Global Online Journal of Academic Research (GOJAR), Vol. 2, No. 4, September-October 2023. https://klamidas.com/gojar-v2n4-2023-01/ |

|||

|

The Impact of Multiple Taxation on the Efficiency of Selected SMEs in Enugu State, Nigeria By Anthonia Onyinye Ilodigwe

Abstract Small and Medium-sized Enterprises (SMEs) are entities that contribute to the overall growth and economic development of a country. However, multiple taxation has been found to hinder the production activities as well as the efficiency of SMEs. This study investigated the impact of multiple taxation on the efficiency of selected SMEs in Enugu State, Nigeria. The study was based on three objectives and two hypotheses. The study is a survey and made use of questionnaire schedule. The population of the study was 17,498 registered SMEs from which 204 were selected as sample using Taro Yamane statistical formula. Statistical Package for Social Sciences (SPSS) was used to process the data collected for the study. Data analysis was done using descriptive statistics (frequency tables and Chi-square inferential statistics were used to test the study hypotheses). Result from the study showed that multiple taxation makes it difficult for SMEs to carry out their production activities; it also reduces SMEs production and service-rendering capacity. The study also found that multiple taxation makes management of SMEs more difficult. Based on the findings of the study, it was recommended that government adopting a single tax system that levy SMEs based on how they earn and using the taxes for the benefit of SMEs will reduce the problems of multiple taxation that affect the production and management efficiency of SMEs in Enugu State. Keywords: SMEs, taxation, multiple taxation, efficiency

Introduction Tax is a levy which is a source of income to governments of various countries. Tax is levied on the citizens of a country, their possessions or businesses mainly for the country or state to generate income for government expenditures and the economic and social development of that country or state (Mieseigha & Ihenyen, 2014). Multiple taxation refers to the situation where the same income or economic activity is subject to taxation by multiple taxing authorities or at various stages of production and distribution (Oseni, 2014). The history of multiple taxation is a complex one, with various forms of taxation emerging and evolving over centuries. In ancient civilizations, such as Egypt, Greece, and Rome, taxes were levied on land, trade, and individuals. Multiple taxes were common even then, with different rulers and regions imposing their own taxes. Also, during the feudal era, landowners often imposed multiple taxes on peasants. These taxes included rent, tithes to the church, and various feudal obligations, leading to a heavy burden on the common people (Nigamaev, Gapsalamov, Akhmetshin, Pavlyuk, Prodanova & Savchenkova, 2018). During the colonial period, European colonial powers imposed various taxes on their colonies, leading to multiple forms of taxation. These included trade tariffs, export duties, and taxes on indigenous populations. The rise of industry in the 18th and 19th centuries also led to the introduction of new forms of taxation, such as income taxes. Multiple taxes on income, property, and goods emerged in many countries (Bush & Maltby, 2004; Cseh &Varga, 2020). In the 20th century, especially with the expansion of the welfare state and globalization, tax systems have become even more intricate as multiple layers of government (local, state, federal) often impose taxes on income, property, sales, and more. Additionally, international taxation treaties and agreements have also added complexity to taxation. Also, the rise of the digital economy and multinational corporations has created challenges in terms of taxation and multiple jurisdictions seek to tax digital services and global profits, leading to debates about fair and effective taxation. The exact beginning of different taxes in Nigeria is somewhat dark. Notwithstanding, Izedonmi (2010) noticed that numerous tax assessments turned out to be more articulated and pervasive in the last part of the 1980s, which coincided with the period when incomes accruable to both the state and local governments from the central federal authority began to continuously decline. That development drove a few state legislatures and numerous local legislatures to look for ways of generating revenues internally, which made a great deal of them to resort to intoducing a variety of taxes (Oboh, Yeye and Filibus, 2013). Multiple taxation has permeated various businesses and industries in Nigeria and SMEs, which make up most of the business endeavours in the Nigerian economy, are not exempted. Small and Medium-sized Enterprises (SMEs) are businesses that fall within a certain range in terms of their employee count, revenue, or assets (Agwu, 2014). The specific criteria for classifying a business as an SME can vary by country and industry but, generally, they are smaller than large corporations but larger than micro-enterprises. SMEs play a significant role in many economies, contributing to job creation and economic growth. In fact, SMEs are the major contributors to the world’s economic growth because they are numerous and can be found in almost every corner of many countries and states. Despite their contributions, SMEs are often faced with unique challenges, the kind of problems larger businesses may not be confronted with. In Enugu state, SMEs abound and are known to encounter lots of difficulties, including financial, political and social ones. However, multiple taxation is a factor that has been found to affect SMEs across many countries in the world, Nigeria inclusive, and this study aims to find out the impact of multiple taxation on the efficiency of selected SMEs in Enugu State. Statement of the Problem It is in acknowledgment of the vital role of SMEs in the growth of Nigeria’s economy that various administrations have been offering incentives to boost SME activities in the country. These notwithstanding, there still remain impediments to the development of SMEs across the country as many of them fold up within the first three years of their start up (Lawal & Aduku, 2016). Momoh (2017) observed that over 75% of SMEs in Nigeria die in infancy, not surviving beyond their 4th anniversary due to myriad of challenges that cannot be remedied by the operations in the sector. Recognizing one of these key difficulties, Kaigama (2016) found that various duty forced on SMEs is a main cause of the early collapse of these organizations in Nigeria as taxes, both legal and illegal, continue to take a large chunk of their earnings. Paying multiple tax and other levies dwindle earnings by SMEs, and this adversely affects the general activities of SMEs as income gained by SMEs largely account for the day-to-day running of their business; it determines their ability to carry out customer demands as well as maintain or expand their production and service rendering capacity. These are some of the problems associated with multiple taxation facing SMEs that necessitated this study’s enquiry into the impact of multiple taxation on the efficiency of selected SMEs in Enugu State. Research Questions The following research questions were asked to guide this study.

Research Objectives The general objective of this study is to investigate the impact of multiple taxation on the efficiency of selected SMEs in Enugu. Specifically, the study aims to

Research Hypotheses The following hypotheses were stated and tested in this study.

Literature Review Review of Conceptual Literature Concept of SMEs The definition of SMEs varies in contexts, according to authors and by countries where these SMEs are found. In Britain for instance, SMEs are defined as enterprises with annual turnover of 2 million pounds or less with fewer than 200 paid employees. In Japan SMEs are seen as businesses with 100 million yen paid up capital and 300 employees (Ekpeyong & Nyong, 1992). In Nigeria, SMEs are defined by the Central Bank of Nigeria (CBN) as those businesses with small number of employees of between 1-100 for small sized businesses and up to 500 or more for medium sized companies. The CBN also defined SMEs as businesses with turnover of less than N100 million per annum and/or less than 300 employees and having capital investment not exceeding N2 million (excluding the cost of land) or a minimum of N5 million naira (Ilemona, Nwite and Oyedokun, 2019). Concept of Multiple Taxation In simple terms, multiple taxation refers to a situation where an individual, business entity or organisation is levied more than once on their income. According to Folayin (2015), multiple taxation is a situation where a tax payer is forced by two or more levels of government to pay either the same or similar taxes in a desperate bid to increase their revenue base. Abiola (2016) further define multiple taxation as a situation where the same level of government imposes two or more taxes on the same base while Adum (2018) described multiple taxation as a case where profit or wealth of an individual, enterprise or corporate body is levied more than once. According to Izedonmi (2010), multiple taxation is said to have occurred when the same income is subjected to more than one tax payment. Multiple taxation may not necessarily be by a single body, agency or government but the major characteristic of multiple taxation is that a particular income is taxed more than once. Problems Associated with Multiple Taxation of SMEs Multiple taxation of SMEs can significantly affect their efficiency and competitiveness. There have been issues associated with multiple taxation pointed out by scholars on SMEs and these problems have affected their viability and overall contribution to national economic growth and development. SMEs often have limited resources, and dealing with multiple taxes at different levels of government (local, state, and national) can be administratively burdensome. This diverts their time and resources away from core business activities (Ademola and Ene, 2009). Also, as a result of multiple taxation, SMEs must allocate a significant portion of their budget to comply with various tax regulations and this can reduce their overall efficiency and profitability (Momoh, 2017). In another vein, Fatai (2015) opined that multiple taxation systems can lead to cash flow challenges for SMEs as they may need to pay various taxes at different times, affecting their ability to manage working capital effectively. Thus, high tax burdens can discourage SMEs from making investments in their businesses. This can impede their growth and expansion, limiting their potential to create jobs and contribute to economic development (Okolo et. al. 2016). Theoretical Framework Ability to Pay Theory Ability to pay theory was propounded by Pigou (1877–1958). The main assumption of the theory is that taxpayers in a country should pay taxes based on their ability (Onyeukwu, Ihendinihu, & Nwachukwu, 2021). This theory seems to be just and equitable as it considers the potential capacity of an individual taxpayer before a tax is levied. This theory is closely linked to the principles of fairness and equity in taxation. The ability to pay theory supports progressive taxation systems where individuals and organization with higher incomes pay a larger percentage of their income in taxes and those with lower income pays a lower percentage of their income in taxes. This approach aims to distribute economic resources and the tax burden more equitably, with those who can afford to contribute more doing so. Overall, the “ability to pay” theory aims to create a tax system that takes into account an individual’s or entity’s financial capacity to contribute to the common good while promoting economic fairness and social stability. As regards the effect of multiple taxations on the efficiency of SMEs, this theory is relevant as it creates a balance between the taxation of large enterprises and SMEs. It implies that tax levied on both SMEs and large businesses should vary and be based on the ability to pay. On the other hand, if SMEs are taxed on multiple occasions and unfairly, they would find it difficult to pay, and their enterprise will suffer, which may lead to inefficiency and closures (Okolo et al, 2016). Empirical Literatures Okolo, Okpalaojiego and Okolo (2016) examined the effect of multiple taxation on investments in SMEs. The study used survey design with SME population of 80. Questionnaire was used to collect data. Simple percentages/frequencies were used to analyze the data and the research hypotheses were tested with ANOVA. It was found that SMEs in Enugu pay taxes to more than three agencies. The study also found that multiple taxation has negative effect on SMEs investment. Furthermore, the relationship between SMEs investment and its ability to pay tax is significant. The researcher recommends that government should develop a tax policy that considers the enhancement of SMEs’ capital allowance when imposing taxes. Government should also consider a tax policy that encourages investment in SMEs by consolidating all taxes in one slot and latter disseminate to various government purses rather than having many closely related but different taxes at the same time. Keywords – investments, multiple taxation, small and medium enterprises. Adewara, et. al. (2023) examined the effect of multiple taxations on the financial performance of SMEs in Ekiti State, Nigeria. The study used a survey research method and analyzed it with correlation coupled with multiple regression analysis. The population comprises all registered and functional SMEs located in Ado Ekiti, Nigeria, that have been in existence for over 5 years with valid proof of tax payment. The results found that multiple tax burdens and multiple tax administrations exhibited a significant negative relationship with the financial performance of SMEs in Ekiti State, Nigeria, while the ability to pay tax revealed a significant positive relationship. From the aforementioned results, it was concluded that multiple taxes served as a worm that deeply reduced the investment potential of SMEs and invariably affected the chunk of revenue generated by the sector in the state. It was therefore suggested that the Joint Tax Board in the state and other institutions responsible for multiple tax management should awaken to their functions and harmonize all government revenue to prevent the occurrence of multiple taxes from causing a burden and hindering the survival of SMEs in the state. Adeniyi and Imade (2018) looked at the implication of multiple taxations in achieving sustainable development among the small enterprises domiciled in Lagos state, Nigeria. The study looked at the burdens of multiple taxes and the administrative influence of multiple taxes on small-scale enterprises’ performance. Questionnaires distributed among target SMEs in Lagos State were employed using percentages and ANOVA techniques. The outcome of the findings revealed that both burdens of multiple taxes and the administrative influence of multiple taxes significantly influence small-scale enterprises’ performance in Lagos State, Nigeria. Ocheni and Gemade (2015) carried out a study that investigated the effects of multiple taxation on the performance of small and medium scale business enterprises in Benue State. The study also examined the effect of multiple taxation on SMEs’ survival. The study involves a survey research design with a population of 91. The researchers derived their sample size to arrive at 74 and a self-administered questionnaire was used to collect data. This data was quantitatively analyzed with simple percentages and the research hypotheses were tested with ANOVA. Findings revealed that multiple taxation has negative effect on SMEs’ survival and the relationship between SMEs’ size and its ability to pay taxes is significant. The research, therefore, recommends that government should come up with uniform tax policies that will favour the development of SMEs in Nigeria and government should put into consideration the size of SMEs when formulating tax policies. Aluko et al. (2022) assessed the effect of tax incentives on the liquidity performance of quoted manufacturing firms in the Nigeria Exchange Group. The study used an expo-facto research design, and the population of the study comprised 18 industrial goods firms listed in the Nigeria Exchange Group from 2012 to 2021. The sample size of 10 firms was selected through a purposive sampling technique. The data for the study was obtained from secondary sources through the published financial statements of the companies. Data were analyzed through descriptive and inferential statistics. The result from the analysis of data revealed that tax savings had a significant and positive effect on the liquidity performance of companies. The findings from the study also revealed that tax holiday has a negative and insignificant effect on companies’ liquidity performance. Using selected firms that engaged in hospitality services in Abia State, Onyeukwu et al. (2021) looked at how their financial performance is being affected by multiple taxations. Its study aimed at analyzing whether multiple taxes hinder the survival and growth of selected firms in the state. Data were gathered through a questionnaire and analyzed with multiple regression estimation techniques. The findings revealed that multiple taxations represented by non-statutory fees significantly influence the performance of the firm. Nyong (2021) investigated the outcome of multiple taxations on the growing status of SMEs in Nigeria. Secondary data were obtained from selected SMEs of the state and analyzed with regression analysis estimation techniques. It was discovered that tenement rate, refuse disposal, business permit fee, signpost/advert fee, and development levy did not influence the growth prospect of SMEs in Nigeria. Methodology Research Design This study is a survey research design. Survey research design is a research design that makes use of primary method for data collection to gather information needed for a study from a sample of a given population (Avedian, 2014). This study thus made use of quantitative instrument (questionnaire) in collecting data from the population of the study. Area of Study The area of the study is Enugu state. Enugu State is located in South Eastern Nigeria. It is located at 6°30′N 7°30′E of the equator. The state is bordered on the north by Benue and Kogi States, bordered on the east by Ebonyi State, bothered by Abia State on the south, and Anambra State to the west. Enugu is known for the production of agricultural products such as yam, cocoyam, groundnuts, palm oil, maize, beans, and cassava, among others. The state also hosts lots of manufacturing and service rendering firms – large, medium and small. The presence of many SMEs in the area made it suitable for the present study. Population of the Study According to National Bureau of Statistics (NBS) and Small and Medium Enterprises Development Agency of Nigeria (SMEDAN, 2013), there are seventeen thousand four hundred and ninety-eight (17,498) registered SMEs in Enugu State. Sample Size The sample size for the study was estimated using Taro Yamane statistical formula. The formula is stated thus:

Where n = sample size sought N= population size 1= constant e = degree of error (0.07) Therefore,

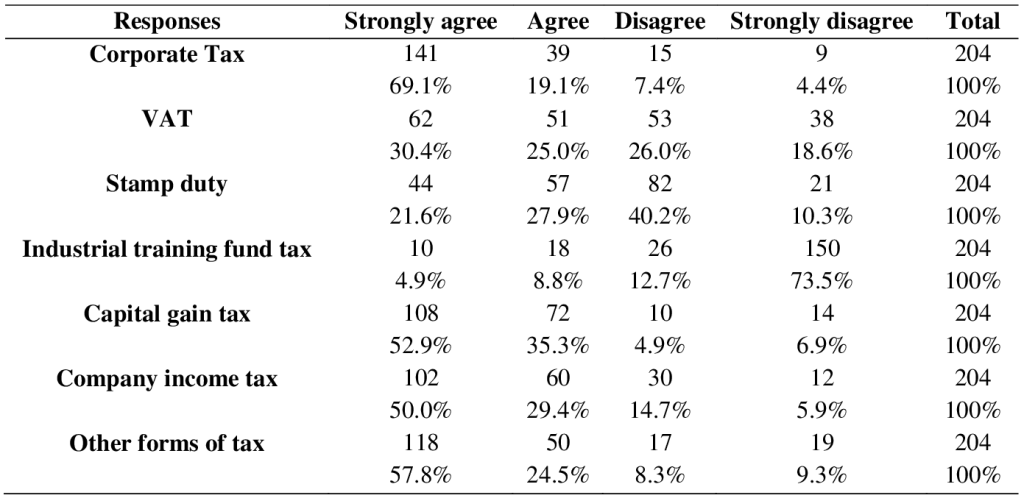

This study was conducted using 204 registered SMEs across various local government areas in the state. The population for the study was made up of 204 managers and CEOs of the 204 selected SMEs. Method of Data Analysis Statistical Package for the Social Sciences (SPSS) was used to process the data collected from the field. The data collected for the study were analysed using descriptive statistics and presented in frequency tables, chart and graphs. The stated hypotheses were tested using Chi-square inferential statistics at 0.05 level of significance. Data Presentation and Analysis In this section, the data gotten from the field were analysed and presented. The research questions and objectives were first analysed after which the study hypotheses were tested. Research Question 1: What are the various forms of taxes paid by SMEs in Enugu State? Table 1: Taxes Paid by SMEs in Enugu State

Table 1 shows that there are several taxes paid by SMEs in Enugu State. And these include Corporate Tax, Value Added Tax, Stamp duty, Industrial trading fund tax, capital gain tax and other taxes and levy. However, the major taxes paid by majority of the SMEs are Corporate Tax (69.1%), Capital gain tax (52.9%), Company income tax (50%) and other taxes (57.8%). Table 2: Number of Agencies SMEs pay tax to in Enugu State

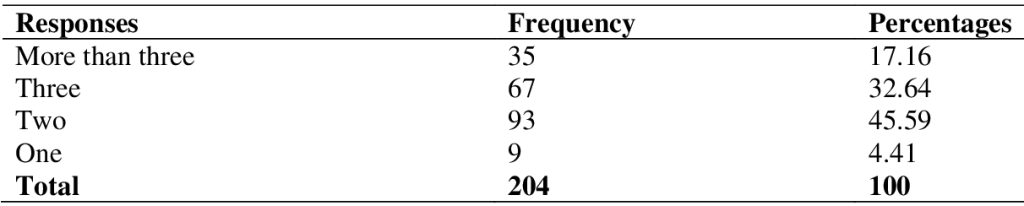

Table 2 shows the responses given by respondents when asked the number of agencies they pay taxes to. Data from the table shows that 17.16% of the respondents indicated more than three agencies, 32.64% of the respondents indicated three, 45.59% of the respondents indicated two while 4.41% indicated one. This result means that majority of SMEs in Enugu pay tax to three or more agencies. Research Question 2: What is the impact of multiple taxation on the production efficiency of SMEs in Enugu State? Table 3: Respondents’ levels of agreement on whether multiple taxation makes it difficult to carry out production activities

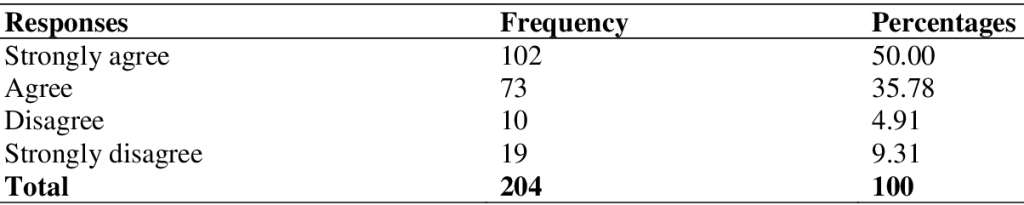

Table 3 shows that 50.00% of the respondents strongly agreed that multiple taxation makes it difficult for their enterprise to carry out production activities and 35.78% of the respondents agreed that multiple taxation makes it difficult for their enterprise to carry out production activities. On the other hand, 4.91% of the respondents disagreed that multiple taxation makes it difficult to carry out production activities while 9.31% of the respondents strongly disagreed that multiple taxation makes it difficult to carry out production activities. This result implies that majority of the respondents strongly agreed that multiple taxation makes it difficult for SMEs to carry out their production activities. Table 4: Respondents’ levels of agreement on whether multiple taxation affects the quality of products and services

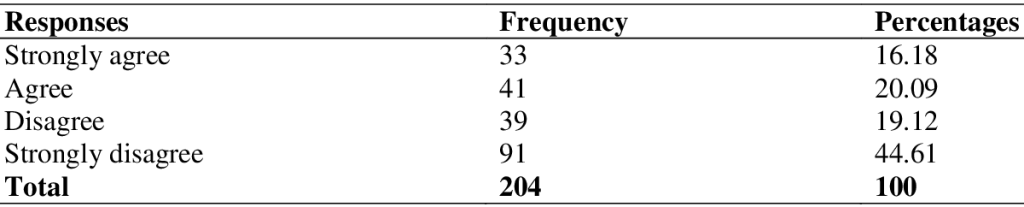

Table 4 shows that 16.18% of the study respondents strongly agreed that multiple taxation affects the quality of their products and services and 20.09% agreed that multiple taxation affects the quality of products and services. On the other hand, 19.12% of the respondents disagreed that multiple taxation affects the quality of products and services while 44.61% of the respondents which is the majority strongly disagreed that multiple taxation affects the quality of products and services. This implies that majority of SMEs’ products and services quality in Enugu State is not affected by multiple taxation. Table 5: Respondents’ levels of agreement on whether multiple taxation reduces production and service rendering capacity of SMEs

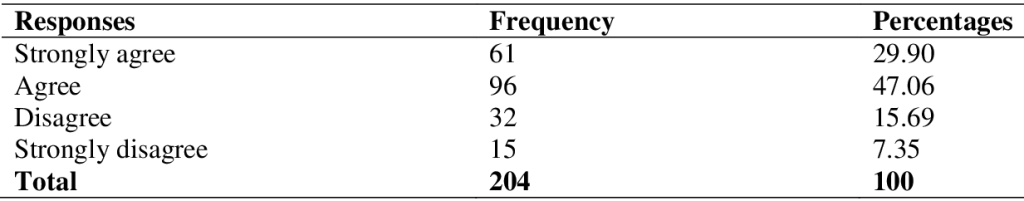

Table 5 shows that 29.90% of the respondents strongly agreed that multiple taxation reduces their enterprise production and service rendering capacity, 47.06% agreed that multiple taxation reduces their enterprise production and service rendering capacity, 15.69% disagreed that multiple taxation reduces their enterprise production and service rendering capacity while 7.35% of the respondents strongly disagreed that multiple taxation reduces their enterprise production and service rendering capacity. The result in table 5 implies that majority of the respondents agreed that SMEs production and service rendering capacity is reduced by multiple taxation in Enugu State. Table 6: Respondents’ views on the production efficiency of their enterprise

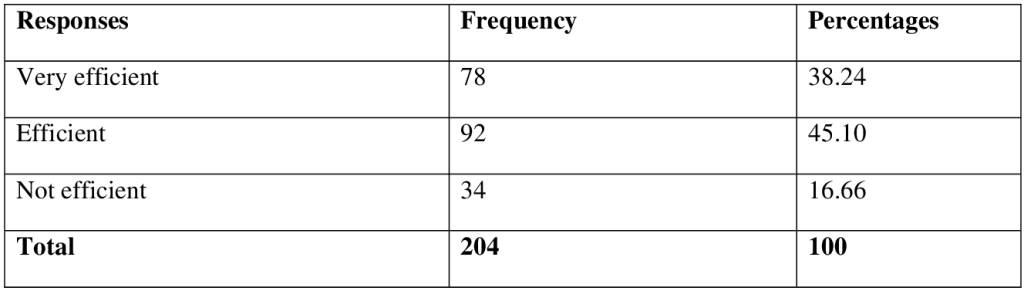

Table 6 shows the responses given by respondents on the efficiency of their enterprise. Data presented in the table show that 38.25% of the respondents indicated that their enterprise is very efficient, 45.10% of the respondents indicated that their enterprise is efficient while 16.66% of the respondents indicated that their enterprise is not efficient. The result in table 6 shows that majority of the respondent agreed that their enterprise is efficient with regards to production. Research Question 3: What is the impact of multiple taxation on management efficiency of SMEs in Enugu State? Table 7: Respondents’ level of agreement to whether multiple taxation affects the day-to-day coordination of SMEs

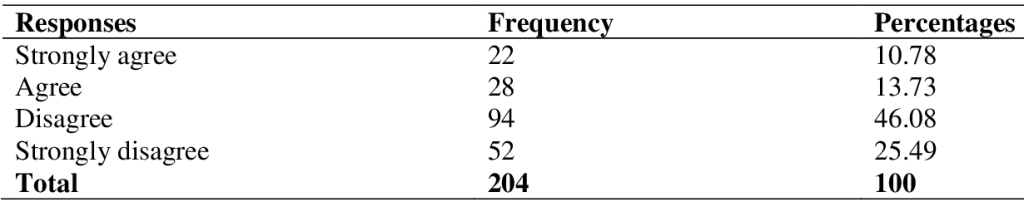

Table 7 shows that 10.78% of the respondents strongly agreed that multiple taxation affects the day-to-day coordination of SMEs, 13.73% of the respondents agreed that multiple taxation affects the day-to-day coordination of SMEs, 46.08% of the respondents disagreed that multiple taxation affects the day-to-day coordination of SMEs while 25.49% of the respondent strongly disagreed that multiple taxation affects the day-to-day coordination of SMEs. Data in table 7 shows a high level of disagreement by respondents which is an indication that multiple taxation does not affect the day-to-day coordination of SMEs in Enugu State. Table 8: Respondents’ views on whether multiple taxation makes management of enterprise more difficult

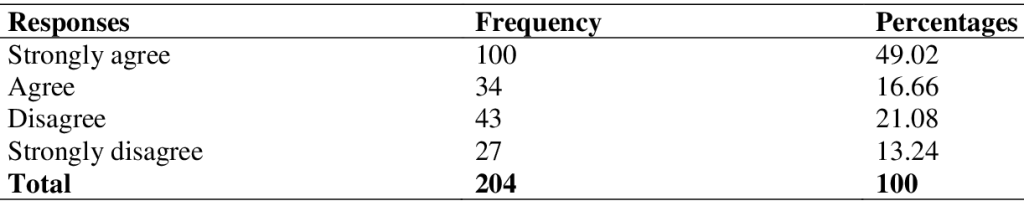

Data in table 8 show that 49.02% of the respondents strongly agreed that multiple taxation makes management of their enterprise more difficult and 16.66% of the respondents agreed that multiple taxation makes management of their enterprise more difficult. On the other hand, 21.08% of the respondents disagreed that multiple taxation makes management of their enterprise more difficult while 13.24% of the respondents strongly disagreed that multiple taxation makes management of their enterprise more difficult. Data presented in table 8 show that there is strong level of agreement among the study respondents that multiple taxation makes management of SMEs more difficult in Enugu State. Table 9: Respondents’ views on the management efficiency of their enterprise

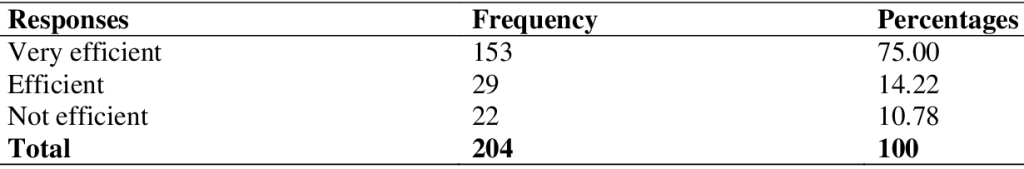

Table 9 shows the level of efficiency among SMEs in Enugu State. Data in the table show that 75.00% of the respondents indicated that their management is very efficient, 14.22% indicated that their management is efficient while 10.78% of the respondents indicated that the management of their enterprise is not efficient. By implication, majority of the respondents agreed that the management of their enterprise is efficient. Research Question 4: How can multiple taxation problems of SMEs be curbed in Enugu State? Table 10: Respondents’ levels of agreement on whether adopting single tax system can curb SMEs multiple taxation problems

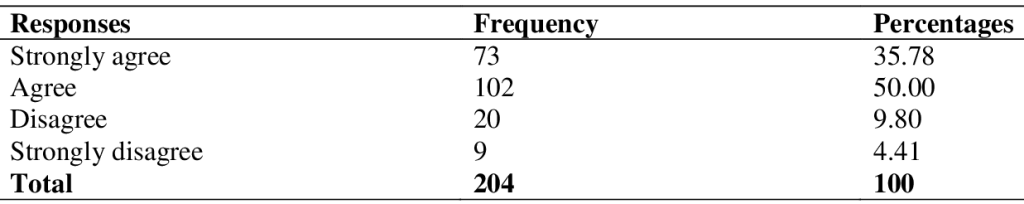

Table 10 shows that 35.78% of the respondents strongly agreed that adopting single tax system can curb SMEs multiple taxation problems, 50.00% of the respondents agreed that adopting single tax system can curb SMEs multiple taxation problems, 9.80% of the respondents disagreed that adopting single tax system can curb SMEs multiple taxation problems while 4.41% of the respondents strongly disagreed that adopting single tax system can curb SMEs multiple taxation problems. Data in table 10 show that there is a strong agreement among respondents that adopting single tax system can curb SMEs multiple taxation problems. Table 11: Respondents’ levels of agreement on whether taxing SMEs as they earn can curb multiple taxation problems

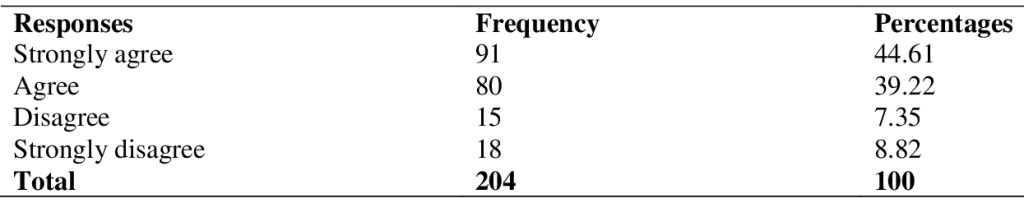

Table 11 shows respondents’ level of agreement when asked whether taxing SMEs as they earn can curb multiple taxation problems. Data from the table shows that 44.61% of the respondents strongly agreed that taxing SMEs as they earn can curb multiple taxation problems while 39.22% of the respondents agreed that taxing SMEs as they earn can curb multiple taxation problems. On the other hand, 7.35% of the respondents disagreed that taxing SMEs as they earn can curb multiple taxation problems while 8.82% of the respondents strongly disagreed that taxing SMEs as they earn can curb multiple taxation problems. The implication of data presented in table 11 shows that majority of the respondents are in agreement that taxing SMEs as they earn can curb multiple taxation problems. Table 12: Respondents’ level of agreement on whether putting taxes to good use to benefit SMEs can eradicate multiple taxation problems

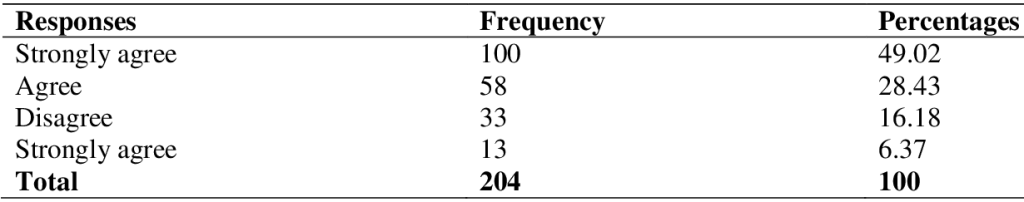

Table 12 shows the responses given by respondents when asked whether putting taxes to good use to benefit SMEs can eradicate multiple taxation problems. Data from the table show that 49.02% of the respondents indicated strongly agree, 28.43% of the respondents indicated agree, 16.18% indicated disagree while 6.37% of the respondents indicated strongly disagree. This result implies that majority of the respondents strongly agreed that putting taxes to good use to benefit SMEs can eradicate multiple taxation problems. Test of Hypotheses The hypotheses stated in this study were tested using Chi-square inferential statistics with a level of significance of 0.05. Hypothesis 1: There is no significant relationship between multiple taxation and production efficiency of SMEs in Enugu State. Data in tables 2 and 6 were crossed to test the first research hypothesis. Table 13: Test of relationship between multiple taxation and production efficiency

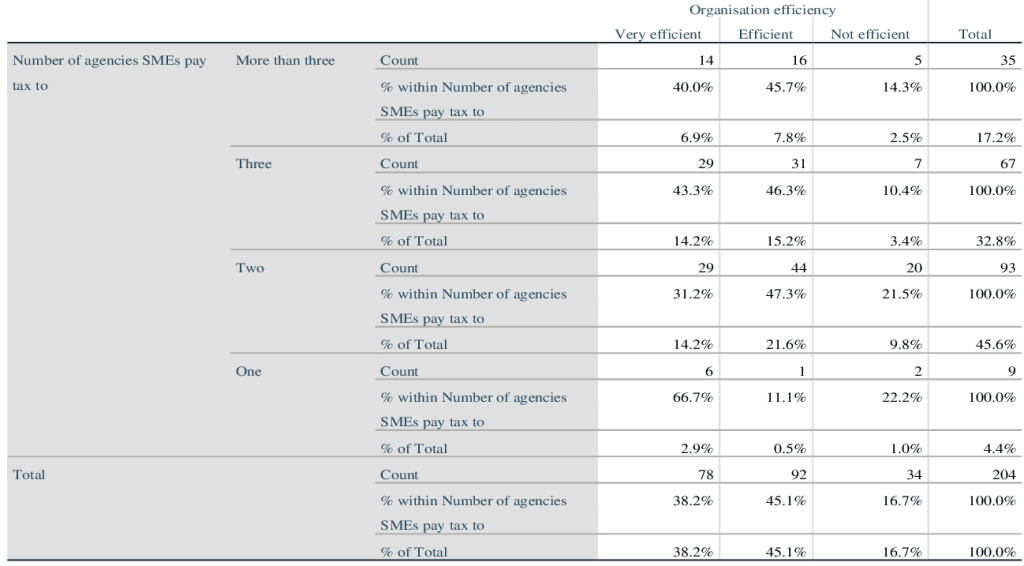

x² = 9.164, df = 6, p = .165 Data in table 13 show an x² value of 9.164, degree of freedom (df) of 6 and an asymptotic value of .165. Since the asymptotic value is greater that the level of significance (0.05), it is an indication that the alternative hypothesis is rejected. This implies that there is no significant relationship between multiple taxation and production efficiency of SMEs in Enugu State. It can be concluded that paying multiple tax does not have impact on the production efficiency of SMEs in Enugu State. Hypothesis 2: There is no significant relationship between multiple taxation and management efficiency in Enugu State. Data in tables 2 and 9 were crossed to test the second research hypothesis. Table 14: Test of relationship between multiple taxation and management efficiency

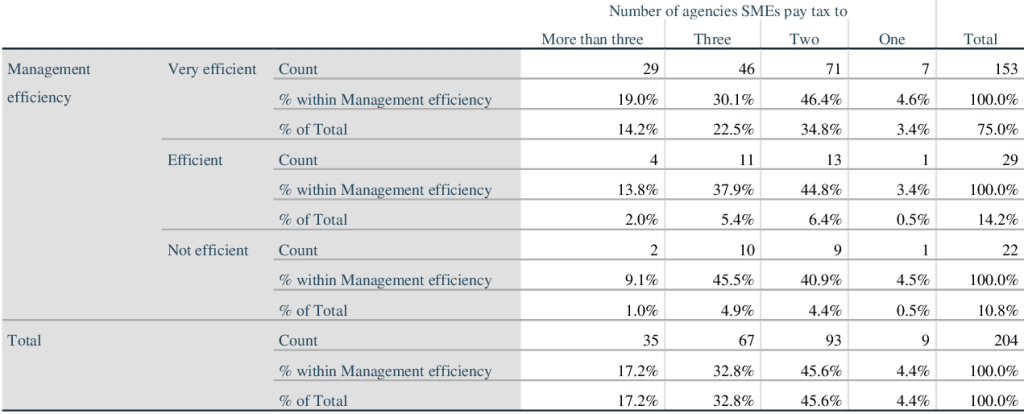

x² = 3.170, df = 6, p = .787 Data in table 14 show an x² value of 3.170, degree of freedom (df) of 6 and an asymptotic value of .787. Since the asymptotic value is greater that the level of significance (0.05), it is an indication that the alternative hypothesis is rejected. This implies that there is no significant relationship between multiple taxation and management efficiency of SMEs in Enugu State. It can be concluded that paying multiple tax does not have impact on the management efficiency of SMEs in Enugu State. Discussion of Findings From the analysis of the first research question, it was found that there are several taxes paid by SMEs in Enugu State; major taxes paid by majority of the SMEs are corporate tax, capital gain tax, company income tax and other taxes. It was also found through the first research question that majority of SMEs pay taxes to two or more agencies in Enugu state. This finding supports the finding of Okolo, Okpalaojiego and Okolo (2016) who found that SMEs in Enugu pay tax to more than three agencies. The second research question asked was to find out the impact of multiple taxation on the production efficiency of SMEs in Enugu State. The analysis of the second research question showed that multiple taxation makes it difficult for SMEs to carry out their production activities. On the other hand, it was also found through the second research question that multiple taxation does not affect the quality of SMEs’ products and services in Enugu state. However, it was found that SMEs’ production and service rendering capacity is reduced by multiple taxation in Enugu State. This finding partly supports the findings of Adewara, Dagunduro, Falana, and Busayo (2023) who found that multiple taxation reduces the investment potential and earnings of SMEs. Thus, the more production and service rendering capacity of SMEs are reduced, the more their income is reduced. The third research question asked was to find out the impact of multiple taxation on management efficiency of SMEs in Enugu State. Analysis of the third research question showed that multiple taxation does not affect the day-to-day coordination of SMEs in Enugu State but makes management of SMEs more difficult. This finding partly supports the findings of Ocheni and Gemade (2015) who found that multiple taxation makes the survival of SMEs difficult. The fourth research question was asked to find out how multiple taxation problems of SMEs can be curbed in Enugu State. Analysis of the fourth research question showed that adopting single tax system can curb SMEs multiple taxation problems. The analysis also showed that taxing SMEs as they earn can curb multiple taxation problems. Further, the analysis of the fourth research question showed that putting taxes to good use to benefit SMEs can eradicate multiple taxation problems. This finding supports the finding of Ocheni and Gemade (2015) who found that considering SME size when taxing and also putting tax to good use help curb the adverse effect taxation may have on SMEs. The first hypotheses tested found no significant relationship between multiple taxation and production efficiency of SMEs in Enugu State. The second hypothesis tested also found that paying multiple taxes does not have impact on the management efficiency of SMEs in Enugu State. Conclusion The study investigated the impact of multiple taxation on the efficiency of selected SMEs in Enugu. From the analysis conducted, the study concluded that multiple taxation makes the production of goods and services difficult and reduces the production and service rendering capacity of SMEs. The study also concludes that multiple taxation also makes management of SMEs more difficult. Recommendations Based on the findings of the study, the study recommends that government adopting a single tax system that levy SMEs based on how they earn and using the taxes for the benefit of SMEs will reduce the challenges of multiple taxation problems that affect the production and management efficiency of SMEs in Enugu State. References Abiola, S. (2012) Multiplicity of taxes in Nigeria: Issues problems and solutions. International Journal of Business and Social Sciences 3(17), 229. Adewara, Y., Dagunduro, E., Falana, G., and Busayo, T., (2023). Effect of Multiple Taxation on the Financial Performance of Small and Medium Enterprises (SMEs) in Ekiti State, Nigeria. Journal of Economics, Finance and Accounting Studies, 5(3), 121–129. Adum, S. O (2018) Burning issues in Nigeria tax system and tax reforms on revenue generation: Evidence from Rivers state. International Journal of Finance and Accounting, 7(2), 36-48. Agwu, M. (2014). Issues, Challengesand Prospectsof Small and Medium Scale Enterprises (SMEs) in Port-Harcourt City. European Journal of Sustainable Development. 3. 101-114. 10.14207/ejsd.2014.v3n1p101. Avedian, A. (2014). Survey design: Overview. Harvard Law School. Available at: http://hnmcp.law.harvard.edu/wp-content/uploads/2012/02/Arevik-Avedian-Survey-DesignPowerPoint.pdf Bush, B. & Maltby, J. (2004). Taxation in West Africa: Transforming the colonial subject into the `Governable Person’. Critical Perspectives on Accounting. 15. 5-34. 10.1016/S1045-2354(03)00008-X. Chukwuemeka, N. (2017) Multiple taxation and the operations of business enterprises in Abia metropolis. Pyrex Journal of Business and Finance Management Research 3(6), 132-138. Cseh, B. &Varga, J. (2020). Taxation and Humans in the Age of the Fourth Industrial Revolution – Financial and Ethical Comments. Acta Universitatis Sapientiae, European and Regional Studies. 17. 103-117. 10.2478/auseur-2020-0005. Ekpenyong, D.B. and Nyong, M.O. (1992) Small and Medium-Scale Enterprises in Nigeria. Their Characteristics, Problems and Sources of Finance. African Economic Research Consortium, Nairobi. Faloyin, S. K. (2015) Unveiling the potentials of entrepreneurship. Contemporary studies 68(6), 273-284. Ilemona, S. A., Nwite, S., & Oyedokun, G. E. (2019). “Effects of Multiple Taxation on the Growth of Small and Medium Enterprises in Nigeria,” Journal of Taxation and Economic Development, Chartered Institute of Taxation of Nigeria, 18(2), 1-8. Izedonmi, F., (2010). Eliminating multiple taxation in the capital market: the capital market perspective. A paper presented at the University of Benin, Benin City. Lawal, K. S &Aduku, N. R (2016) Strategies for wooing investors in Nigeria. Paper Presented at entrepreneurship conference Federal Polytechnic Idah, May 8th–10th. Mieseigha, E. G., &Ihenyen, C. J. (2014). Environmental Cost Accounting Information and Strategic Business Decision in Nigeria. Acta Universitatis Danubius. Economica, 10, 18-27. Momoh, U. K (2017) Challenges of Entrepreneurship Growth and Development in Nigeria. Multidisciplinary Journal of Contemporary Issues, 6(4), 31 – 39. National Bureau of Statistics (2013). Smedan and National Bureau of Statistics collaborative survey: selected findings (2013). (n.d.). Available at: https://www.google.com/url?sa= t&sourc e=web&rct=j&opi=89978449&url= https://nigerianstat.gov.ng/download/290&ved= 2ahUK EwiQy5LxibSBAxUXVkEAHbq6 CJIQFnoECBoQAQ&usg=AOvVaw0SLqhzyfLKwBPofYz aBPofYza6N7J Nigamaev, A.Z., Gapsalamov, A. Akhmetshin, E., Pavlyuk, A., Prodanova, N.A., &Savchenkova, D.V. (2018). Transformation of the Tax System During the Middle Ages: The Case of Russia. European Research Studies Journal. 21. 242-253. 10.35808/ersj/1057. Oboh, C., Yeye, O., &Filibus, E. (2013). Multiple Tax Practices and Taxpayers’ Non-Compliance Attitude in Nigeria. International Research Journal of Finance and Economics. 10. Ocheni, S. I. &Gemade, T. I. (2015) Effects of multiple taxation on the performance of small and medium scale business enterprise in Benue state. International Journal of Academic Research in Business and Social Sciences5(3), 345-349. Okolo, U. E., Okpalaojiego, E. C. & Okolo, C. V. (2016) The Effects of Multiple Taxation on Investment in Small and Medium Scale Enterprises in Enugu State, Nigeria. International Journal of Economics and Management, 10 (1),378-385. ISSN 1307-6892. Onyeukwu, O. O., Ihendinihu, J. U., & Nwachukwu, M. I. (2021). Effect of multiple taxation on the financial performance of hospitality firms in Abia State, Nigeria. Journal of Research in Business and Management, 9(5), 1-10. Oseni, M. (2014). Multiple Taxation as a Bane of Business Development in Nigeria. Academic Journal of Interdisciplinary Studies. 3. 10.5901/ajis.2014.v3n1p121. Raigama, N.U (2016) Entrepreneurship growth in Nigeria: Problems and prospects. Journal of Economic Financial 6(4), 18-24.

|

|||