International Journal of General Studies (IJGS), Vol. 3, No. 1, January-March 2023, https://klamidas.com/ijgs-v3n1-2023-04/ |

||

|

The Effects of Government Expenditure on Human Capital Development and Economic Growth in Nigeria By Ogonna Clara Ngangah

Abstract This study is an evaluation of the effects of government expenditure on human capital development and economic growth in Nigeria. Human capital development is the engine of economic growth not only in developed nations but also in developing countries. No matter the investment a country makes on other areas of development, unless its human capital is developed it cannot experience rapid and sustainable technological and industrial growth. Human capital development entails the acquisition of knowledge and applicable skills by a nation’s work force with a view to increasing and maximizing the country’s productive and inventive capacity. A skilful and well-equipped human resource is what creates economic growth in any country. This paper appraises the result and impact of government expenditure on the development of human capital in Nigeria and how this enhances or drives economic growth in the country. The paper specifically examines government’s recurrent and capital spending on education, health, and on research and development over a given period (1989-2018). The study adopted the ex-post facto research design method because secondary source of data was employed for the study. The paper relied on historical time series secondary data that were collected from the Central Bank of Nigeria’s annual statistical bulletin from 1989-2018. The study shows that there is need not only to inject more funds for human capital development through budgetary allocations, but also to efficiently use government expenditure for human capital development in Nigeria. Keywords: government expenditure, human capital development, economic growth, Nigeria

1.1 Background of the Study 1.2 Statement of the Problem Studies in Nigeria that dominate extant literature on government expenditure on human capital development and economic growth emphasize government expenditure on education and government expenditure on health as proxies for human capital development, such as Jaiyeoba (2015); Mba, Mba, Ogbuabor and Ikpegbu (2013), Ogujiuba (2013), etc studies on human capital development failed to include technology as well as research and development. Inspite of government”s effort, the level of human capital development in Nigeria as a developing economy remains small considering the level of enormous resources available in Nigeria. As Okafor, Ogbonna, and Okeke (2017) submitted, the fiscal policies and engagement of Nigerian government expenditure have overtime failed to address the necessary human capital development shortfalls within the economy. Equally, in the views of Ehimare et al (2014), available record shows that the Nigerian education sector has consistently received less allocation than advocated by United Nations Educational Scientific and Cultural Organization (UNESCO). Following UNESCO’s prescription, the standard funding requirement for education for every country is to allocate at least 26 percent of its annual budget to its education sector. Nigeria spends less than nine per cent (9%) of its annual budget on education on the average. The health sector similarly has challenges. According to Ayuba (2014), in Nigeria, almost 70% of total expenditure on health (90% of which is out-of-pocket) is private expenditure. This high level of out-of-pocket expenditure implies that health care has placed a significant financial burden on households resulting to poor health management and consequently leading to poor quality of human capital. Furthermore, emphasis have been laid by many other studies on the fact that the differences in the level of socio-economic development across nations is attributed not so much to natural resources and endowments and the stock of physical capital, but to the quality and quantity of human resources (Dauda, 2010; Ehimare et al, 2014). It becomes necessary therefore, to investigate how government expenditure in human capital development represented by government expenditure on education, health, technology, and research and development affect economic growth in Nigeria. This will enable the study to propose solutions to the problem by way of recommendations. 1.4 Research Questions In order to achieve the above stated objectives, the following research questions were formulated: From the above research questions, the following null hypotheses were formulated.:

2. REVIEW OF RELATED LITERATURE This section provides an overview of previous research on government expenditures on Human Capital Development and Economic Growth in Nigeria. 2.1 Conceptual Review 2.1.1 Economic Growth Economic growth as defined by Hardwick, Khan and Langmead (1994), is an increase in a country’s productive capacity, usually detectable by a sustained rise in real national income. It has to be noted however that the reported increase in the countries productive capacity has to be sustained over a period of time, for instance, five years to ten years and the average growth per year deduced and reported as the annual rate of growth. In Anyanwuocha (2006), economic growth is the process by which national income or output is increased. Equally from this perspective, an economy is said to be growing if there is a sustained increase in the actual output of goods and services per head. Accordingly, the rate of economic growth therefore measures increase in real national income during a given period of time usually one year. Economic growth in a country is proxied by Gross Domestic Product (GDP). However, in this study, the real gross domestic product (RGDP) is used to conceptualize the monetary value of all goods and services produced in an economy over a specified period, usually one year. RGDP is an inflation-adjusted measure of the nominal GDP and accounts for changes in price levels and also provides a more accurate figure of economic growth. 2.1.2 Human Capital Formation Human capital refers to the abilities and skills of human resources (Harbinson, 1973). Human Capital is an important factor for converting all resources to benefit humanity. Economists have observed that economic growth is boosted by human capital utilization and development. A number of studies including Barro and Salai-Martin (1995) and Temple (1999) have analysed the channels through which human capital can affect economic growth of a nation both human and physical capital. Human capital formation connotes the process of accumulating human capital (Ogujiuba, 2013). In the submission of Schugurensky (2002), the concept of human capital implies an investment in people. 2.1.3 Human Capital Development The Organization for Economic Corporation and Development (OECD) (2001) views human capital as the stock of knowledge, skills, competitiveness, habits, social and personality attributes that include but not limited to creativity, cognitive abilities and other competencies embodied in the ability to perform labour in a way as to produce economic value. Accordingly, labour as one of the factors of production can also be referred to as workforce (Mba, Mba, Ogbuabor, & Ikpegbu, 2013). Schutz (1993) on his part opines that human capital is the key element in improving firms’ asset and employees in order to improve productivity as well as sustain competitive advantage. In another perspective, Jaiyeoba (2015) views health and education as the two closely related human (resource) capital components that work together to make the individual more productive. In this regard, and according to Anyawnu (1997) health connotes the ability to lead a socially and economically productive life. Furthermore, United Nations often relates Human Capital to Human Development in a nation. The statistical indicator of estimating human development in each nation is the Human Development Index (HDI). The HDI is a combination of Life expectancy index; Education Index; and Income Index. From the afore discussion it can be necessary to corroborate Gardner and Gardner (2012) opinion that in general, investment in health usually complements investment in education and training since returns to the latter will be higher if people can work for longer periods or at a higher level of intensity if they have better health. Similarly, returns to health will likely be higher if the labour force is better educated and more informed about what contributes to its state. 2.1.3.1 Education as a Component of Human Capital Development Lawanson (2009) corroborated many other empirical studies in considering human capital as those resources that are inherent in each human being, which can be traced between the users and the owners to improve their respective living conditions. In this regard, Lawanson summarised the inherent resources in human beings to include knowledge (knowing what to do), skills (knowing how to do what is to be done), and attitude (behavioural demonstration of a favourable inclination while doing that which is to be done). Adekola (2014) on his part argues that Human capital development increases the number of knowledgeable workers by improving their skills. 2.1.3.2 Evolution of Public expenditure on Education in Nigeria Lawanson (2009) reports that Education in Nigeria is a constitutional matter, and therefore a responsibility of the government, although it is financed by the public sector in conjunction with the private sector and external bodies. It becomes glaringly clear that the sources of education investment funds are majorly public in nature. In this regard one of the ways the government systematically employs in financing education is the annual budgetary allocation to the sector that are usually channelled as subventions or grants to the different levels of education. According to Dauda (2011) an attempt by Nigeria to demonstrate her willingness to commit more investment in human capital commenced precisely in 1959. The importance of this date lies in the fact that it was the year preceding independence, and the Ashby Commission was set up to conduct a study on Nigeria’s needs in the light of post-school certificate and higher education for the subsequent 20 years. The recommendations of this report that was submitted in 1960 led to considerable investment in education which was distinguished as the only means of human capital formation in that era. Okuwa (2004) recounted that prior to this period, investment in formal education was more of private affairs and also deeply rooted and extended to the works of the Christian missionaries in the colonial epoch. Ever since independence in 1960, government expenditure in education has been on the increase, even though it has not yet met the 26 percent UNESCO recommendation. For instance as at 2010, Obadara (2010) stated that the number of Universities in Nigeria had grown to one hundred and one (101) categorized into twenty-seven (27) federal universities, thirty-three (33) state universities and forty-one (41) private universities with a student enrolment of 1, 096,312. According to him, the staff strength of these universities was 99, 464 divided into 27, 394 teaching staff and 72, 070 non-teaching staff. As at 2017, the number of Universities had risen to 153 broken into 43 federal, 48 state owned, and 79 private universities with a student enrolment of 1.9 million. 2.1.3.3 Health as Human Capital According to Gardner and Gardner (2012), preventive and therapeutic health care services could improve workers’ productivity in addition to increasing their quality of life. Pocas (2014), outlined channels through which health contribute to render human capital more valuable. Some of these include: i) Productive efficiency – According to Cai and Kalb (2006) there is empirical evidence to show that healthier workers have more physical and mental energy, being more creative and productive. ii) Life expectancy – An important outcome of health status improvements is the fact that life expectancy is raised. iii) Creativity – It is asserted that health improvements induce better educational achievements, which are likely to have additional effects on the country’s creativity and innovation activity. Nelson and Phelps (1966) showed that educational improvement speeds technological diffusion. 2.1.3.4 Evolution of Public Expenditure on Health in Nigeria In the views of Eneji, Juliana, and Onabe (2013), Public health and human rights are complementary approaches to promoting and protecting human dignity and wellbeing. Public capital health expenditure witnessed fluctuating trend within the period under study. In 1988, it stood at 0.42 billion naira, increased to N 0.58 billion in 1989 before falling to N 0.5 billion in 1990. Although with minimal fluctuations, it by 2000 it had increased to N 15.2 billion. It increased to N231.8 billion in 2011 but dropped to N 197.9 billion before picking up steam again in 2013 rising to the peak of N 257.7 billion in 2015. It declined to N 202.4 Billion in 2016. Nigeria’s health reform agenda is ably expressed in the National Economic Empowerment and Development Strategy (NEEDS), engineered by the National Planning Commission (NPC, 2004). Despite this, Nigeria, which is the most populous country in Sub-Saharan Africa and 6th oil-producing country, has continued to experience health problems in the form of high rates of infant and maternal mortalities due to prevalence of different diseases, increase in morbidity rate which has resulted to low life expectancy. According to Bleakley (2010), poor countries are inclined to be unhealthy, and unhealthy countries are likely to be poor. 2.1.3.5 Technology and Human Capital Development According to Wikipedia, technology is the collection of techniques, skills, methods, and processes used in the production of goods or services or in the accomplishment of objectives, such as scientific investigation. According to Basu (2014), technology transfers in the form of collaborations with foreign firms facilitate human capital development. Human capital can be thought of as the set of marketable skills of workers in which a variety of investments are made, such as training and education. It corresponds to any stock of knowledge or characteristics the worker has (either innate or acquired) that contributes to his or her productivity (Acemoglu & Autor, 2011). Human capital needs investment in the form of health and education for development just like all forms of capital. 2.1.3.6 Research and Development Impact on Human Capital Development Research and development refers to innovative activities undertaken by corporation or government in developing new services or products or improving new service or products (Wikipedia). Acccording to Blanco, Luisa, Prieger, James and Gu (2013), Griliches (1979), productivity growth is the consequence of expenditures on R&D. In the endogenous growth model developed by Romer (1986), firms’ expenditure on R&D results in greater aggregate output because private R&D leads to spillovers through its contribution to the public stock of knowledge. In the views of Okokpujie, Fayomi, and Leramo (2018) research and development are key long determinant of profitability and buyer welfare. 2.2 Theoretical Framework A number of theories link human capital development and economic growth. Some of the theories considered relevant for this study include: Musgrave and Rostow theory of public expenditure, Schultz Theory (1961) of Human Capital, Adolph Wagner’s theory of increasing Government Expenditure and Endogenous growth theory. 2.2.1 Musgrave and Rostow theory of public expenditure Musgrave and Rostow advanced a development model under the causes for growth in public expenditure. They argue that public expenditure is a prerequisite for economic growth. The public sector initially provides economic infrastructure such as roads, railways, water supply and sanitation. As economic growth takes place the balance of public investment shifts towards human capital development through increased spending in education, health and welfare services (Edame & Eturoma, 2014). 2.2.2 Schultz (1961) Human Capital Theory Human Capital Theory was postulated by Schultz (1961). Schultz argues that both knowledge and skill are a form of capital, and that this capital is a product of deliberate investment. Schultz exemplifies by quoting Western economies, and explains the increase in their national output as a result of investment in human capital. 2.2.3 Endogenous Growth Theory The flame work for understanding economic growth is rooted, according to Uwakaeme (2015), in the endogenous growth theory which emphasises that economic growth is an outcome of an economic system and not the result of forces that impinge from outside.. According to this theory anything that enhances economic efficiency is also good for growth. The theory emphasizes the importance of entrepreneurship, knowledge, innovation, and technology as factors engineering economic growth. Theorists such as Romer (1990) consider technical progress as the main determinant of economic growth. In the same vein, Aghion, Howitt (1992) also emphasize on technical progress, positing that a country with more resources of educated people will grow faster than a country with a lower level of human capital. 2.2.4 Adolph Wagner’s Theory of Increasing Government Expenditure Adolph Wagner, a German economist propounded the law of increasing state activities which states that with economic growth and development, a nation will experience an increase in the activities of public sector. The ratio of the increase would raise the output per capita i.e ratio of public consumption expenditure to Gross National Product (GNP) will rise and hence Gross National Product (GNP) rises. He gave a relationship between level of development and public expenditure.

2.3. Review of Theoretical Literature 2.3.1 Education as component of Human Capital and Economic Growth In this perspective, Human capital theory sees education as a tool that increases the stock of human capacities available in a nation which then determines the level of economic growth. Lawal and Wahab (2011) in their own contribution opined that a more educated labour force is expected to be able to achieve faster productivity growth. 2.3.2 Health as Component of Human Capital and Economic Growth Although Schultz (1961) and Mushkin (1962) had floated the idea that human capital accumulation could be improved by investing in the population’s health just as education, the idea actually gained prominence after Grossman’s (1972) pioneer work. Accordingly, Grossman (1972) was the first to consider explicitly this issue, relating a higher preference for health as consumption good to more educated individuals (Pocas, 2014). Becker (2007) opined that health status is an important part of human capital, which is directly linked with education, and it can be defined as an individual’s health stock and depreciates over time just as physical capital stock does. This notwithstanding, individuals can invest to improve on their health status by spending more on keeping a healthy body and attaching more importance on the nutritional value of their food in-take. 2.2.3 Technology and Economic Growth In the field of growth economics, both standard neoclassical growth theory and recent endogenous growth theory attribute the income difference between developing and developed countries as being partly due to differences in technology between rich and poor countries. From the perspective of neoclassical theory (the Solow-Swan model), technology is not only generally available, but also universally applicable (Solow, 1956). From the perspective of endogenous growth theory, gaps in the endowment of ideas and the limited capacity of developing countries to absorb new knowledge are the main reasons for the income gap (Romer, 1994). According to Basu (2014), one of the methods in which this interaction between technology and skills is put into effect is through technology transfer. 2.4 Empirical Review 2.4.1 Government Expenditure on Education and Economic Growth Amaghionyeodiwe (2019) investigated government spending on education and economic growth in West African countries for the period 1990 to 2016 covering data for 15 selected ECOWAS countries and employing cointegration and causality test analysis. Findings revealed that government spending on education and economic growth in West African countries are positively and significantly related. Ayeni and Omobude (2018) conducted a study to investigate educational expenditure and economic growth nexus in Nigeria. The study employed the Autoregressive Distributed Lag (ARDL) and bound test approach to analyze the data. Findings showed that educational expenditure was inconsistent with education sectoral output; meanwhile recurrent educational expenditure exhibited significant relationship with real gross domestic product (economic growth), and in contrast, capital expenditure on education was insignificant. Obi and Obi (2014) used Johansen’s co-integration analysis and ordinary least square (OLS) to analyze the relationship between gross domestic product (GDP) and recurrent education expenditure in Nigeria from 1981 to 2012. Findings indicated the subsistence of a positive relationship between education expenditure and economic growth, but no long run relationship existed over the period under study. Nurudeen and Usman (2010) carried out a dis-aggregated analysis on government expenditure and economic growth in Nigeria. Their analysis concluded that there was no significant relationship between expenditure on education and economic growth in Nigeria. Odeleye (2012) assessed the effect of education on economic growth using primary and secondary annual data ranging from 1985 to 2007. The findings showed that only recurrent expenditure has significant effects on economic growth as the academic qualifications of teachers also have significant impact on students’ academic performance. Adenuga (2006) examined the relationship between economic growth and human capital development using Nigerian data from 1970 to 2003. They applied co-integration analysis incorporating the Error Correction Mechanism and found that investment in human capital through the availability of infrastructural requirements in the education sector accelerate economic growth. Chude and Chude (2013) conducted a study to determine the effect of public expenditure on economic growth in Nigeria using Error Correction Model (ECM) to analyze data from 1977 to 2012. The results of the study indicated that Total Expenditure in Education is highly and statistically significant and have positive relationship on economic growth in Nigeria in the long run. Omotor (2004) examine the profile of educational expenditure in Nigeria from 1977-1998. The study constructed and tested an education expenditure model using the ordinary least squares (OLS) technique and showed that federal government revenue was the singular significant determinant of educational expenditure A study by Musibau and Rasak (2005) investigated the long-run relationship between education and economic growth in Nigeria by employing the Johansen’s Co integration tools. Findings showed that there exists a long-run relationship between education and economic growth in Nigeria. Torruam, Chiawa, and Abur (2014) investigated the impact of public expenditure on tertiary education and economic growth in Nigeria using time series data for the period 1990 – 2011. They employed cointegration and error correction technique and the study revealed that public expenditure on tertiary education has positive impact on economic growth in Nigeria. 2.4.2 Government Expenditure on Health and Economic Growth Eneji, Juliana, and Onabe (2013) carried out a study to establish the relationship between healthcare expenditure, the health status and national productivity in Nigeria. The work focussed on public healthcare expenditure from 1999-2012 for objective analysis. By regressing Public health care expenditure the explanatory variable for health status, and real GDP, the study showed a weak causal relationship in the Nigeria scenario. Dauda (2011) examined whether health as a component of human capital matters for the growth of the Nigerian economy by analyzing annual time series data from 1970 to 2009. The study adopted cointegration and error correction mechanism to complete the analysis. The results of the study showed that health expenditure is positive and statistically significant but the coefficients of the second and third lags are negative and statistically significant. Bakare and Olubokun (2011) carried out research on the relationship that exists between health care expenditures and economic growth in Nigeria and found that a positive and significant relationship exists between both indices. 24.3 Government Expenditure on Education and Health and Economic Growth Omodero (2019) assessed the impact of government general spending on human development in Nigeria from 2003 to 2017 by examining the response of Human Development Index (HDI) to recurrent and capital government expenditure. The study employed the Ordinary Lease Squares method for data analysis. The result of the study showed that government recurrent expenditure has strong and significant positive impact on HDI while government’s capital expenditure had an insignificant negative influence on HDI Ogunleye, Owolabi, Sanyaolu, and Lawal (2017) employed the ordinary least square regression analysis to examine the impact of human capital development on economic growth of Nigeria from 1981 to 2015. The result showed that human capital development has significant impact on economic growth. Osoba and Tella (2017) examined the interactive effects of the relationship between human capital investment components and economic growth in Nigeria for the period of 1986 – 2014. The results of the study showed that there was positive and significant relationship between the interactive effects of human capital components and growth in Nigeria Okafor, Ogbonna, and Okeke (2017) examined the long run relationship between the governmental expenditure in education and health and Human Capital Development in Nigeria. Empoying VAR model for the analysis, the result showed that HDI is significant in the current year but tends to converge insignificantly in the previous years. Adekola (2014) examined a regime shift analysis of the empirical relationship subsisting between public investment in human capital and economic growth in Nigeria within the period 1961 to 2012. Using cointegration technique and error correction procedure, the study found that federal and states governments’ spending on human capital (education and health) impacted positively on economic growth in Nigeria individually and collectively. By employing cointegration and Vector Error Correction (VEC) Model Based Causality, Ayuba (2014) examined the causal relationship between public social expenditure (education and health) and economic growth in Nigeria for the period of 1990 to 2009. The study found that there is a unidirectional causality running from economic growth to health expenditure, thereby supporting the Wagner’s Law. Adeyemi and Ogunsola (2016) examined the impact of human capital development on economic growth in Nigeria using time series data spanning from 1980 to 2013. The study employed ARDL Co-integration analysis to estimate the relationship between human capital indices (education and health) and economic growth. Findings from the study revealed that there is positive long-run relationship among secondary school enrolment, public expenditure on education, life expectancy rate, gross capital formation and economic growth but it is statistically insignificant. Ebong, Ogwumike, Udongwo, and Ayodele (2016) assessed the impact of government capital expenditures on economic growth in Nigeria during 1970 and 2012. A multiple regression model based on a modified endogenous growth framework was utilized to capture the interrelationships among capital expenditures on agriculture, education, health economic infrastructure and economic growth. The result showed that short-run and long-run impacts on growth of capital expenditures on Education were 0.45 and 0.48, respectively. These results were positive and statistically significant at the 5% level. The short-run impact of health capital expenditures on economic growth was 0.21, while the long-run impact was 0.16. These impacts were negative and insignificant. Expenditures on economic infrastructure had significant positive impacts on growth of 0.28 in the short-run and 0.32 in the long-run. Obi, Ekesiobi, Dimnwobi, and Mgbemena (2016) examined government education spending and education outcome in Nigeria from 1970 – 2013. The study revealed that public education spending has a positive and significant effect on education outcome in Nigeria. Landau (1997) studied the impact of government expenditure for human capital (education and health) on economic growth, and the actual human capital created, The regressions indicated that differences in government expenditure on human capital (as a share of GNP) have no statistically significant impact on the rate of economic growth, and a limited impact on the actual levels of education and health achieved Jaiyeoba (2015) investigated the relationship that subsist between investment in human capital (education and health) and economic growth in Nigeria within the span of 1982 to 2011. Government expenditure in education and primary enrolment rate had a negative relationship with economic growth. 2.4.4 Government Expenditure on Technology and Economic Growth Sulaiman et al. (2015) investigated the impact of human capital and technology on economic growth in Nigeria for the period (1975-2010) employing autoregressive distributed lag approach to cointegration to establish the relationship between the variables. The result showed that human capital in the form of secondary and tertiary school enrollments have had significant positive impact on economic growth. Technology also showed significant positive impact on economic growth. The study concluded that human capital and technology are important determinants of growth in Nigeria. Borensztein, Gregorio and Lee (1998) examined the role of Foreign Direct Investment (FDI) in technological diffusion and economic growth by developing a model of endogenous growth. The data was taken for 69 developing countries from Barro and Lee (1994), International Monetary Fund (IMF) and Organization for Economic Co-operation (OECD) publications for the period 1970-89. They aimed at determining the channels through which the FDI inflow from industrialized countries can affect economic growth. The study concluded that FDI is more productive in those countries where the human capital accumulation is comparatively low. This shows the effect of FDI on economic growth through the improved human capital and technology diffusion. Gold (2011) investigated the roles of Telecommunications and Information Technology (IT) and its effect on the Nigerian economy while examining the growth implication. Data collected was analyzed using Ordinary Least Square (OLS) method. The Findings of the study revealed that telecoms have influenced the economy by increasing their market access and reduced distribution cost, which invariably affected the service provider cost. The study also showed that GSM has enabled Nigerians to transact their businesses easily resulting in higher productivity; reduction in poverty level and prevalence through increase in income generating capacity and business expansion; improved living standard; boosted economic capacity, and stimulated the economy to achieve the desired macroeconomic policy targets. Abu and Abdullah (2010) investigated the relationship between government expenditure and economic growth in Nigeria from the period ranging from 1970 to 2008. They used disaggregated analysis in an attempt to unravel the impact of government expenditure on economic growth. Their results reveal that government total capital expenditure, total recurrent expenditure in Education have negative effect on economic growth. On the contrary, government expenditure on transport, communication and health result in an increase in economic growth. Bakare (2006) examined the growth effect of human capital investment in Nigeria employing the vector autoregressive error corrections mechanism. The study showed that there is a significant functional and institutional relationship between the investments in human capital and economic growth in Nigeria. 2.4.3 Research Gaps In Nigeria, most studies on government expenditure on human capital development and economic growth focused mainly on education and health as components of human capital development. However, it has been revealed by other extant studies that there are other components of human capital development which may have implications on economic growth apart from education and health. This study is set to fill this gap in Nigeria by including Government expenditure on technology and on Research & Development as components of human capital Development on economic growth.

This chapter aims to give an introduction to the study and the specific methodology used. It presents the description of the research design, sources of data, model specification, method of data analysis etc.

3.1 Research Design The study adopted the ex-post facto research design method because secondary source of data was employed for the study. This is justified because procedure demands that this method be used when the data for the study are secondary. Hence, the study relied on historical time series secondary data that were collected from the Central Bank of Nigeria’s annual statistical bulletin from 1989– 2018. 3.2 Sources and Nature of Data Source of data included the Central Bank of Nigeria (CBN) Statistical Bulletin, various issues. All the data were annual time series data from 1989 to 2018 and secondary in nature. 3.3 Model Specification Subsequent to a detailed review of previous studies and improving upon the theoretical postulate and econometric models, this study modified the model of Jaiyeoba (2015) in studying Human Capital development and Economic Growth in Nigeria stated as GDP = f (GEOH, GEOE, GEOT, GEORD) Where: GDP = Real Gross Domestic Product, GEOH = Government Expenditure on Health, GEOE = Government Expenditure on Education, GEOT = government expenditure on technology, GEORD = Government expenditure on research and development. The mathematical form of the model is RGDP= f(EDU, HLTH, TECH, RDV) The econometric form of the model is RGDP= β0 + β1EDU+ β2HLTH+ β3TECH+ β4RDV+ µ Where: RGDP = Real Gross Domestic Product. EDU = Government expenditure on education. HLT = Government expenditure on health. TECH = Government expenditure on technology = Government expenditure on research and development. β0 = Constant term (intercept) that is the value of real GDP when all the independent variables in the model are each equal to zero. βn =1-4 = Coefficient of Explanatory Variables. µ = Disturbance, Stochastic or Error term 3.4 Method of Data Collection Documentary evidence constituted the instrument of data collection as the study was based on Secondary data. The figures of the data are annual aggregates. 3.5 Justification for Variables This study examined government expenditure on human capital development and economic growth in Nigeria within the period 1989 to 2018.

3.5.1 The Dependent variable Economic growth, the dependent variable is proxied by the RGDP growth rate. RGDP growth has traditionally been used to represent the nation’s economic growth and implies annual changes in monetary terms of the total goods and services produced within the territorial boundary of a country. 3.5.2 The Independent Variable Human capital development, the independent variable, is proxied by government expenditure on selected components of human capital development viz; 3.5.2.1 Government Expenditure on Education According to Ilegbinosa (2013), human capital could be viewed as the inherited and acquired abilities of labour with education being the primary source of acquiring these abilities. This justifies the use of education expenditure as proxy. Adekola (2014) on his part argues that human capital development increases the number of knowledgeable workers by improving their skills and enabling them to new challenges. 3.5.2.2 Government Expenditure on Health According to Gardner and Gardner (2012), preventive and therapeutic health care services may improve workers’ productivity as well as increase their quality of life, productivity of labour services as well as the quality of life emanating from that stock. 3.5.2.3 Government Expenditure on Technology It has generally been asserted that the interaction between technology and skills with a view to reducing the idea gap is the most effective method for growth. Solow’s 1956 growth model incorporates technology as a factor of production.

3.5.2.4 Government Expenditure on Research and Development (R&D). According to Pisano (1990), firms are commercially incentivised to invest in R&D in order to build strategic and technological capabilities. These capabilities enable firms to gain premium advantages which can be commercialised by means of innovative product or service development. 3.6 Method of Data Analysis In order to measure government expenditure deployed for Human Capital Development, the study considered government spending on some generally accepted components of human capital. These include; government’s expenditure on education, government’s expenditure on health, government’s expenditure on technology, and government’s expenditure on Research and Development. Economic growth the dependent variable is represented by the RGDP growth rate. The data met the requirements of quantitative data available for the study. The study therefore proceeded to investigate the relationship between the independent variables and the dependent variable and also test the null hypotheses using the P-values, the t-statistic, while the validity of the model was tested by the F-statistic of the econometric soft ware, Eviews 9.0. Also, some diagnostic tests were conducted on the various time series data of the variables of the different proxies to attest their stationarity. A unit root exists in most macroeconomic time series data as posited by Nelson and Plosser; Chowhury as amplified in Ugbaje and Ugbaje (2014), produce spurious results which may lead to inconsistency in parameter estimates. Data is stationary if it is well behaved (has a constant mean wave) therefore, predictable. 3.6.1 Diagnostic tests To reach the objectives of the study therefore the following diagnostic tests were carried out, viz; unit root test – in this case, Augmented Dicky Fuller (ADF) test proposed by Dicky and Fuller (1981) and Philip Peron (PP) unit root test to determine the stationarity of the variables, Normality test, Serial correlation test and stability of the model tests.

3.6.1.1 Unit Root Tests For the ADF and Philip-Peron unit root tests, if the time series are stationary in their level ie the t-statistic is more negative than the critical value, then they are said to be integrated of order zero ie 1(0), if the time series are stationary in their first differences, then they are said to be integrated of order one ie 1(1), if stationary in their second difference, then they are integrated of order two i.e 1(2). The Null hypothesis of a unit root will be rejected against the one sided alternative if the t-statistics is less than the critical value.

3.6.1.2 Normality Test Normality tests are used to determine whether a data set is well-modeled by a normal distribution or not, or to compute how likely an underlying random variable is to be normally distributed. Generally, sample data sets are often skewed to the right for various reasons, and if we cannot normalize the data we should not compare. In other words, in order to be consistent we need to formally test our assumptions of normality. To test formally for normality we use Jarque-Bera test statistic. Thus, the formula for the test is given below: Jarque-Bera = where ‘S’ is the skewness and ‘K’ is the kurtosis. The reported Probability is the probability that a Jarque-Bera statistic exceeds (in absolute value) the observed value under the null hypothesis – a small probability value leads to the rejection of the null hypothesis of a normal distribution at the 5% significance level.

3.6.1.3 Serial Correlation Serial correlation, also known as autocorrelation is the relationship between a given variable and a lagged version of itself over various time intervals. Generally, repeating patterns as in time series data often show serial correlation when the level of a variable affects its future level. If this is not checked, autocorrelation will fault the result of the regression and render it unfit for statistical inference.Serial correlation was tested using Breusch-Godfrey LM test statistic. The null hypothesis of the LM test is that there is no serial correlation

3.6.1.4 Cointegration Test – Autoregressive Distributed Lag (ARDL) Bound Testing Approach Cointegration test was conducted to find out if a long run relationship exists between the dependent and the independent variables. The series in this study was found to be of mixed order of integration, that is I(0) and I(1) implying that Engel -Granger or Johansen cointegration techniques which require that data must be of same order of integration could not be used. This study therefore used a more robust technique – the Autoregressive Distributed Lag (ARDL) bound testing cointegration technique. The ARDL bound test is used in determining the long run relationship between series with different order of integration (Pesaran and Shin, 1999, and Pesaran, Shin, & Smith, 2001). After selecting the appropriate lags of 2 using the Akaike Information Criterion (AIC), the long run relationship of the underlying variables were detected through the bound test. In this approach, long run relationship of the series is said to be established when the F-statistic exceeds the critical value band (Pesaran, Shin,and Smith, 2001). Pesaran, Shin,and Smith(2001) gave two sets of critical values. One set assuming that all the variables are I(0) (that is. lower critical bound which assumes all the variables are I(0), meaning that there is no cointegration among the underlying variables) and another assuming that all the variables in the ARDL model are I(1) ( that is upper critical bound which assumes all the variables are I(1), meaning that there is cointegration among the underlying variables). For each application, there is a band covering all the possible classifications of the variables into I(0) and I(1). The ARDL technique crashes in the presence of integrated stochastic trend of I(2). This is why the unit root test was conducted to make sure that no variable was I(2).

3.7 Model Estimation Procedure -Autoregressive Distributed Lag (ARDL) Short Run and Long Run Dynamics This study employs ARDL approach to estimate long run as well as short run relationship between the dependent and the independent variables. By Distributed Lag (DL) variables, we imply lagged values of observed exogenous predictor variables while Autoregressive (AR) variables are lagged values of observed endogenous response variables. In ARDL approach a dynamic error correction model (ECM) is derived from ARDL that integrates the short-run dynamic with the long-run equilibrium without losing long run information. The ARDL model was estimated with the variables in their levels (non-differenced data) form using ordinary Least Squares (OLS) to determine if the lagged values in the model were each statistically significant or not. The lags of the variables were alternated, model re-estimated and compared. The model with the smallest AIC, estimates, small standard errors and high R2 were selected as procedure demands. The best performed model was then restructured. The restructured result of this model gives the short-run dynamics and long run relationship of the considered variables.

3.8 Post Estimation Tests To ascertain the robustness of the model, we conducted some post –estimation tests. Some of these were to test the stability properties of the model using Recursive Residuals Plots, Cumulative sum of residual (CUSUM) and cumulative sum of residual square (CUSUMSQ) tests.

3.9 A Priori Expectation The initial presumption and deduction of this study is that human capital determinants of education, health, technology, research and development, contribute significantly to the growth of the Nigerian economy. This statement is translated mathematically to imply that the coefficients of the econometric model are each expected to be greater than zero or positive as shown below;

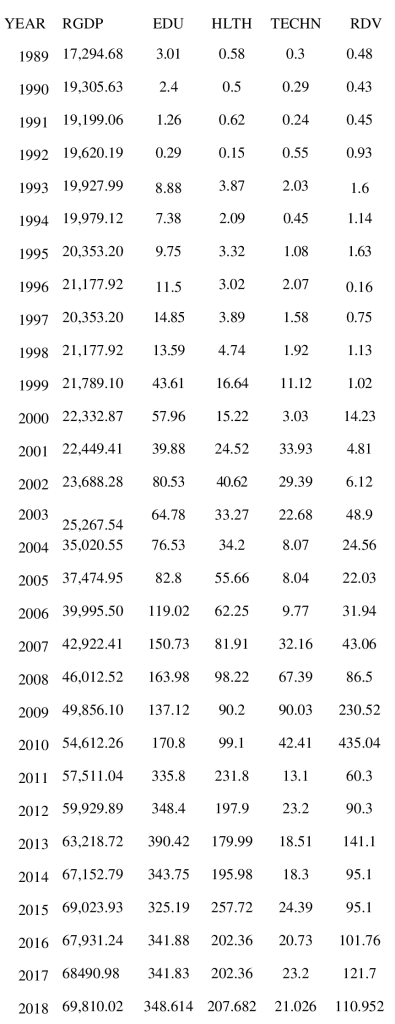

4.1 Data Presentation The data used in the estimation of the model are presented in this section. The sources of the data are predominantly from the Central Bank of Nigeria (CBN) Statistical Bulletin, Central Bank of Nigeria (CBN) economic and financial review of various years. Data for human Capital expenditure viz; real Gross Domestic product (GDP), Education (EDU), Health (HLTH), Technology (TECH), and Research and Development (RDV) in Billions of Naira are presented in Table 4.1. Table 4.1: RGDP and Government Expenditure on Human Capital Development 1989 – 2018 (in Billions of Naira)

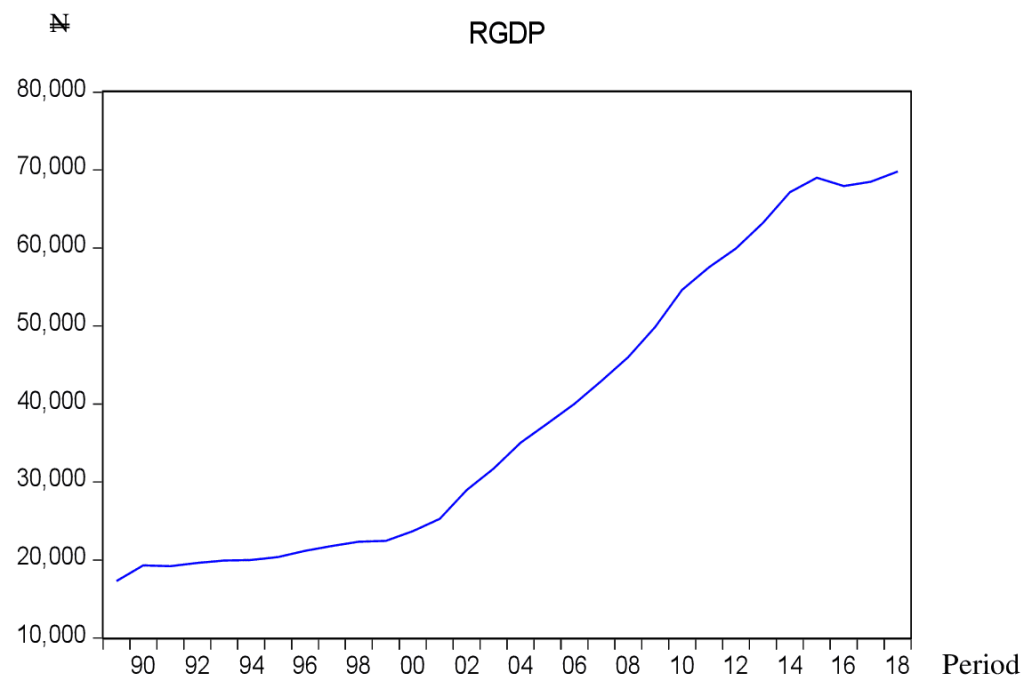

Sources: (1) CBN Statistical Bulletin, (2) CBN Economic and Financial Review of various years, 4.1.1 Trend Analysis of the variables in the Model 4.1.1.1 Real Gross Domestic product (RGDP) Figure 4.1 depicts a gradual rise of the gross domestic product (GDP) from 17,294.68 Billion in 1989 to 69,810.02 Billion at the end of 2018.

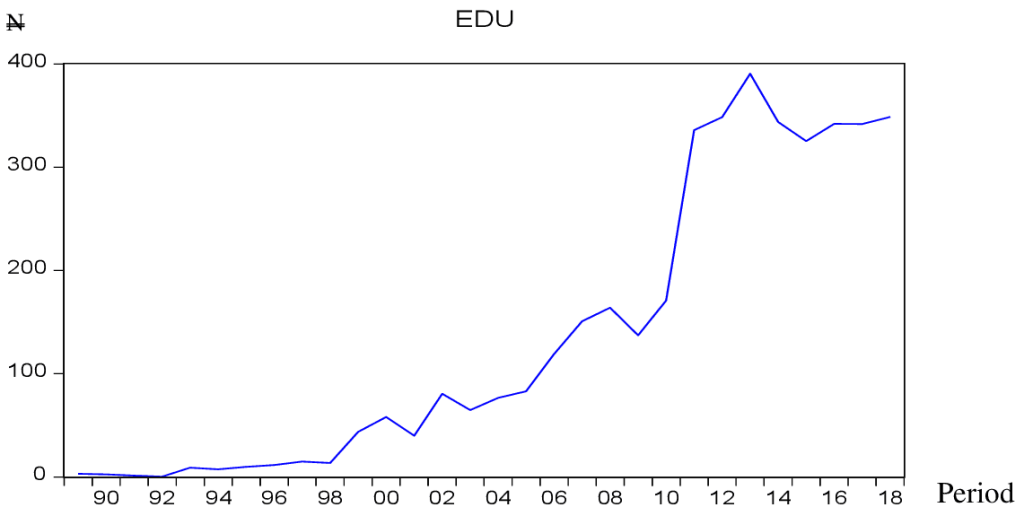

Figure 4.1 Trend in Real Gross Domestic Product 1989 – 2018 4.1.1.2 Government Human Capital Expenditure on Education There was a fluctuation of government expenditure on education from 1989 to 2004, from when there was a steady rise from 76.53 Billion to 163.98 Billion in 2008. Government expenditure on education later dropped to 137.12 Billion in 2009, before rising to the highest figure of 390.42 Billion in 2013 and fluctuating from thence to end the year 2018 with 348.614 Billion. Figure 4.2 is a graphical presentation of the trend analysis of government Expenditure Education.

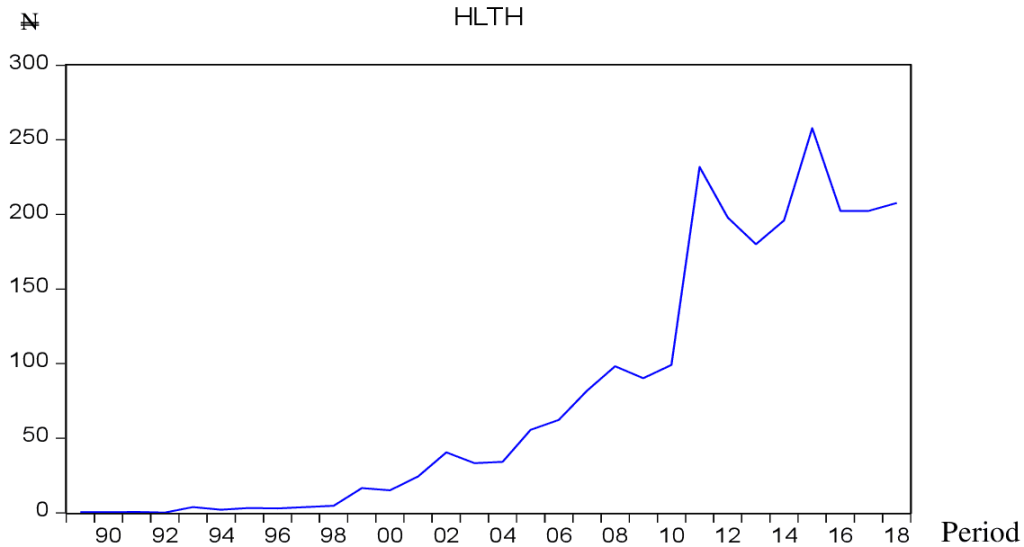

Figure 4.2: Trend in Government Human capital Expenditure on Education 1989 – 2018 4.1.1.3 Government Human capital Expenditure on Health Government expenditure on health rose steadily from 0.58 billion in 1989 to 98.22 billion in 2008. It then witnessed minor fluctuations to 195.98 billion in 2014, rose again to a maximum value of 257.72 billion in 2015 before decreasing again to 207.682 billion in 2018. Figure 4.3 is a pictorial presentation of the trend in Government expenditure in health over the period under study.

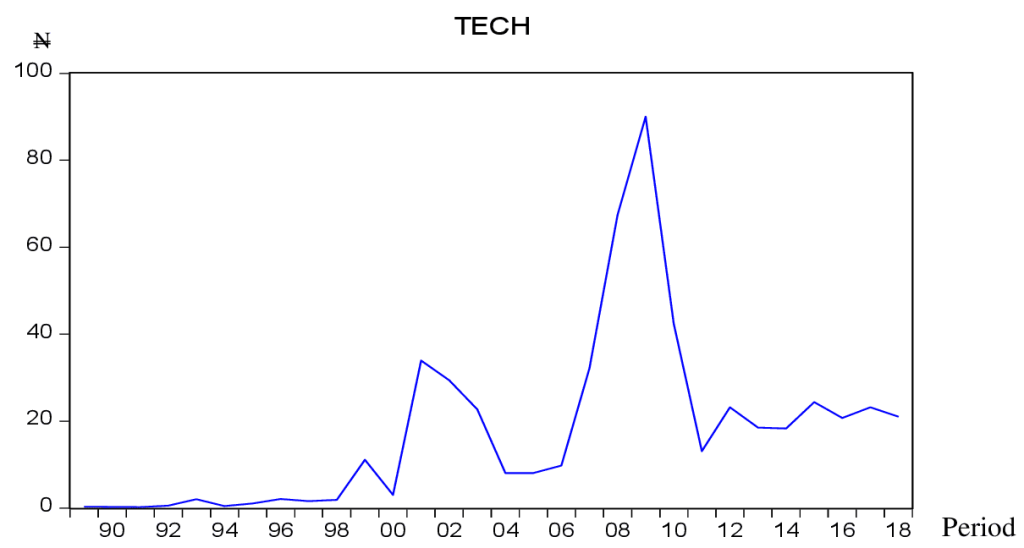

Figure 4.3: Trend in Government Expenditure on Health 1989 – 2018 4.1.1.4 Government Human Capital Expenditure on Technology Government expenditure on technology had the greatest fluctuation amongst all the variables under study. Starting in 1989 with a value of 0.3 billion, it rose to a maximum value of 90.03 billion in 2009, and decreased 18.3 billion in 2014 before rising steadily to 21.026 billion in 2018. A graphical presentation of the trend of government expenditure in Technology is shown in Figure 4.4.

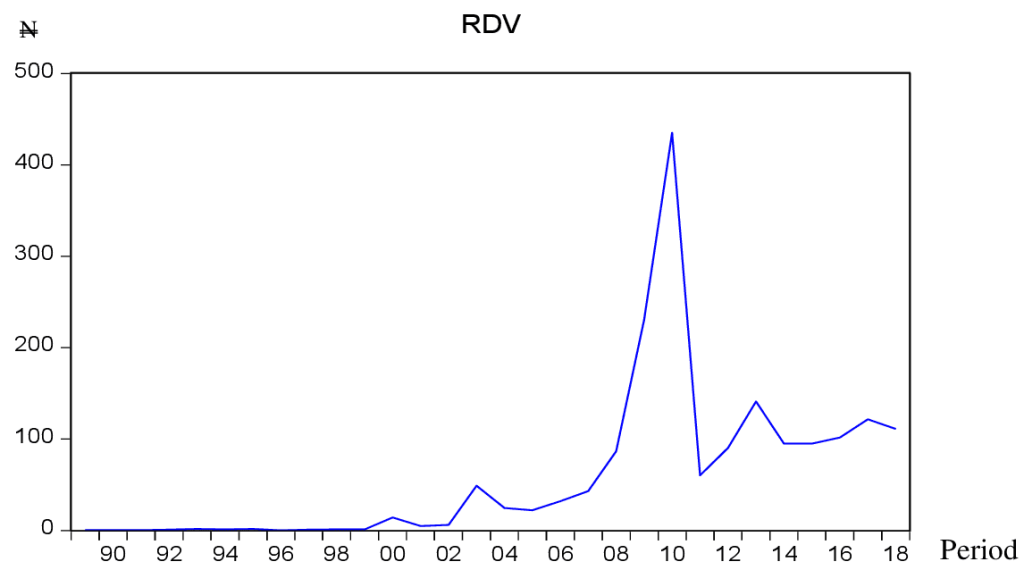

Figure 4.4: Trend in Government Human capital Expenditure on Technology 1989 – 2018 4.1.1.5 Government Human Capital Expenditure on Research and Development Government expenditure on research and development increased from 0.48 billion in 1989 to a maximum of 435.04 billion in 2010, before fluctuating decreasingly to settle at 110.952 billion at the end of the study period. Figure 4.5 is a pictorial presentation of the trend of government expenditure on research and development from 1989 to 2018.

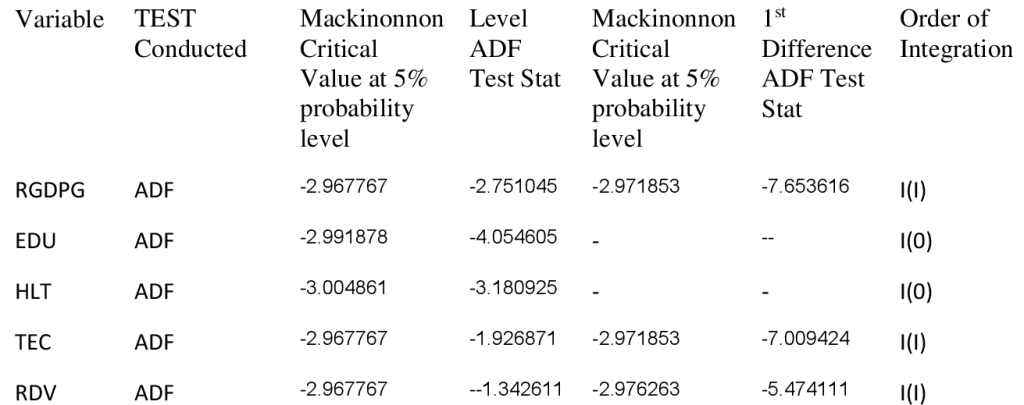

Figure 4.5: Trend in Government Human capital Expenditure on R&D 1989 – 2018 4.2 Results of Preliminary Tests 4.2.1 Unit Root Tests The unit root tests of the data were conducted in this section. The rationale for the tests were to determine the unit root properties of the data. This was necessary since time series data is known for producing spurious results when they are not stationary (the mean variances, and covariance of the data are not constant) as earlier stated. In other words, some preliminary tests were conducted to verify if the data was stationary, and to determine the order of stationarity. That is if they were of order I(0) or I(1). Knowing the level of stationarity enabled us to make a decision on the method of testing for cointegration and coefficients estimation. The most popular method of determining the stationarity of a particular time series is the Augmented Dickey-Fuller test. The null hypothesis of the test is that the time series possess unit root, meaning the time series are non stationary. The summary of the Augmented Dickey Fuller unit root test results for all the variables under study is presented in table 4.2. The results indicate a mixed order, I(0) and I(1) of integration. It shows that while EDU and HLTH are stationary at level, I(0), RGDP, ECH, and RDV are stationary at 1st difference, I(1). Following the mixed order of integration, this study employed the ARDL bound testing and cointegration techniques to test the long run relationship. The ARDL estimation technique was used and coefficient estimation and testing of hypotheses was done employing the ARDL estimation method. Table 4.2 Summary of Unit root test results of the data and the order of integration

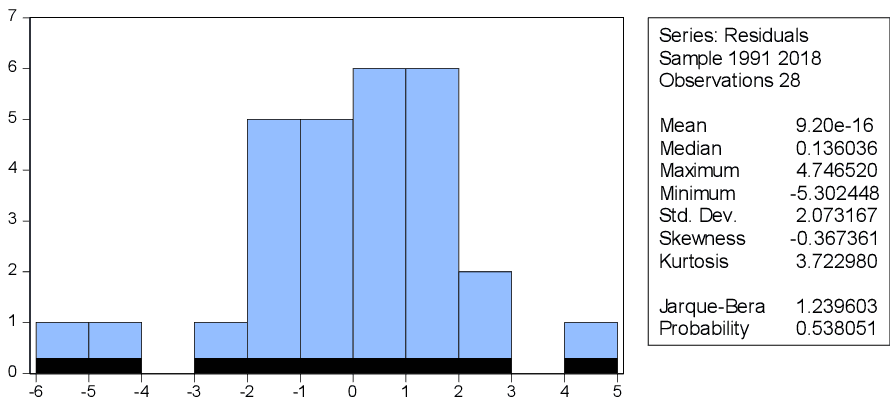

Source: Author’s Summary Computation extracted from Eviews 9.0 output 4.3 Results of Diagnostic Tests 4.3.1 Normality test The normality test was carried out to determine whether the data do not follow a normal distribution. The Jarque-Bera test was employed for this purpose. The Null hypothesis for the Jarque-Bera test is that there is a normal distribution of the data. That is H₀: Data follow a normal distribution

Figure 4.6 Normal distribution test To determine whether the data do not follow a normal distribution, the p-value is compared to the significance level. As usual, a significance level (denoted as α or alpha) of .05 is conventionally accepted. A significance level of .05 indicates that the risk of concluding the data do not follow a normal distribution—when, actually, the data do follow a normal distribution—is 5%. P-value ≤ α: The data do not follow a normal distribution (Reject H0) P-value > α: Cannot conclude the data do not follow a normal distribution (Fail to reject H0) From Figure 4.6, the P value is 0.538051 is greater than the alpha value of 0.05. Decision: H0: data follow a normal distribution is accepted and the alternative H1: data do not follow a normal distribution is rejected 4.3.2 Serial Correlation LM Test Table 4.3 Breusch-Godfrey Serial Correlation LM Test

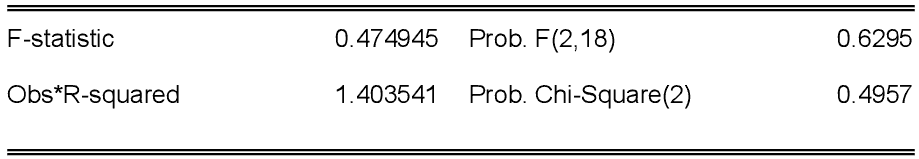

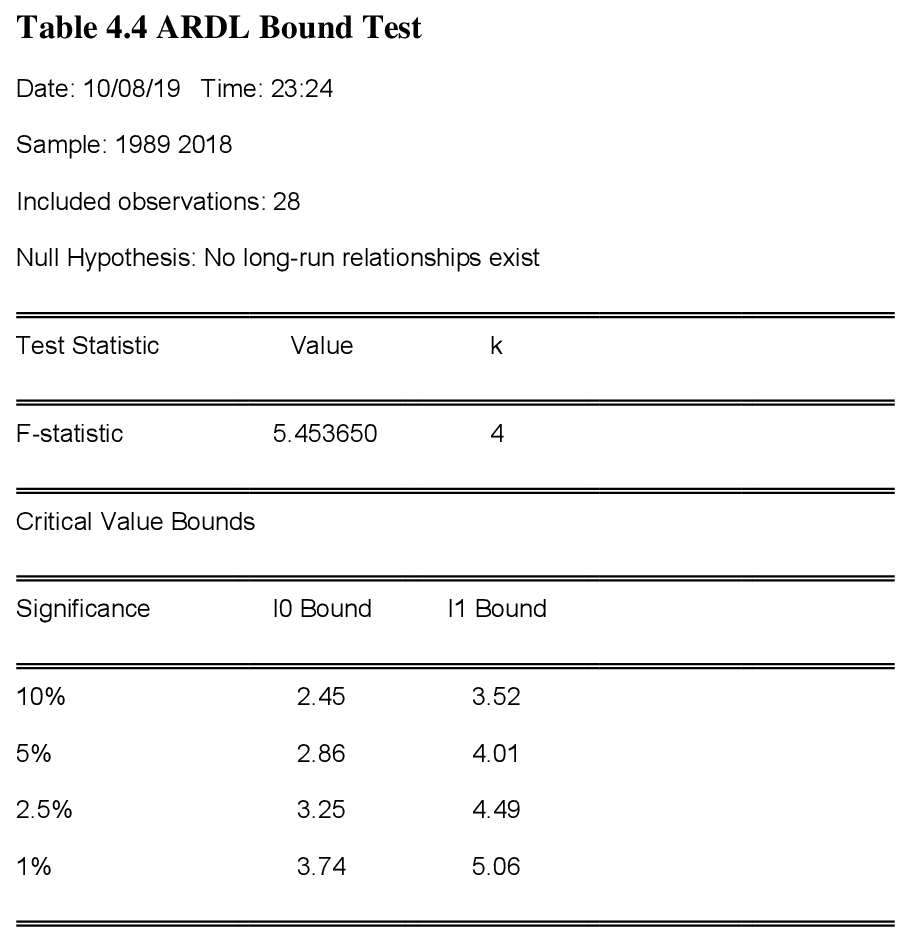

Source: Output from Eviews 9.0 The null hypothesis for Breusch-Godfrey Serial Correlation is that there is no serial correlation. From table 4.3, the P value of .6295 is greater than .05 level of significance. The test therefore accepts the null hypothesis of no serial correlation. Since the LM test indicates that the residuals are not serially correlated and the model is free from autocorrelation and fit for hypothesis tests and forecasting. 4.4 Cointegation Test The existence of a mixed order of integration, that is I(0) and I(I) presupposes that a method other than the Johansen and Engel granger cointegration techniques be used to test the long run relationship of the variables. In this regard, the Autoregressive distributed lags (ARDL) bound testing technique was employed in this study to test the long run relationship of the variables. ARDLs are standard least squares regressions which include lags of both the dependent variable and independent variables or regressors. The result of the bound test is presented in Table 4.4.

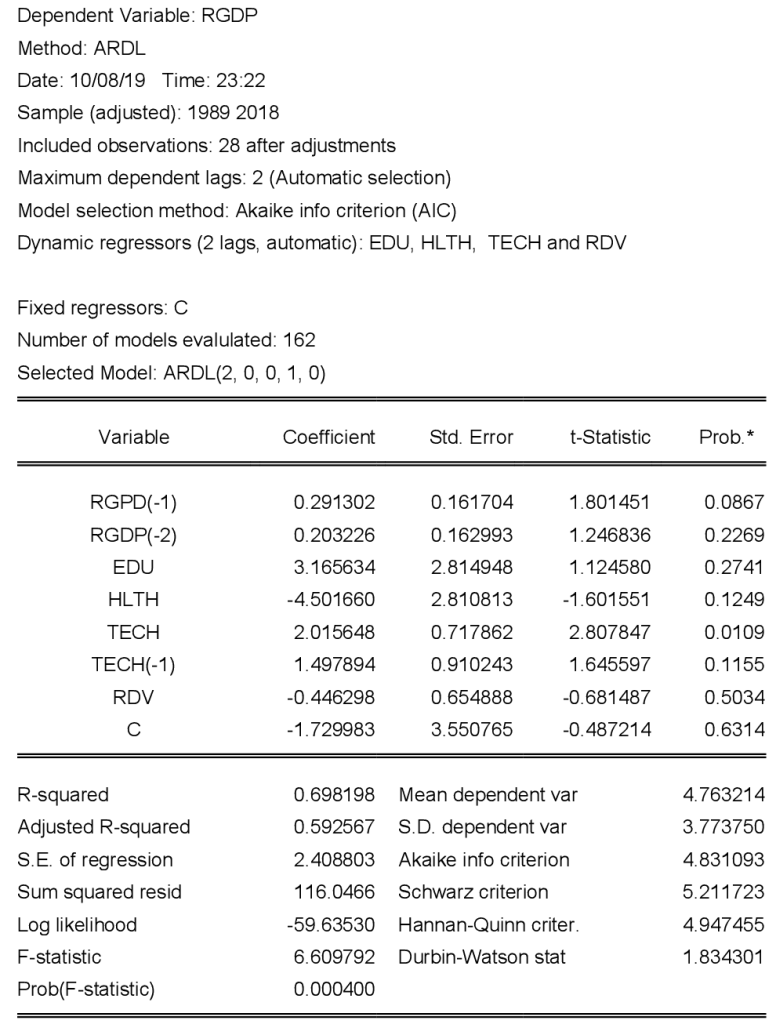

As seen from Table 4.4, the F-statistic of 5.453650 is greater than the upper bound at 1%, 2.5%, 5%, and 10% level of significance which are 5.06, 4.49, 4.01, and 3.52 respectively. This shows that there is cointegration between the dependent and the independent variables implying a long run relationship exists between Economic growth and the independent variables, namely, Government expenditure on education (EDU), government expenditure on health (HLTH), Government expenditure on technology, and Government expenditure on research and development (RDV) in Nigeria. This result ensures that we can proceed with further analysis of the model. 4.5 Autoregressive Distributed Lag (ARDL) Model Selected Using Akaike Info criterion, the Selected Model was ARDL (2, 0, 0, 1, 0) with the following parameters as presented in table 4.5 Table 4.5: Selected Model ARDL(2, 0, 0, 1, 0)

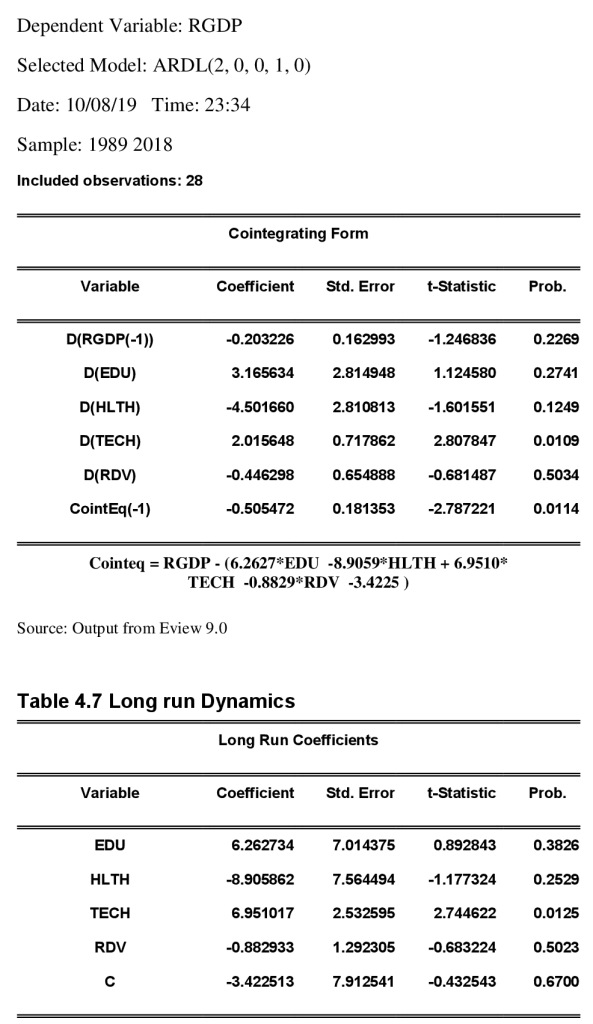

The selected model, Table 4.5 is similar to the short run dynamics. The difference is the inclusion of all the lags in the model. 4.6 Coefficient Estimation using the selected ARDL Model The coefficients in the model were estimated using the restructured ARDL model that was earlier selected. The ARDL model has the advantage that it simultaneously displays the short run and the long run form of the regression. The short run dynamics and the long run dynamic are presented in Table 4.5 and Table 4.6 respectively. Table 4.6 ARDL short run Dynamics

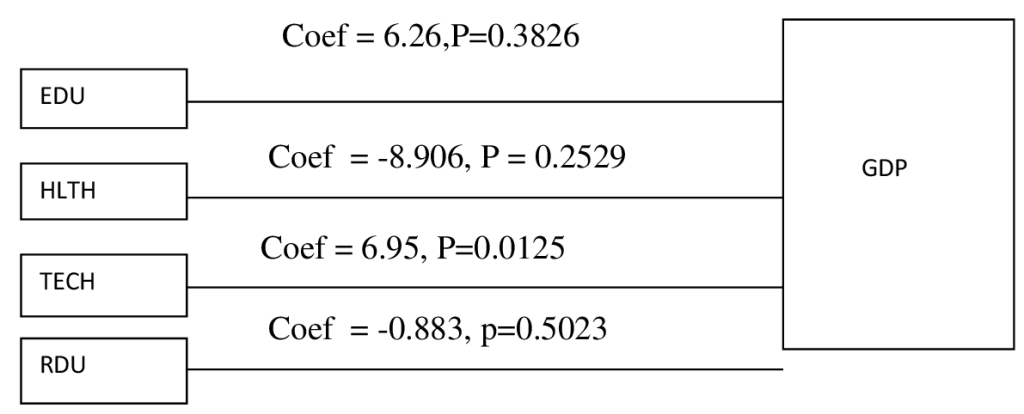

4.7 Interpretation of Results The coefficient of the first lag of RGDP is 0.29 and the P value is 0.08. This imply that the immediate past period value of RGDP (RGDP(-1)) has a positive and insignificant effect on the current value of the RGDP at 0.05% level of significance. Similarly, RGDP (-2) has a coefficient of 0.20 and P value of 0.20 implying that it has a positive but insignificant effect on RGDP. Lagged value of government expenditure on technology has a similar effect as above. The coefficient of determination R- square and adjusted R- square values of 0.698198 and 0.592567 respectively in the selected ARDL model (table 4.5) imply that 59% variations in the dependent variables are as a result of the effect of the independent variable represented in the model and 41% by other factors represented by the error term. The values of the F-statistic of 6.609792 and Prob (F-statistic) of 0.000400 shows that the parameters in the model have a joint effect on the dependent variable, and that the effect is significant at o.05 level of significance. The results in the short run in table 4.5 reveal that coefficient of lagged values of RGDP is negative (-0.2) and the P value is 0.2 implying that lagged values of RGDP have a negative but statistically insignificant effect on the current values of RGDP in the short run. In the short run, the values of the coefficient of Government human capital expenditure on education are 3.16 and the P value is 0.27 respectively (Table 4.6),while in the long run (Table 4.7) they are 6.26 and 0.38 respectively. This implies that the Government human capital expenditure on education has a positive, but statistically insignificant effect on real gross domestic product growth rate at 0.05% level of significance in the short run and in the long run. Also in the short run, the values of the coefficient of Government human capital expenditure on health are -4.50 and the P value is 0.12 respectively (Table 4.5),while in the long run (Table 4.6) they are -8.90 and 0.25 respectively. This implies that the Government human capital expenditure on health has a negative, but statistically insignificant effect on real gross domestic product growth rate at 0.05%level of significance in the short run and in the long run. Equally, in the short run, the values of the coefficient of Government human capital expenditure on technology are 2.01 and the P value is 0.01 respectively (Table 4.6),while in the long run (Table 4.7) they are 6.95 and 0.01 respectively. This implies that the Government human capital expenditure on technology has a positive and statistically significant effect on real gross domestic product growth rate at 0.05%level of significance both in the short run and in the long run. Furthermore, in the short run, the value of the coefficient of Government human capital expenditure on research and development is -0.44 and the P value is 0.5 respectively (Table 4.6),while in the long run (Table 4.7) they are -0.88 and 0.5 respectively. This implies that the Government human capital expenditure on research and development has a negative sign, but statistically insignificant effect on real gross domestic product growth rate at 0.05% level of significance in the short run and in the long run. The error correction term (ECTt-1) which is the adjustment coefficient is of the expected negative sign (-0.505472) and also significant (P = 0.0114 ). This term tells the rate at which disequilibrium is corrected in order to reach equilibrium. It measures the speed of adjustment. It shows that in the short run, there is an error and the absolute value of the coefficient of the error-correction term of 0.505472 indicates that about 50% of the disequilibrium in the RGDP is corrected by short-run adjustment in each year. In other words, 50% disequilibrium in the short-run between real gross domestic product and the independent variables is adjusted within one period which is one year.

4.8 Discussion of Findings RGDP = + 6.2627*EDU -8.9059*HLTH + 6.9510*TECH -0.8829*RDV -3.4225 It has been shown statistically that in a linear model as the one employed in this study the relationship between a percentage change in X and a unit change in Y can be predicted exactly as ∆Y = (β/100)% ∆X (Wooldridge, 2013). Therefore, from table 4.7, ∆RGDP =(6.3/100) % ∆EDU = 0.063 ∆EDU. This shows that a 1% increase in government expenditure on education will lead to an increase in real gross domestic product (GDP) of 0.063%. This increase is however, insignificant at 0.05 or 5% level of significance following the P value of 0.38. This result is consistent with some works reviewed in the literature, but inconsistent with others. For instance, apart from Amaghionyeodiwe (2019) who revealed that government spending on education and economic growth in West African countries are positively and significantly related, most of the studies reviewed showed that government expenditure on education although has a positive effect on economic growth, the effect is however statistically insignificant at the 5% level of significance (Obi & Obi, 2014; Nurudeen & Usman, 2010; Mussagy & Babatunde, 2015). The study by Ayeni and Omobude (2018) , Odeleye (2012) showed that educational expenditure was inconsistent with education sectoral output and concluded that the impact of educational expenditure on real GDP is mainly a function of the expenditure type. The coefficient of government expenditure in health in the model is negative (Table 4.7) implying that an increase in government expenditure on health will lead to a decrease in a economic growth in Nigeria even though the increase will not be statistically significant following that the probability of 0.2529 is clearly greater than 0.05. Specifically, ∆RGDP is approximately (-8.9/100)% ∆HLTH = -0.089%∆HLTH This implies that a 10% increase in government expenditure in health will result to 0.89% decrease in real GDP. This is consistent with Adeyemi and ogunsola (2016) who equally showed a negative effect of government expenditure on health on economic growth. Some studies reviewed also showed this trend (Dauda, 2011; Bakare & Olubokun, 2011; Torruam, Chiawa, & Abur, 2014). The result of this study shows that the government expenditure has not improved the health of an average Nigerian. The coefficient and P value of government expenditure in technology in the regression analysis of 6.951017 and 0.0125 respectively showed that government expenditure on technology has a positive and statistically significant effect on economic growth at 0.05 level of significance according to a priory expectation. Specifically, a 10% increase in government human capital expenditure on technology will lead to 0.70% increase in RGDP This is consistent with Gold (2011) and Sulaiman et al. (2015) in Nigeria, and Kuo and Yang (2008) in China who found similar results. This is also consistent with theory. Also, the coefficient of log of research and development in Table 4.7 is -0.88 and the P value is 0.5. The sign of the coefficient of research and development (R&D) is negative contrary to a priori expectations. This implies that R & D has a negative effect on Nigeria’s economic growth. Precisely, a 10% increase in government expenditure on research and development will result to a reduction in RGDP of 0.9%. This is contrary to previous studies reported in other economies (Ballot, Fakhfakh & Taymaz, 2001; Chou, 2002; Okokpujie, Fayomi, & Leramo, 2018). The magnitude of the probability value (P- value) of 0.5023 indicates that the effect though negative, is not statistically significant at the 5% level of significance.

4.9 Test of Hypotheses The four Null hypotheses in the study are tested in this section. Test of Hypothesis I H0: Government Expenditure on Education does not have a significant effect on economic growth in Nigeria Decision rule If P value 0.05 at 5% level of significance, reject H0 and take the alternate, if P value 0.05 at 5% level of significance, accept Ho and reject the alternate. From table 4.7, the P-value of EDU, 0.3826 is greater than 0.05 at 5% level of significance. Decision: Ho is accepted and the alternate of significant effect rejected. Government expenditure on education does not have a significant effect on economic growth. Test of Hypothesis II H0: Government Expenditure on Health does not have a significant effect on economic growth in Nigeria Decision rule If P value 0.05 at 5% level of significance, reject H0 and take the alternate, if P value 0.05 at 5% level of significance, accept Ho and reject the alternate. From table 4.7, the P-value of HLTH, 0.2529 is greater than 0.05 at 5% level of significance. Decision: Ho is accepted and the alternate of significant effect rejected. Government expenditure on health does not have a significant effect on economic growth. Test of Hypothesis III H0: Government Expenditure on Technology does not have a significant effect on economic growth in Nigeria Decision rule If P value 0.05 at 5% level of significance, reject H0 and take the alternate, if P value 0.05 at 5% level of significance, accept Ho and reject the alternate. From table 4.7, the P-value of TECH, 0.0125 is less than 0.05 at 5% level of significance. Decision: Ho is rejected and the alternate of significant effect accepted. Government expenditure on technology has a significant effect on economic growth. Test of Hypothesis IV H0: Government Expenditure on Research and Development does not have a significant effect on economic growth in Nigeria Decision rule If P value 0.05 at 5% level of significance, reject H0 and take the alternate, if P value 0.05 at 5% level of significance, accept Ho and reject the alternate. From table 4.7, the P-value of RDV, 0.5023 is greater than 0.05 at 5% level of significance. Decision: Ho is accepted and the alternate of significant effect rejected. Government expenditure on research and development does not have a significant effect on economic growth.

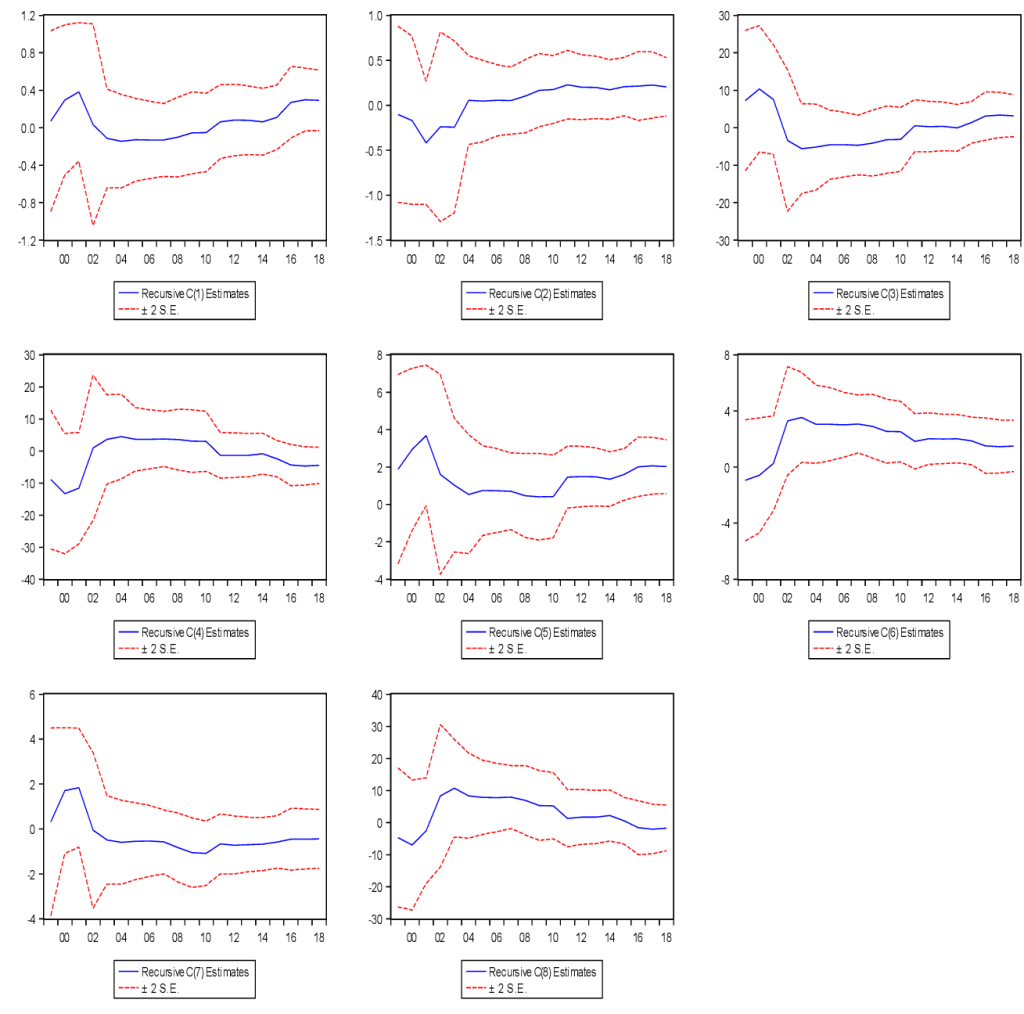

4.10 Result of Post Estimation Tests The existence of cointegration amongst variables does not necessarily imply the robustness of the ARDL model. To ascertain the robustness of the model, we conducted some post –estimation tests. Some of these were to test the stability properties of the model using Recursive Residuals Plots, Cumulative sum of residual (CUSUM) and cumulative sum of residual square (CUSUMSQ) tests. Recursive Residuals This option shows a plot of the recursive residuals about the zero line. Plus and minus two standard errors also shown at each point. Residuals outside the standard error bands suggest instability in the parameters of the equation. The recursive plots of the eight (8) parameters in the model viz; 5 variables and 3 lags are shown in Figure 4.7.

It can be seen that none of the residuals in the eight recursive plots lies outside the standard error bands thereby suggesting the stability in the parameters of the model.

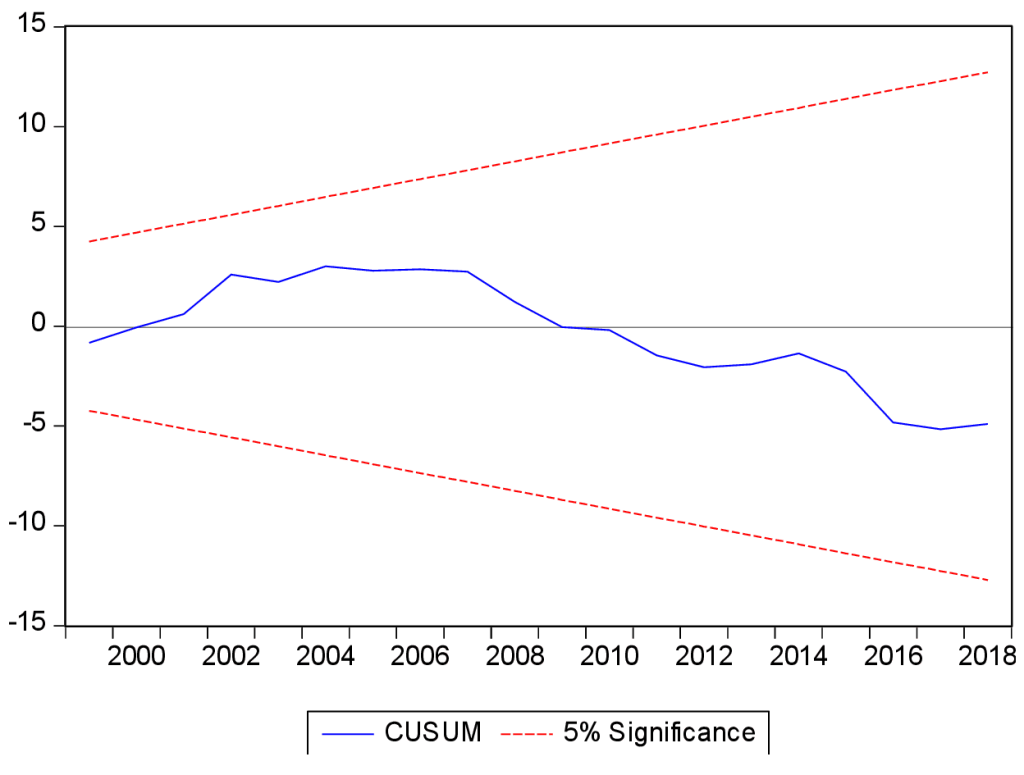

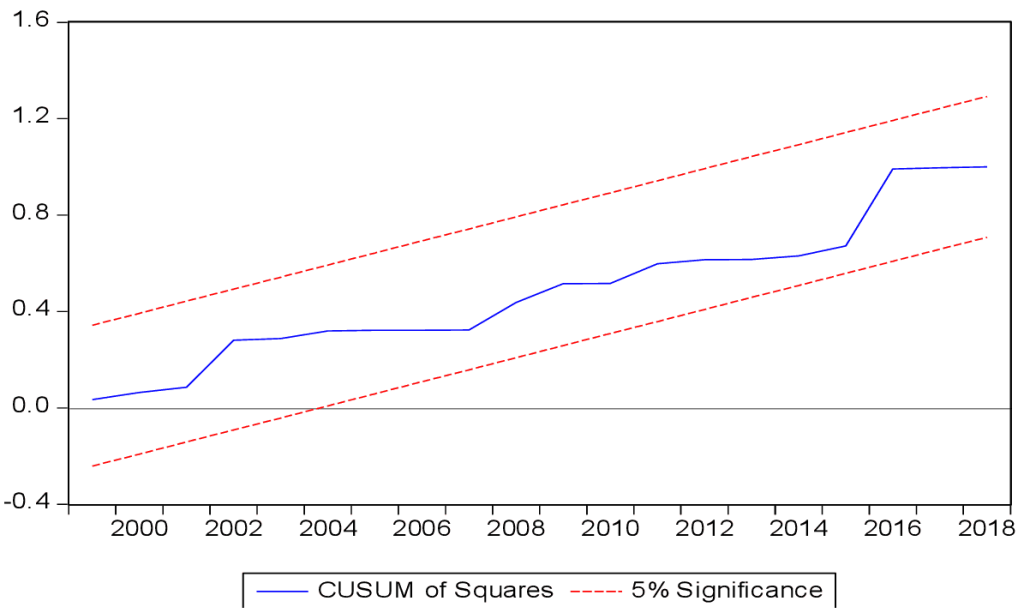

CUSUM and CUSUM Square Tests Also, the existence of parameter instability is established if the cumulative sum of the residuals and cumulative sum of residuals square go outside the area between the two critical (dotted) lines estimated at 5% critical level. Figure 4 and Figure 5 are the cumulative sum of residuals and cumulative sum of residuals square plots.

Figure 4.8 CUSUM

It can be deduced from figures 4 and 5 that for the period under study, stability is established, since the CUSUM and CUSUM Square did not go outside the critical line. This adds to the robustness of the study.

This study examined government expenditure on human capital development and economic growth in Nigeria within the period 1989-2018. The independent variables were represented by Government human capital expenditure on education, government human capital expenditure on health, government human capital expenditure on technology, and government human capital expenditure on research and development. The dependent variable was represented by the real gross domestic product (GDP) growth rate. The study adopted the ex-post facto research design and relied on historical time series data collected from the Central Bank of Nigeria (CBN) annual statistical bulletin various editions. The study conducted Augmented Dickey Fuller (ADF) diagnostic tests on the data to ascertain their stationarity and order of integration. All the variables were stationary, but with a mixed order of integration ie I(0) and I(1). The study used the Autoregressive Distributed lag (ARDL) bound testing cointegration approach to establish that a long run relationship exists between the human capital development proxies under study and economic growth. The study proceeded with the step wise ARDL model to ascertain the type and magnitude of the effect of each of the variables under study on economic growth in the short run and in the long run. The results showed that government expenditure in technology has a positive and statistically significant effect on economic growth in Nigeria based on its short run and long run coefficients in ARDL restructured model. Government expenditure in education also has a positive effect on economic growth although the effect is statistically insignificant. The rest of the variables viz; government expenditure in health and government expenditure on research and development both had negative but statistically insignificant effects on economic growth. The adjusted R-square value of 0.5926 of the coefficient of determination in the ARDL model implies that 59% variations in the independent parameters were found to predict economic growth. Equally, the value of the F-statistic of 6.6098 and Prob (F-statistic) of 0.0004 show that the parameters in the model have a joint effect on the dependent variable, and that the effect is significant. We concluded from the results that expenditure on human capital development has an effect on economic growth in Nigeria and recommended that policy makers and operators should direct more funds and devise strategies to develop human capital in Nigeria. The study recommends that;

5.4 Contribution to Knowledge

As shown above, for every 1% increase in government human capital expenditure on technology, there is a 0.70% increase in RGDP Growth. It also showed that a 1% increase in government expenditure in education will lead to an increase in RGDP growth of 0.063%. Also a 1% increase in government expenditure in health will result to 0.89% decrease in RGDP.