professionally qualified, non-executive and independent directors on the board, the adequate timely disclosure of information and the prompt discharge of statutory duties. Of importance is how directors and management develop a model of governance that aligns the values of the corporate participants and then evaluate this model periodically for it’s effectiveness. In particular, senior executives should conduct themselves honestly and ethically especially concerning actual or apparent conflict of interest and disclosure in financial report. The Organization for Economic Cooperation and Development (OECD) put forward a set of international principles of corporate governance. These principles were developed both in response to growing recognition of the importance of governance to enterprise performance and to the spate of recent corporate failures in Asia, America and other parts of the world. The OECD principles are organized under five headings, namely: The rights of shareholders, The equitable treatment of shareholders, The role of stakeholders, Disclosure and transparency; and The responsibilities of the board. The Rights of Shareholders: This principle deals with the rights of shareholders. It concerns the protection of shareholders’ rights and the ability of shareholders to influence the behaviour of the corporation. The basic shareholders’ rights include the right to: Secure methods of ownership registration; Convey or transfer share; Obtain relevant information on the corporation on the timely and regular basis; Participate and vote in general shareholder meetings; Elect members of the board; and Share in the profits of the corporation. Equitable Treatment of Shareholders: This principle emphasizes that all shareholders, including foreign shareholders, should be treated fairly by controlling shareholders, boards and management. This principle calls for transparency with respect to the distribution of voting rights and the ways in which voting rights are exercised. The high points of the principles include: All shareholders of the same class should be treated equally. , Insider trading and abusive self-dealing should be prohibited, Members of the board and management should be required to disclose any materials interests in transactions or matters affecting the corporation The Role of Stakeholders: A good corporate governance framework should recognize the rights stakeholders has, as established by law. Such a framework should encourage active cooperation between corporations and stakeholders in creating wealth, jobs, and the sustainability of a sound enterprise. To achieve this, corporate governance should ensure that: The rights of stakeholders are protected by law; The rights of the shareholders are respected; Stakeholders have the opportunity to redress any violation of their rights, Permit performance enhancing mechanism for stakeholders participation, Provides stakeholders with access to relevant information to enable them participate actively in the governance process Disclosure and Transparency This principle supports the development of high internationally recognized accounting standards. This stipulates that all the material matters regarding the governance and performance of the corporation be disclosed. This also underscores the importance of applying high quality standards of accounting, disclosure and auditing. Disclosure should include, but not limited to, material information: The financial and operating results of the company, Company objectives; Major share ownership and voting rights; Members of the board and key executives and their remuneration; and Governance structure and policies information should be prepared, audited and disclosed in accordance with high quality standards, while the channels for disseminating information should be fair, timely and cost-effective. The Responsibilities of the Board: The traditional view of directors is that they serve primarily to monitor management. However, there is an emerging school of thought that directors can and should add value to the enterprise (Fredrick, 1999). The principle, which reflects the value-added approach, suggests that directors are responsible for the strategic guidance of the enterprise in addition to monitoring management. Thus, the board has a definite function to perform to ensure the strategic guidance of the company, the effective monitoring of management by the board, and the board’s accountability to the corporation and shareholders. In doing this, board members should: Ensure the independence of the board; Act on a fully informed basis and in good faith, with due diligence and care, and in the best interest of all stakeholders; Treat all shareholders fairly, particularly in decisions that affect different shareholder groups; and Ensure compliance with applicable laws Other principles of corporate governance include Honesty, Trust, Transparency, Performance Orientation, Integrity, Responsibility, Accountability, Mutual Respect, Commitment to the Organization PILLARS OF CORPORATE GOVERNANCE In all fields of human endeavour, good corporate governance is founded upon the attitudes and practices of the society. According to Kwakwa and Nzekwe (2003), these values centre on the: Accountability of power, based on the fundamental belief that power should be exercised to promote human well-being; Democratic values, which relate to the sharing of power, representation and participation and participation; The sense of right and wrong; Efficient and effective use of resources; Protection of human rights and freedoms, and the maintenance of law and order and security of life and property; Recognition of the government as the only entity that can use force to maintain public order and national security; and Attitude towards the generation and accumulation of wealth by hardwork.. The above attributes have been reduced to four pillars on which governance is framed. These pillars encompass; Effective body responsible for governance, separate and independent of management, An approach to governance that recognized and protects the rights of members and all stakeholders Institutions to be governed and managed in accordance with its mandate; and An enabling environment within which the institutions’ human resources could contribute and bring to bear their full creative powers. The Business Roundtable (2002) supports the following guiding principles of corporate governance:

2.1.3 Board size and firm performance There are two opposing ideas on the relationship between board size and firm performance. The first thought holds that the lesser the board size the more it can greatly contribute to the company’s success. A study by Yermack (1966) found an inverse relationship between board size with company’s value and favorable financial ratios such as profitability, asset utilization, and Tobin’s Q Empirical evidence of S. Cheng showed that companies that have more board members, the variability of the firm performance would be lower. The second thought argued that a large board size will increase the firm performance. Board size is a determinant of the ability of directors to monitor and control manager. R. Adam and H. Mehran argued that the company should have a large board size to be able to monitor effectively. Large board size will support a more effective management of the 2.1.4 Board Gender Diversity Board gender diversity is the mixture of men and women, people from different age brackets, people with different ethnic groups and racial backgrounds (Enobakhare, 2010). Currently board diversity is a highly debatable corporate governance topic. The topic put more emphasis on, gender diversity, i.e. the inclusion of women on corporate boards of directors, considered as an instrument to improve board variety and thus discussions Anastasopoulos et al (2002). This is calculated as the total number of women in the board over the board size in a given over a period. Its’ believed that board diversity affects corporate governance either a direct or an indirect effect on the firm. Though board diversity might be a constraint according to Goodstein, nevertheless it goes without doubt that for boards to be effective there is need for diverse perspective Ogbechie & Koufopoulos (2009). With reference to the relationship between gender diversity and firm performance, the few existing empirical studies show contrasting results. Dutta and Bose, 2006) reported a statistically significant positive relationships between both the presence and the percentage of women on the board of directors and market value added (MVA) and firm value. 2.1.5 Board Independence Fuzi, Halim, Abdul, and Julizaerma (2016) submitted that, the board comprises of executives and non-executives who are either independent or non-independent directors. The Independent directors specifically are the person entrusted by shareholders to represent them and will help to reduce agency problems. As recommended by the Code of Corporate Governance and regulators, every organization must have a board room that consists of independent directors. However, mere compliance with the recommendations is not enough if the independent directors did not do their work well. In view of this, independent directors may not necessary leads to high firm performance. 2.1.6 Return on Assets The return on assets ratio, often called the return on total assets, is a profitability ratio that measures the net income produced by total assets during a period by comparing net income to the average total assets. In other words, the return on assets ratio or ROA measures how efficiently a company can manage its assets to produce profits during a period. Since company assets’ sole purpose is to generate revenues and produce profits, this ratio helps both management and investors see how well the company can convert its investments in assets into profits. You can look at ROA as a return on investment for the company since capital assets are often the biggest investment for most companies. In this case, the company invests money into capital assets and the return is measured in profits. 2.2.0 Theoretical Framework There are a number of theoretical perspectives which are used in explaining the corporate governance and performance of industrial goods firm in Nigeria. 2.2.1 Agency Theory Agency theory is a theory that has been applied to many fields in the social and management sciences: politics, economics, sociology, management, marketing, accounting and administration. The agency theory a neoclassical economic theory Ping & Wing (2011) and is usually the starting point for any debate on the corporate governance. The theory is based on the idea of separation of ownership (principal) and management (agent). It states that “in the presence of information asymmetry the agent is likely to pursue interest that may Hurt the principal. Sanda, Mikailu & Garba (2005). It is earmarked on the assumptions that: parties who enter into a contract will act to maximize their own self-interest and that all actors have the freedom to enter into a contract or to contract elsewhere. Furthermore, it is concerned with ensuring that agents act in the best interest of the principals. The agency role of the directors refers to the governance function of the board of directors in serving the shareholders by ratifying the decisions made by the managers and monitoring the implementation of those decisions. The focus of agency theory of the principal and agent relationship (for example shareholders and corporate managers) has created uncertainty due to various information asymmetries Deegan (2004). The separation of ownership from management can lead to managers of firms taking action that may not maximize shareholder wealth, due to their firm specific knowledge and expertise, which would benefit them and not the owners; hence a monitoring mechanism is designed to protect the shareholder interest (Jensen & Meckling, 1976). This emphasizes the role of accounting in reducing the agency cost in an organization, effectively through written contracts tied to the accounting systems as a crucial component of corporate governance structures, because if a manager is rewarded for their performance such as accounting profits, they will attempt to increase profits which will lead to an increase in bonus or remuneration through the selection of a particular accounting method that will increase profits. Arising from the above is the agency problem on how to induce the agent to act in the best interests of the principal. Jensen and Meckling (1976) defined agency costs: the sum of monitoring expenditure by the principal to limit the aberrant activities of the agent; bonding expenditure by the agent which will guarantee that certain actions of the agent will not harm the principal or to ensure the principal is compensated if such actions occur; and the residual loss which is the dollar equivalent to the reduction of welfare as a result of the divergence between the agents decisions and those decisions that would maximize the welfare of the principal. However, the agency problem depends on the ownership characteristics of each country. In countries where ownership structures are dispersed, if the investors disagree with the management or are disappointed with the performance of the company, they use the exit options, which will be signaled through reduction in share prices. 2.2.2 Stakeholders’ Theory The stakeholders’ theory was adopted to fill the observed gap created by omission found in the agency theory which identifies shareholders as the only interest group of a corporate entity. Within the framework of the stakeholders’ theory the problem of agency has been widened to include multiple principals (Sand, Garba & Mikailu 2011). The stakeholders’ theory attempts to address the questions of which group of stakeholders deserve the attention of management. With an original view of the firm the shareholder is the only one recognized by business law in most countries because they are the owners of the companies. In view of this, the firm has a fiduciary duty to maximize their returns and put their needs first. In more recent business models, the institution converts the inputs of investors, employees, and suppliers into forms that are saleable to customers, hence returns back to its shareholders. This model addresses the needs of investors, employers, suppliers and customers. Pertaining to the scenario above, stakeholder theory argues that the parties involved should include governmental bodies, political groups, trade associations, trade unions, communities, associated corporations, prospective employees and the general public. In some scenarios competitors and prospective clients can be regarded as stakeholders to help improve business efficiency in the market place. Stakeholder theory has become more prominent because many researchers have recognized that the activities of a corporate entity impact on the external environment requiring accountability of the organization to a wider audience than simply its shareholders. One must however point out that large recognition of this fact has rather been a recent phenomenon. Indeed, it has been realized that economic value is created by people who voluntarily come together and cooperate to improve everyone’s position Freeman et. Al (2004). Jensen (2001) critiques the Stakeholder theory for assuming a single-valued objective (gains that accrue to a firm’s constituency. The argument of Jensen (2001) suggests that the performance of a firm is not and should not be measured only by gains to its stakeholders. Other key issues such as flow of information from senior management to lower ranks, interpersonal relations, working environment, etc. are all critical issues that should be considered. Some of these other issues provided a platform for other arguments. An extension of the theory called an enlightened stakeholder theory was proposed. However, problems relating to empirical testing of the extension have limited its relevance (Sanda et. al., 2005).The stakeholders‟ theory proposes that companies have a social responsibility that requires them to consider the interest of all parties affected by their actions. The original proponent of the stakeholders‟ theory suggested a re-structuring of the theoretical perspectives that extends beyond the owner- manager-employee position and recognizes the numerous interest groups. 2.2.3 Stewardship Theory Stewardship theorists suggest that directors have interests that are consistent with those of stakeholders. According to Donaldson and Davis (1991) “organizational role-holders are conceived as being motivated by a need to achieve and gain intrinsic satisfaction through successfully performing inherently challenging work, to exercise responsibility and authority, and thereby to gain recognition from peers and bosses”. They contend that where managers have served an organization for a number of years, there is a “merging of individual ego and the corporation”. Managers may carry out their role from a sense of duty and responsibility. Psychological and situational review of the theory holds that there is no inherent, general problem of executive motivation. “A steward protects and maximizes shareholders wealth through firm performance, because, by doing so, the steward’s utility functions are maximized” Davis, Schoorman and Donaldson (1997). The steward identifies greater utility accruing from satisfying organizational goals than through self-serving behaviour. This suggests that the attainment of organizational success also satisfies the personal needs of the steward. Stewardship theory recognizes the importance of welfare structures that empower the steward which in the long run provides maximum autonomy built upon believe and trust in the organization. This in effect reduces the cost of mechanisms aimed at monitoring and controlling behaviours (Davis, Schoorman and Donaldson, 1997). 2.2.4 The political model The political model recognizes that the allocation of corporate power, privileges and profits between owners, managers and stakeholder is determined by how governments favour their various constituencies. The ability of corporate stakeholders to influence allocation between themselves at the micro level is subject to the macro framework, which is interacting subjected to the influence of the corporate sectors. 2.3 Empirical Literature Bebehuk, Cohaen, and Ferrell (2004) also finds out that, board size, board composition, and whether the CEO is also the board chairman have shown that well governed firms have higher firm performance. Though, there is a view that large board are better for corporate performance because they have a range of expertise to help make better decisions, and are harder for a powerful CEO to dominate. Adekunle and Aghedo (2014) examined the relationship between corporate governance and financial performance of selected quoted companies in Nigeria. Both return on assets and profit margin were adopted as proxies for financial performance and they served as the dependent variables while board composition, board size, CEO status and ownership concentration were used as proxies form corporate governance as well as the independent variables. Findings of the study showed that board composition and board size have positive relationship with financial performance while ownership concentration has a negative relationship with financial performance of selected companies in Nigeria. Cheema and Din (2013) investigated the relationship between corporate governance and profitability of Cement industry in Pakistan for the period 2007 to 2011. The study relied on data from 15 (fifteen) cement manufacturing firms and board size, CEO’s duality and board diversity were chosen as proxies for corporate governance. Return on assets was used as the proxy for profitability and it served as the dependent variable. The Ordinary Least Squares (OLS) multiple regression method was used to carry out the empirical analysis. Findings showed that board size does not have any significant relationship with profitability while CEO duality has a significant effect on profitability in the 15 cement companies selected for the study. Sathyamoorthi, Baliyan, Dzimiri and Wally-Dima (2017) carried out an investigation into the impact of corporate governance on financial performance of listed companies in the consumer services sector in Botswana for the period 2012 to 2016. The study adopted return on assets as proxy for financial performance as well as the dependent variable while board size, gender diversity, composition of executive and non-executive directorship, number of sub-committees and frequency of board meetings were used as proxies form corporate governance. Findings of the study showed that gender diversity has a negative relationship with financial performance. Also, the study revealed that composition of executive and non-executive directorship and frequency of board meetings have negative relationship with financial performance of listed companies in Botswana. Finally, the study revealed that only number of sub-committees has a significant effect on financial performance of listed companies in Botswana. Dzingai and Fakoya (2017) investigated the effect of corporate governance structure on the financial performance of firms in Johannesburg for the period 2010 to 2015. The study relied on data collected from 37 mining firms listed on the Johannesburg Stock Exchange. Board size, board independence and sales growth were adopted as proxies for corporate governance and they were used as the independent variables while return on equity was used as the dependent variable. Findings of the study showed that there was a weak negative correlation between return on equity and board size while a positive relationship was established between board independence and return on equity. The study further revealed that sales growth has a weak positive relationship with return on equity while firm size has a negative and weak relationship with return on equity. George & Karibo (2014) studied the impact of corporate governance mechanisms on firm financial performance using listed firms in Nigeria as case study for two years 2010 and 2011. The study adopted a content analytical approach to obtain data through the corporate website of the respective firms and website of the Securities and Exchange Commission. A total of 33 firms were selected for the study cutting across three sectors: manufacturing, financial and oil and gas. The result of the study showed that most of the corporate governance items were disclosed by the case study firms. The result also showed that the banking sector has the highest level of corporate governance disclosure compared to the other two sectors. The result thus indicates that the nature of control over the sector have an impact on companies’ decision to disclose online information about their corporate governance in Nigeria; and that there were no significant differences among firms with low corporate governance quotient and those with higher corporate governance in terms of their financial performance. Thus among others the study recommends that deliberate steps be taken in mandatory compliance with SEC code of best practice for all sectors in Nigeria. Carter, D‘Souza, Simkins, and Simpson (2007) examined the impact of board gender and ethnic diversity on the financial performance of all firms listed on the Fortune 500 over the period 1998-2002. Their results show support for the positive effect of diversity on financial performance measured by Tobin‘s Q. Smith, Smith and Verner (2005) examined the relationship between gender diversity and firm performance using 2,500 largest Danish firms over the period 1993-2001, and find that the proportion of women on the board have positive effect on firm performance. Oxelheim and Randoy (2001) examined the effect of foreign board member diversity on firm value in Norway and Sweden, and the result indicates a significantly higher performance for firms with foreign board membership.

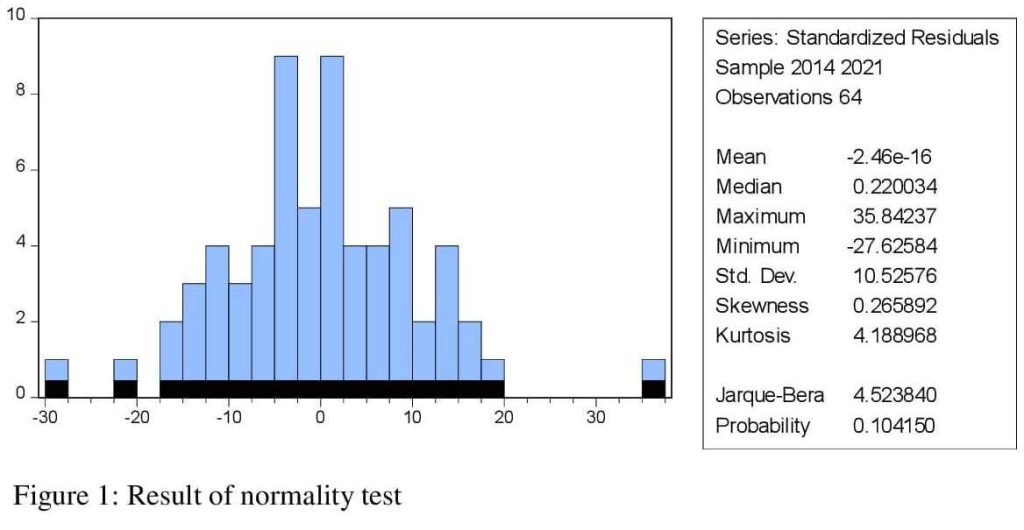

RESEARCH METHODOLOGY 3.1 Research Design The study adopted the ex-post facto research design method because secondary source of data was employed for the study. This is justified because procedure demands that this method be used when the data for the study are secondary. Hence, the study relied on historical secondary data collected from the financial statements of the companies under study to quantitatively investigate the effect of corporate governance on performance of the companies. 3.2 Nature and Sources of Data Data collection is a crucial element in which the data gathered could make a major effect to the thoroughness and viability of the investigation. In this research, secondary data were used and were obtained from listed companies in the NSE from their existing financial audited annual reports uploaded in the internet, within the range of 2012-2021 accounting year. 3.3 Population of the Study Population is a group of individuals who have the same characteristics. Population can be seen as the aggregation of elements from which actual sample is selected. The population of the study comprises industrial goods companies listed on the Nigerian Stock Exchange (NSE). 3.4 Sample size By sample size, we understand a group of subjects that are selected from the general population and is considered a representative of the real population for that specific study. Sample size refers to the number of participants or observations included in a study. The sample size was drawn from 12 listed industrial goods companies in the Nigeria Stock Exchange (NSE) out of which 7 were selected due to complete availability of materials. 3.5 Method of Data Analysis Giving that observations were across several companies, the appropriate tool used was the simple panel least squares. By blending the inter-individual differences and intra-individual dynamics, panel data have several advantages over cross-sectional or time-series data. It is said to yield more accurate inference of model parameters 3.6 Model Specification Model specification is the expression of a relationship into precise mathematical form. Thus, this study introduced static OLS equation and following the research objectives, the functional form of the variable are hereby developed in form of Y = B0 + …B1X ………………..3.1 The specification of any relationship will be guided by existing theory or empirical evidence from previous studies. The model relevant to this study is therefore adopted from the studies of Cheema, and Muhammad (2014) Stated:

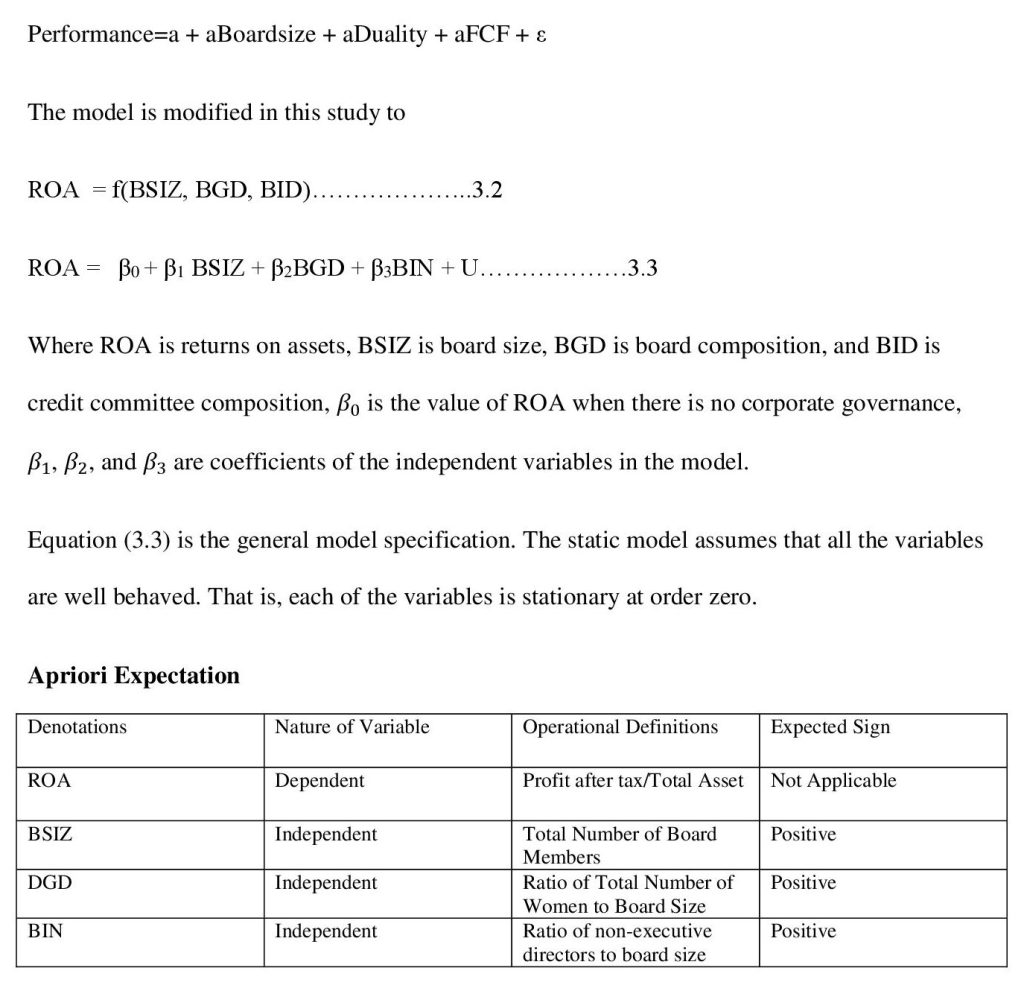

PRESENTATION AND ANALYSIS OF DATA 4.1 Data Presentation In order to answer the questions derived from the objectives of the study and equally test the subsequent formulated hypotheses, Panel least squares regression analysisstatistical techniques have been employed. A 5% (0.05) level of significance or 95% confidence level was chosen for the purpose of the study. However, before a regression analysis was conducted; a descriptive statistic was carried out. 4.1.1 Descriptive Analysis Table 4.1 Descriptive Statistics

Return on Assets (ROA) expresses the relationship between the net profit after taxes of the firm and its net assets. Like the other profitability ratios, the higher the ROA, the better. A low level of ROA may be the result of a low level of profit margin or low turnover of total assets which may partly result from poor loan performance. From Table 4.1, the combined ROA for the eight industrial good industries studied averaged 3.59% for the period under study with a minimum and maximum values of -26.37% and 36.77% respectively. Within the same period, board size (BSIZ) fluctuated between 5 board members to19 while averaging about 9. Meanwhile board gender diversity (BGD) and board independence (BIN) fluctuated between 0% to 60% and 0.0% to 88.24% respectively. Result of Normality Test

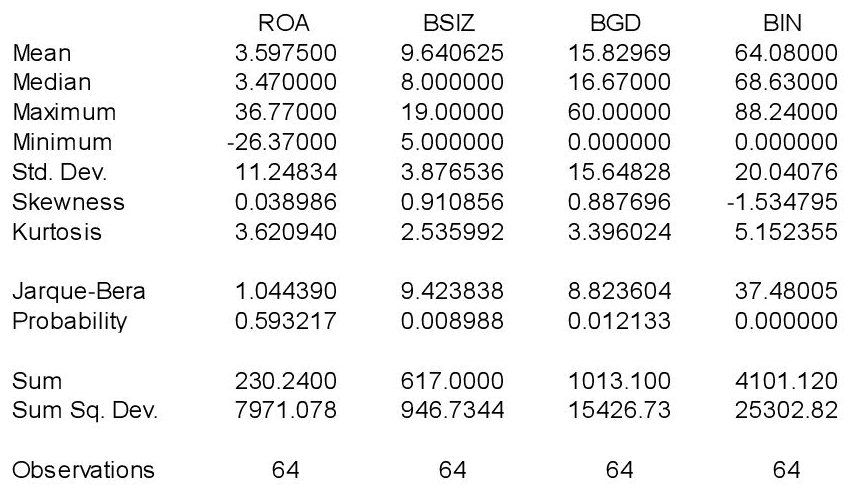

In order to ascertain that data used for this study was normally distributed, so the result of the study could be used for inferences, the normality test was carried out. The Jarque-Bera Normality test which requires that for a series to be normally distributed, the histogram should be Bell-shaped was used. The result of the test is presented in Figure 1. From the figure the distribution has a bell shape as required. The null hypothesis for Jarque-Bera test is H₀: Data follow a normal distribution at .05 level of significance. From Figure 1, the P-value is 0.104150, which is greater than 0.05. The Null hypothesis of normal distribution can therefore not be rejected. Thus, the data for the study followed normal distributed. 4.2 Data Analysis Table 2 Panel Least Squares Regression

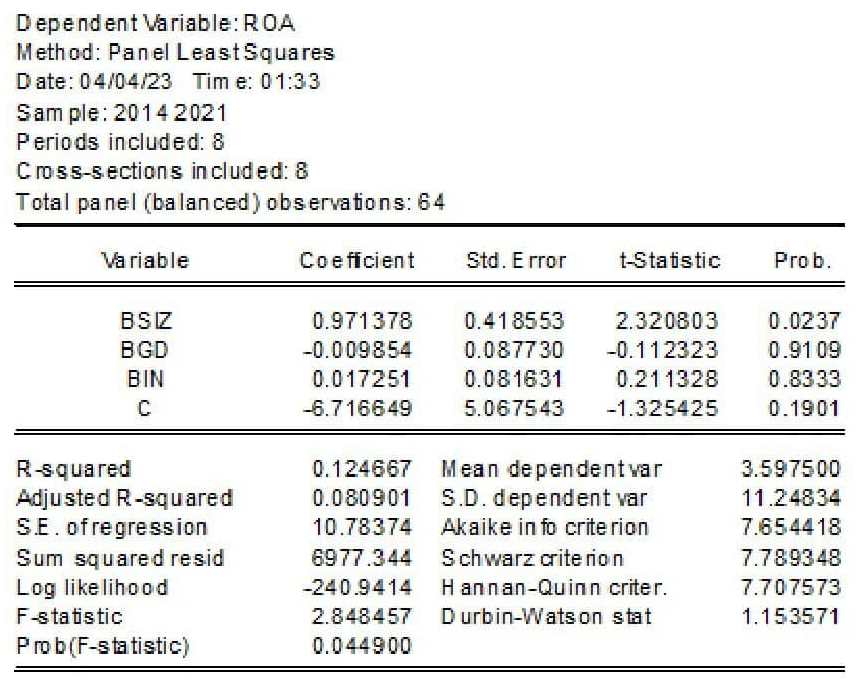

The regression result in Table 2 is a panel least squares aggregate regression of all the industrial goods companies under study. The result showed from the coefficients of the variables that Board size (BSIZ) and board independence (BIN) each has a positive effect on returns on asset (ROA) as expected. However, while the effect of BSIZ is significant at 5% level of significance, bin is not significant. Specifically, the coefficient of BSIZ of 0.97and its probability of 0.00237 (P < .05) shows that board size is has a positive and significant effect on industrial goods companies performance as measured by ROA. It implies that the Null hypothesis H01 of no significant effect of BSIZ on ROA is hereby rejected. It shows that an increase of one unit increase in board size will lead to an increase of returns on asset (ROA) by 0.97 units. Although not significant at 0.05 level of significance, the coefficient of board independence (BIN) is 0.017251 and its probability is 0.833 (P > .05) implying that we fail to reject the Null hypothesis H02 of no significant effect of board independence on industrial goods companies performance represented by returns on asset (ROA). However, it shows that an increase of 1 independent board director will result in an increase of 0.017 unit of returns on assets (ROA) which is however, not significant. Also, the result of the least squares panel regression analysis in Table 2 shows that the coefficient of board gender diversity (BGD) is -0.009854 and its probability is 0.9109 (P > .05). This implies that board gender diversity (BGD) has a negative, but insignificant effect on ROA. It therefore implies that we fail to reject the Null hypothesis H03 of no significant effect of BGD on ROA. The coefficient of determination (R2) of 0.12806 shows that the variables used in the model can explain 13% of the changes in the value of ROA and 87% by other variables not employed in the model. The F-statistic of 2.9 and its corresponding probability of 0.040 (P < .05) shows that the variables in the model have a joint positive effect on returns on assets of industrial goods companies under study and the effect is significant at .o5 level of significance.

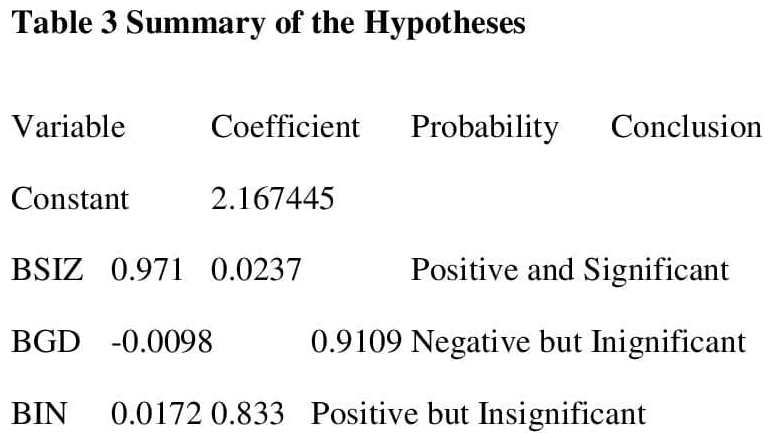

Hypothesis One Ho1: Board Size has no significant effect on the performance of industrial good firms in Nigeria. From Table 3 above, since the probability value is less than 5% (0.0237< .05), the null hypothesis is rejected Hypothesis Two Ho2: Board Gender Diversity has no significant effect on the performance of industrial goods firms in Nigeria as measured by return on assets. From Table 3 above, since the probability value is greater than 5% (0.9109 > .05), we fail to reject the null hypothesis and conclude that BGD has no significant effect on the performance of industrial good firms in Nigeria as measured by return on assets. H03: Board independence has no significant effect on the performance of industrial good firms in Nigeria as measured by return on assets. From Table 3 above, since the probability value is greater than 5%(0.8333> 0.05), we fail to reject the null hypothesis and reject the alternative hypothesis which says that board independence has a significant effect on the performance of industrial goods firms in Nigeria 4.3 Discussion of Findings The result showed that Board Size (BSIZ) has a positive, and significant effect on Returns on Asset for the aggregates values for the industrial goods firms. This result is consistent with that of Adekunle and Aghedo (2014) whose study of selected companies showed a similar impact. A study by Sathyamoorthi, Baliyan, Dzimiri and Wally-Dima (2017) on impact of corporate governance on financial performance of listed companies in the consumer services sector in Botswana for the period 2012 to 2016 showed that gender diversity has a negative impact on firm performance just as is the case of this study although the negative impact here is insignificant.The study also revealed that composition of executive and non-executive directorship have negative relationship with financial performance of listed companies in Botswana. However, Carter, D‘Souza, Simkins, and Simpson (2007) showed a positive impact of the proportion of women in a company on performance. A study by Dzingai and Fakoya (2017) that investigated the effect of corporate governance structure on the financial performance of firms in Johannesburg for the period 2010 to 2015 showed that board independence has a positive impact on return on equity. This is similar to this study in which board independence has a positive impact on returns on assets although the effect is insignificant. Summary of Findings, Conclusion and Recommendations 5.1 Summary of Findings The focus of this chapter was to highlight the findings of the study, draw conclusion as well as made recommendations concerning corporate governance and its effect on performance of industrial goods firms in Nigeria.

The F-statistic of 2.9 and its corresponding probability of 0.040 (P < .05) shows that the variables in the model have a joint positive effect on returns on assets of industrial goods companies under study and the effect is significant at .o5 level of significance. However, the coefficient of determination (R2) = 0.1246 showed that just about 13% of changes in the performance of Industrial goods firms in Nigeria is accounted for by the level of corporate governance.The implication is that there are many other factors outside corporate governance that contribute to the performance of Industrial goods firms in Nigeria. The F-statistics (2.84) with probability p: 0.04 < 0.05) indicated that all the independent variables used in the model have significant effect on the performance of Industrial goods firms in Nigeria. 5.2 Conclusion Findings of the study have shown that board size has positive and significant effect on return on assets of industrial goods firms in Nigeria, at least within the period covered by the study. Board independence equally showed a positive effect on ROA, although the effect is insignificant. However, gender diversity showed a negative though insignificant effect on ROA of industrial goods firms implying that the moderating role of female directors is not well utilized in the governance of industrial goods firms in Nigeria. The study therefore concludes that what matters most in the industrial goods firms in Nigeria is the size of the board as more board members will bring diverse ideas which if well harnessed will always lead to higher returns on assets. 5.3 Recommendations

REFERENCES Adam, R. & Mehran, H. (2003). Is Corporate Governance Different for Bank Holding Adekunle, S. A. & Aghedo, E. M. (2014). Corporate Governance and Financial Performance of Selected Quoted Companies in Nigeria. European Journal of Business and Management, 6(9), 53-60. Aggarwal, P. (2013). Impact of Corporate Governance on Corporate Financial Performance. IOSR Journal of Business and Management, 13, 1-5. Akingunola R.O, Adekunle Olusegun.A, & Adedipe, O. A. (2013). Corporate governance and bank’s performance in Nigeria. European Journal of Business and Social Sciences, 2(8) , 89-111. Assenga, Modest, Aly, Doaa A and Hussainey, Khaled (2018). The impact of board characteristics on the financial performance of Tanzanian firms. Corporate Governance: The International Journal of Business in Society, 18 (6). pp. 1089-1106. doi:10.1108/CG-09-2016-0174 Beasley, M.S. (1996) An Empirical Analysis of the Relation between the Board of Director Composition and Financial Statement Fraud. The Accounting Review, 71, 443-465. Bebchuk, L., Cohen, A. and Ferrell, A. (2004) What Matters in Corporate Governance and Control. NBER Working Papers, No. 9371, National Bureau of Economic Research, Inc., Cambridge Brown, L. D. & Caylor, M. L. (2004). Corporate Governance and Firm Performance Working Paper, Georgia State University Cheema, K. R. & Muhammad S.D. (2014). Impact of corporate governanceon performance of firms: A case study of cement industry in Pakistan.Journal of Business and ManagementSciences, 1(4), 44-46. Donaldson, L. & Davis, J. (1991). Stewardship Theory or Agency Theory. Australian Journal of Management, 16, 49-64. Enobakhare, A. (2010). Corporate governance and bank performance in Nigeria. MBA Research Report, University of Stellenbosch. Retrieved from ttp://hdl.handle.net/10019.1/ 8439. Ferguson, A. & Stokes, D. (2002).Brand Name Audit Pricing, Industry Specialization, and Leadership Premiums Post-Big 8 and Big 6 Mergers. Contemporary Accounting Research, 9(1) 77-110. Gaio, C. & Raposo, C.C.(2014). Corporate Governance and Earnings Quality: International Evidence. Journal of Accounting and Finance 14(3), 52-74. George, T. P., & Karibo B. B. (2014) corporate governance mechanisms and financial performance of listed firms in Nigeria: A content analysis. Global Journal of Contemporary Research in Accounting, Auditing and Business Ethics (GJCRA), 1(2). Kajola S. (2008). Corporate Governance and Firm Performance: The Case of Nigerian Listed Firms, European Journal of Economics, Finance and Administrative Science, Issue, 14. Kwakwa, V. and Nzekwu, G. (2003). International Best Practices on Corporate Governance in Alo, O. (2005), Issues in Corporate Governance. Lagos: Finad Servea Institutions Training Centre, 18-39. Ogbechie, C. & Koufopoulos, D, N. (2007). “Corporate Governance Practices in Publicly Quoted Companies in Nigeria” presented at the 4th World Congress on Corporate Governance, McMaster University, Hamilton, Ontario, Canada, Okereke, E. J. Abu, S. S., & Anyanwu, G. I. (2011). Impact of corporate governance on the performance of Nigerian deposit money banks. Indian Journal of Corporate Governance, 4, 15-26. Retrieved from Owolabi, S.A. & Dada, S.O. (2011). Audit Committee: An instrument of effective corporate governance, Ghana Journal of Education and Teaching. 12(1), 115-122. Oyedokun G. O. (2019). Board characteristics and financial performance of Commercial Banks in Nigeria. Accounting and Taxation Review, 3(2): 31-48 Ping Z, Wing C (2011) Corporate governance: a summery review on different theory approaches. Int Res J Finance Eco ISSN 1450–2887 68:7–13 Ponnu C.H. (2008).*Corporate Governance Structures and the Performance of Malaysian Public Listed Companies. Sathyamoorthi, C. R., Baliyan, P., Dzimiri, M., & Wally-Dima, L. (2017). The Impact of Corporate Governance on Financial Performance: The Case of Listed Companies in the Consumer Services Sector in Botswana. Advances in Social Sciences Research Journal, 4(22). Shungu, P., Ngirande, H, & Ndloy, (2014). Impact of Corporate Governance on the Performance of Commercial Banks in Zimbabwe. Mediterranean Journal of Social Sciences, 5(15), 93-105. Strine Jr, L. E. (2010). Can Corporations Be Managed for the Long Term Unless Their Powerful Electorates Also Act and Think Long Term? Business Lawyer, 66(1) Surbakti, Lidya Primta & Binti Shaari, Hasnah & Ahmed Bamahros, Hasan Mohammed, 2017. Effect of audit committee expertise and meeting on earnings quality in Indonesian listed companies: A conceptual approach, Journal of Accounting and Finance in Emerging Economies, CSRC Publishing, Center for Sustainability Research and Consultancy Pakistan, 3(1), 47-54. Yermack, D. (1996) High Market Valuation of Companies with a Small Board of Directors. Journal of Financial Economics, 40, 185-211.

|

||||||||||||||