Journal of Medicine, Engineering, Environmental and Physical Sciences (JOMEEPS), Vol. 1, No. 2, October-November 2023. https://klamidas.com/jomeeps-v1n2-2023-03/ |

||||||

|

Challenges and Prospects of Real Estate Investment Funding in South East Nigeria: Way Forward on Capital Market Instruments Hyacinth O. Eze, Loveline I. Nebo & Eliezer O. Obera

Abstract The failure of the conventional means of funding real estate development is raising serious concerns in Nigeria. This has necessitated the need for reliable alternative means of funding real estate investment. Unfortunately, extant studies have shown that capital market instruments considered to be suitable are still slow and low in their performance levels in Nigeria. This research, therefore, focuses on identifying challenges and determining prospects of funding real estate development through capital market instruments in South-East geopolitical zone of Nigeria. The population sample of study is 245; comprising of real estate developers, registered estate firm, primary mortgage and Federal mortgage banks, Nigerian Stock Exchange and Security and Exchange Commission and selected academia in estate surveying profession in the study area. The study adopted holistic sampling, with the use of Likert scale questionnaire and interview schedule. Data were presented in tables, percentages and bar charts; and analyzed with Test of Proportion using Z-approximation test. The result quantitatively identifies 7 major challenges considered to be associated with real estate investment funding in South East Nigeria and highly statistically significant 6 factors determining prospects of the capital market instruments in funding the real estate development in the study area. Based on these findings, useful recommendations are made. Keywords: real estate, housing deficit, capital market instruments, investment funding, securitization

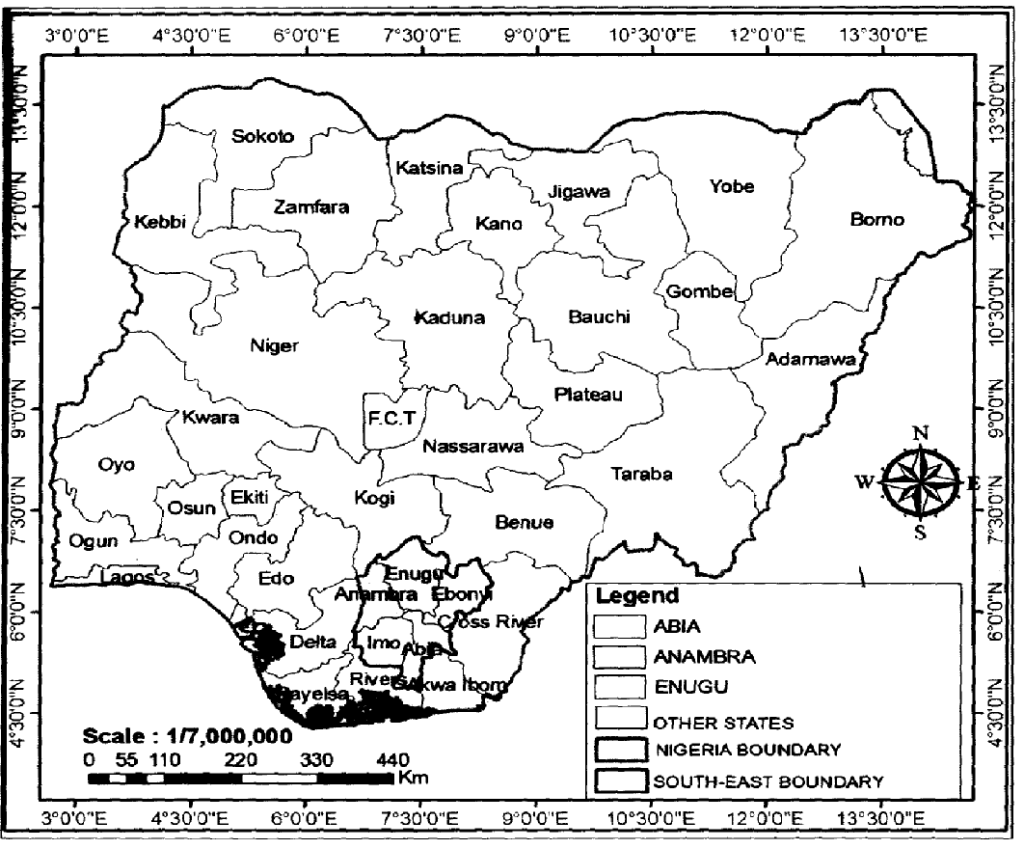

1. INTRODUCTION Investment is classified into two as real estate and financial investments. While real estate investment is that made on physical assets and services like buildings, land and others; financial investment is made on financial aspect or “paper” assets like fixed interest securities, stocks and shares. Real estate investment itself, therefore, is a form of investment which is popular with investors seeking capital growth, particularly during inflation period. The principal sectors of market for this class of investment includes offices, shops, agricultural properties, factories and warehouses, special and residential properties (Udechukwu, 2006). Real estate investment is very essential to socio-economic growth and development, yet the delivery of optimum and affordable real estate investment remains a challenge for numerous countries, particularly developing ones like Nigeria (Nebo et al., 2022). Studies have shown that in the country, several urban dwellers live in inhuman and informal conditions, while those with access to formal housing often live at exorbitant cost (Abubakar & Aina, 2019; Aina, 2018; Ewurum et al., 2020; Odenigbo & Ewurum, 2018). There is no doubt that the provision of real estate is limited and their development requires a lot of money which is usually beyond the reach of most urban dwellers, particularly the low and middle income earners in developing countries like Nigeria. To worsen the situation, the financial security for real estate development has been exacerbated by financial institutions’ stringent stance on lending to real estate developers. The Nigeria real estate developers, investors and companies traditionally raise capital through bank loans in contrast to market-oriented economy like US. Thus, the Nigerian real estate sector is highly underdeveloped. Hence, there is a dire need for innovative means of funding real estate investment in the country like capital market. Capital market which is a long term funding measure plays an important role in this scheme. The capital market is certainly the most robust institution in any economy, characterized by its capacity to mobilize the funds needed to finance long-term and productive projects (Okunev, 2000; Wijburg, 2019). The capital market manages relatively large amounts of capital and is the largest provider of long-term financing for capital projects such as real estate developments that are capital intensive. In spite of this, only a limited number of companies in Nigeria raise funds through the capital market, a model that is recognized globally for its great potential to raise huge capital (Diala et al, 2021; Okunev, 2000; Wijburg, 2019; Nebo et al, 2022). Surprisingly, upon all the benefits derivable from the capital market, real estate developers and investors have not popularized the use of its instruments for real estate funding. In an effort to unravel this gap, this study focuses on assessing the challenges of leveraging on the prospects of capital market instruments for real estate funding. Objectives In assessing the challenges and prospects of real estate development funding through capital market instruments, the study was guided by the following objectives: i. To identify the challenges of funding real estate development through capital market instruments; ii. To determine the prospects of funding real estate development using capital market instruments in the study area; iii. To recommend strategies for improving real estate development through capital market instruments in the study area. II. AREA OF THE STUDY The study area is South East, Nigeria. This is one of the six geopolitical regions in the country. It is made up of five states and their respective capitals are as follows: Abia State (Umuahia), Anambra (Awka), Ebonyi State (Abakaliki), Enugu State (Enugu), and Imo State (Owerri). The area is clearly shown in Figure 1: South East in Geospatial Map of Nigeria, verged borderline with thick black. The research used three states which were emphasized by highlighting their administrative capitals as follows: Abia State – Umuahia, the capital is located along the rail route that lies Port Harcourt to Umuahia’s south and Enugu city to its north. Umuahia has a population of 359,230 based on National Population Census (2006). Anambra State has its capital as Awka. Most of the public estates in Anambra are located in Awka as the administrative capital while Onitsha is the commercial heartbeat of the state, and Nnewi is its industrial nerve center. Enugu State – Enugu City, the Coal City, is the capital of the State. The State has three geopolitical zones of Enugu East, Enugu North and Enugu West with their respective identity local government area/town as Nkanu & Isi-Uzo; Nsukka; Awgu & Ezeagu. The State is cosmopolitan given its former status as the capital of Eastern Nigeria. It has an estimated land area of about 72.8 Sq. Kilometers. The population figure for Enugu urban in 2006 stands as 722,664 (NPC, 2006).

Fig. 1: Geospatial Data of Nigeria, Showing South East Geopolitical Zone, the Study Area Source: Geographical Information System Laboratory (2021). III. REVIEW OF RELATED LITERATURE A skewed sectorial allocation of funds for over two decades from Federal Office of Statistics (FOS) in 2018, according to yearly budget of Central Bank of Nigeria (CBN), confirms that the real estate sector in Nigeria is being starved and needed significant injection of funds. Also, data from mortgage financing about the same period, even with increase of up to100%, indicated that housing stock column showed less commensurate increment and sometimes even negative growth as shown from International Financial Statistics and World Bank Development Indicators (IFS& WBDI). The latter heightens the worrisome state of real estate development in Nigeria and further strengthens the need to assess capital market instruments option by considering their challenges and prospects for real estate funding in the country. A capital market may be defined as a financial market where lenders provide long-term funds in exchange for financial assets issued by borrowers or traded by holders of outstanding tradable debt instruments (Tsoukalas et al., 2017). Capital markets are known institutions that contribute to socio-economic growth and development of developing and developed economies (Onuora, 2019; Tan and Shafi, 2021). They are made popular by their outstanding role in the mediation process in these economies (Diala et al., 2021). Capital market has been recognized as a viable source of funding both in state and municipal infrastructure projects by issuance of bond. This is made clearer when one considers the level of dominance of the capital markets in real estate development within the past two decades, during which landmark government bonds were opened in 2013. Specifically, from 2010 to 2023 government bonds auctioned in the capital market are worth more than N3.36 trillion, which is equivalent to about 90.2% of the debt issued in 20 years. There are a number of other instruments in the capital market that can be used in real estate. These include various instruments such as common stocks, real estate trust, loan and bond stocks, debentures, government development stocks, and project bonds (Nebo et al., 2022 and Ezimuo et al., 2014). It was examined and found remarkable that the utilization of these instruments hold a great potential for the resurgence of domestic real estate financing in Nigeria. In this vein, it becomes imperative that adequately assessing these potentials will go a long way towards resuscitating and advancing the real estate sector and developing the economy of the country. In considering these likely benefits, Arunma (2010), More (2019), Raimi and Uzodinma (2020), and Nebo et al. (2023) identified them as follows:

On the side of potentials, the capital market makes investments in the market very attractive and actually enhances the favourability of this market against some other alternatives. The capital market has been described by Dozie (1996) as a place where a nation’s wealth is bought and sold. The market facilitates the creation of facility to raise funds for investment in long-term assets. Unfortunately, Nigeria’s capital markets do not effectively play these global roles. The potentials available in Nigerian capital markets can be viewed from three different perspectives, namely, corporate finance benefits, financing options in the capital markets, and secondary market activities. Such benefits exist in form of dividends payment, stock split, capital appreciation, long-term hedge against trends (Akintola, 2018). Securitization is another interesting aspect, and it widens the horizon of the world of commercial and mortgage real estate to the public. This results to more active real estate transactions, increasing sales, income and investment movement. Securitization obviously helps overcome the intrinsic negative perception of property as poor inefficient investment medium. According to Okolie and Anidiobu (2021), there are very significant advantages and benefits accruable from securitization, and they include the following:

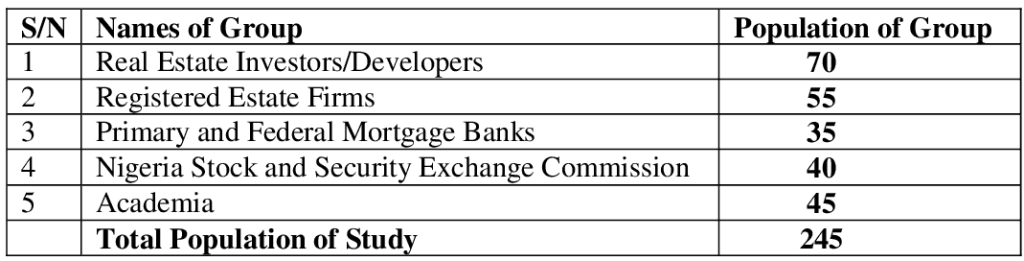

Challenges of accessing property development finance in Nigeria through conventional means has equally been examined and identified as having five distinct challenges in funding real estate developments: First, funds from private equity, retained earnings or profits, accumulated savings or revenue reserves are small in nature and granted on short term basis thereby making it grossly inadequate. Second, debt financing is constrained by the long-term nature of the lender’s own sources of fund. These resources are limited by regulations that dictate the proportion of total funds that can be lent for real estate development purposes. Third, there are uncertainties concerning real estate property titles as evidenced by revocation of rights of occupancy within the Federal Capital Territory, Abuja, and elsewhere within the Nigerian setting. Such experiences make certificates of occupancy (C of Os) vulnerable to litigations. Fourth, the time consuming, cumbersome and high cost of title registration processes coupled with high interest rate and high equity/debt ratio conditions demanded from the borrowers do not encourage the use of conventional sources of funds for any appreciable real estate development. Fifth, there are investments with lower risks and higher earnings within shorter periods (shares and stocks, LPO financing etc) than investments in real estate development competing for investors’ funds. For this reason, these other investment vehicles often attract available loanable funds away from real estate investment opportunities. Agbola (1998) and Diogu (2004) observed the problem of financial dependence on propensity to save as one of the challenges of real estate development finance in Nigeria. This is attributed to the fact that investment in real estate, like in any other sector, has an opportunity cost. Such cost is the return on the alternative form of investment and unless the return on property investment is commensurate with or better than investment in other sectors, there will be no significant inflow of investible funds to housing. Anota (2008) agreed that the potentials of the property sector are grossly underdeveloped in Nigeria. This is due to obvious inherent deficiencies in the property finance system. Akomolede (2007) identify the absence of thriving and sound mortgage system as a contributory factor. He opined that Nigerians, both as property developers or property buyers, do not have any other choice other than to take loans from commercial banks. Okereke-Onyiuke (2000) posits that the cheap source of funds from the capital market remain a critical element in the sustainable development of the economy. Unfortunately, the critical quest for capital market instrument in Nigeria is slow and low level unlike in other parts of the world. Besides, extant literature has done much in terms of examining the potentials of the instruments, with most of the analyses concluding that the role of the capital market in meeting the challenges and prospects of funding real estate through capital market investment leaves much to be desired. This research, aimed at identifying the challenges and prospects of funding real estate development in South-East Nigeria through capital market instruments, fills a gap in as well as adds to the existing literature. IV. METHODOLOGY Data analysis method adopted in the research was that of quantitative technique. Through this approach, the questionnaire generated representative samples data that generalized the population. The questionnaire was that of Likert scale coupled with oral face to face interview. The population of the study comprised real estate investors/developers, estate surveying valuation firms, primary and federal mortgage bank of Nigeria, Nigeria stock exchange commission, and selected academia of estate profession in south-east Nigeria. The total population of the study was 245 distributed among the groups as indicated in Table1. The population generated from the respective directories of the respondents. Table 1: Population Distribution of Sample Groups

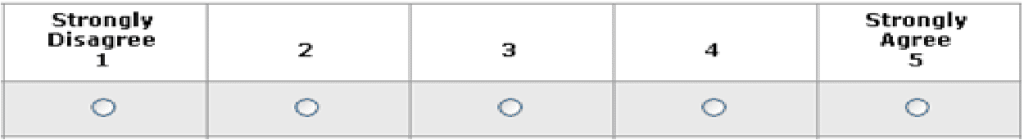

Source: Research Field Survey, 2022 Response Rate: Out of 245 copies of questionnaire distributed, 200 representing 81.6% copies were correctly filled and returned. Respondents were given a five-point Likert rating scale (from strongly disagree to strongly agree) as shown in Table 2 below. Likert rating scale was developed in 1932 by Rensis Likert to measure attitudes (Likert, 1932). The typical Likert scale is a 5- or 7-point ordinal scale used by researchers for respondents to rate the degree to which they agree or disagree with a statement. Table 2: Likert Scale Used in the Study

Source: Research Field Survey, 2022 Decision Rule The following decision rules were applied in the research:

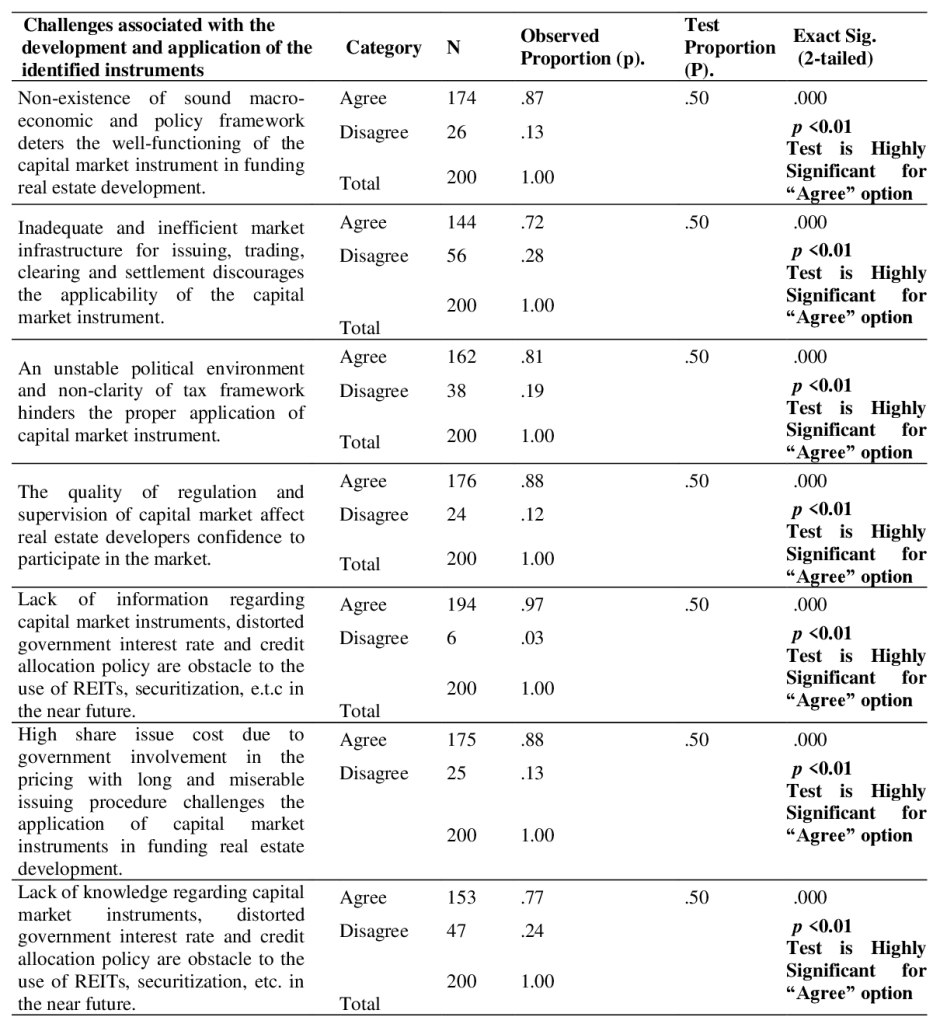

Where p is the level of significance. V. DATA ANALYSES, RESULTS AND DISCUSSIONS Research Objective 1: To identify the challenges associated with the development and application of the identified instruments in funding real estate development in the study area. Table 3: Binomial Test of proportion using Z-approximation

Challenges associated with the development and application of the identified instruments in funding real estate development in the study area were determined as the following:

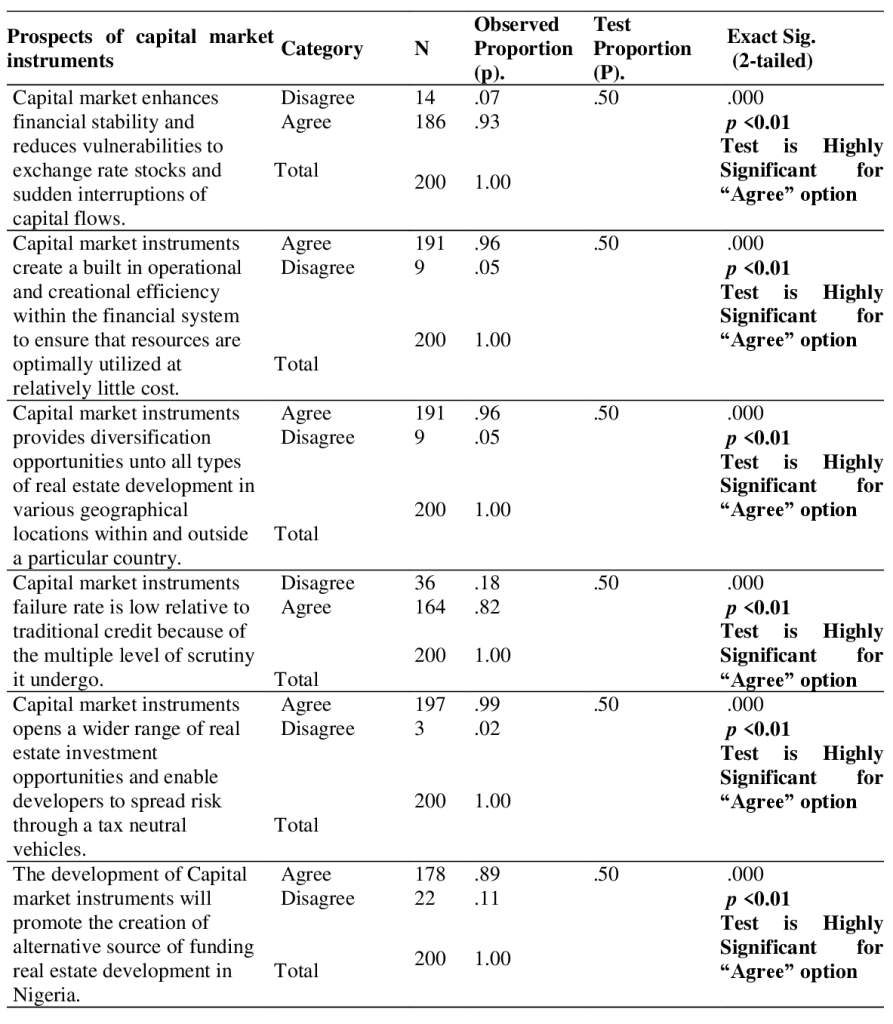

These results suggest that the above challenges associated with the development and application of the identified instruments in funding real estate development in the study area are highly statistically significant (p<0.01). For this study, these seven (7) challenges associated with the development and application of the identified instruments can be adopted with a 99% confidence in funding real estate development in this study area. We conclude that these seven (7) factors are the major challenges associated with the development and application of the identified instruments in funding real estate development in the study area. Table 3 above shows the proportion of respondents observed among respondents that agreed and disagreed for the challenges associated with the development and application of the identified instruments in funding real estate development in the study area. It further confirms the assertion that there was a significant difference in the proportion of respondents observed among respondents that agreed and disagreed to the various challenges associated with the development and application of the identified instruments in funding real estate development in the study area. Research Objective 2: To determine the prospects of capital market instruments in funding real estate development. Table 4: Binomial Test of proportion using Z- approximation

To determine the prospects of capital market instruments in funding real estate development, a binomial Test of proportion using Z- approximation was conducted. Given data from a five point Likert scales reduced to the nominal level by combining all agree and disagree responses into two categories of “Agree” and “Disagree”, a binomial Test of proportion using Z- approximation was calculated as shown in Table 4. The results of this test indicated that there was a highly statistically significant difference (p<0.01) in the proportion of respondents observed among respondents that agreed and disagreed for the various prospects of capital market instruments in funding real estate development. The major prospects of capital market instruments in funding real estate development are stated below:

These results suggest that the above prospects of capital market instruments in funding real estate development are highly statistically significant (p<0.01). For this study, these six (6) prospects of capital market instruments can be adopted with a 99% confidence in funding real estate development. We conclude that these six (6) factors are the major prospects of capital market instruments in funding real estate development in the study area.

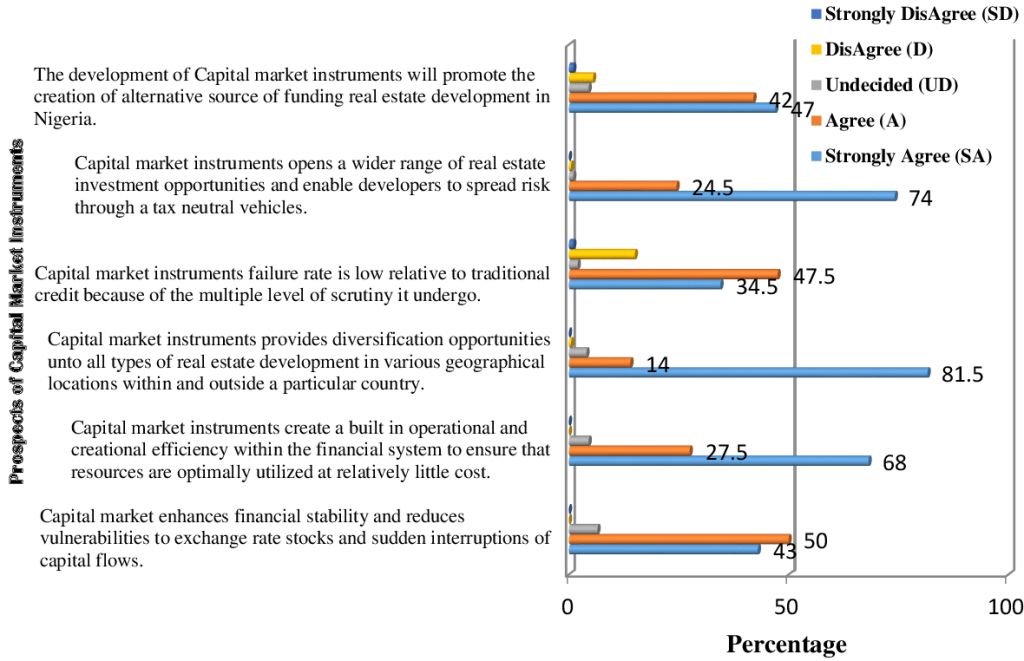

Figure 2: Prospects of Capital Market Instruments in Funding Real Estate Source: Research Field Survey, 2022 Figure 2 above shows the proportion (%) of respondents observed among respondents that agreed and disagreed for the various prospects of capital market instruments in funding real estate development in the study area. It further confirms the assertion that there was a significant difference in the proportion of respondents observed among respondents that agreed and disagreed for the various prospects of capital market instruments in funding real estate development in the study area. VI. CONCLUSION The study quantitatively identifies 7 major challenges considered to be associated with the capital market instruments in funding real estate investment. The challenges notwithstanding, the research concludes that prospects of capital market instruments in funding real estate development are highly statistically significant; with 6 factors determining the prospects of capital market instruments for funding real estate development in the study area. VII. RECOMMENDATIONS Based on the research findings, the following are recommended:

References Abubakar, I.R. & Aina, Y.A. (2019). The prospects and challenges of developing more inclusive, safe, resilient and sustainable cities in Nigeria. Land Use Policy, 87, 104105 Aina, T.A. (2018). Petty landlords and poor tenants in a low-income settlement in metropolitan Lagos, Nigeria. In Housing Africa’s Urban Poor (pp.87-101). Routledge. Agbola, T. (1998). The housing of Nigerians: a review of policy development and implementation. Research Report, No. 14, ii. Akomolede, K. (2007). Challenges of property developer in utilizing commercial loans for housing development and the way forward. Paper presented at the National Workshop of Association of Housing Corporation of Nigeria, Ota. Anota, S. I. (2008). The roles of financial institutions in property development. Paper presented at the 1st Ondo State Property Summit, Akure, Nigeria. Arunma, O. (2010). “Capital Market as a long term option for financing Infrastructure Development”. A paper delivered at the Central Bank of Nigeria Infrastructure Finance Conference, Abuja. Diala, O. A., Ewurum, N.I. & Nissi, C.F. (2021). Affordable Housing Ambidexterity of Real Estate Investment Trusts: SWOT Analysis for N-REITs. European Journal of Business and Management, 13(12). Ewurum, N.I., Aso, N.E. & Ewurum, I.C. (2020). Housing deficit Attenuation through market-oriented polycentric management: Evidence from Nigeria. Developing Country Studies, 10(3). Ezimuo, P.N., Onyejiaka, C.J. & Emoh, F.I. (2014). Sources of real estate finance and their impact on property development in Nigeria: A case study of mortgage institutions in Lagos Metropolis. British Journal of Environmental Research 2(2), 35-58. More, E.A. (2019).Addressing housing deficit in Nigeria: Issues, challenges and prospects. Economic and Financial Review, 57(4), 15. Nebo, L.I., Egolum, C.C. & Emoh, F. I. (2022). Revitalizing Real Estate Investment Financing in Emerging Economies: Capital Market Imperatives. Sustainable Empirical Environmental Research Journal, 3. Nebo, L.I., Egolum, C.C. & Emoh, F. I. (2023).Real estate investment capitalization issues in emerging markets: Reflection on capital market instruments. Journal of Economics, Finance and Management Studies, Volume 6 Issue1. Odenigbo, O.A. & Ewurum, N. I. (2018). Predictors of housing market disequilibrium in South-East Nigeria: Empirical evidence from Anambra and Enugu States. Sustainable Empirical Environmental Research Journal, 1(1): 1-27. Okereke-Onyiuke, N. (2000). “Stock Market Financing Options for Public Projects in Nigeria” The Nigerian Stock Exchange Fact Book, pp. 41 – 49. Okolie, P.I., Anidiobu, G.A. (2021). Imperative of financial management innovations to sustainable economic growth in Nigeria. Advance Journal of Management, Accounting and Finance, 6(1), 80-94. Okunev, J.,Wilson, P. & Zurbruegg, R. (2000). The casual relationship between real estate and stock markets. The Journal of Real Estate Finance and Economics, 21(3), 251-261. Onuora, O.G. (2019). Effects of capital market on economic growth and development of Nigeria (2000-2017). International Journal of Academic Research in Business and Social Sciences, 9(2), 211-220. Raimi, L. & Uzodinma, I. (2020). Trends in Financing Programmes for the Development of Micro, Small and Medium Enterprises (MSMEs) in Nigeria. A Quantitative Meta-synthesis in Contemporary Developments in Entrepreneurial Finance (pp.81-101). Springer, Cham. Tan, Y.L. & Shafi, R.M. (2021). Capital market economic growth in Malaysia: The role of sukuk and other sub-components. ISRA International Journal of Islamic Finance. Tsoukalas, J.D., Tsoukas, S.A. (2017). To what extent are savings-cash flow sensitivities informative to test for capital market imperfections? Review of Finance, 21(3), 1251- 1285. Udechukwu, C.E.(2006). Introduction to Estate Management, Lagos. TREEM Nigeria Limited. Wijburg, G. (2019). Reasserting state power by remaking markets? The introduction of real estate investments trusts in France and its implications for state-finance relations in the Greater Paris region. Geoforum, 100, 209-219.

|

||||||